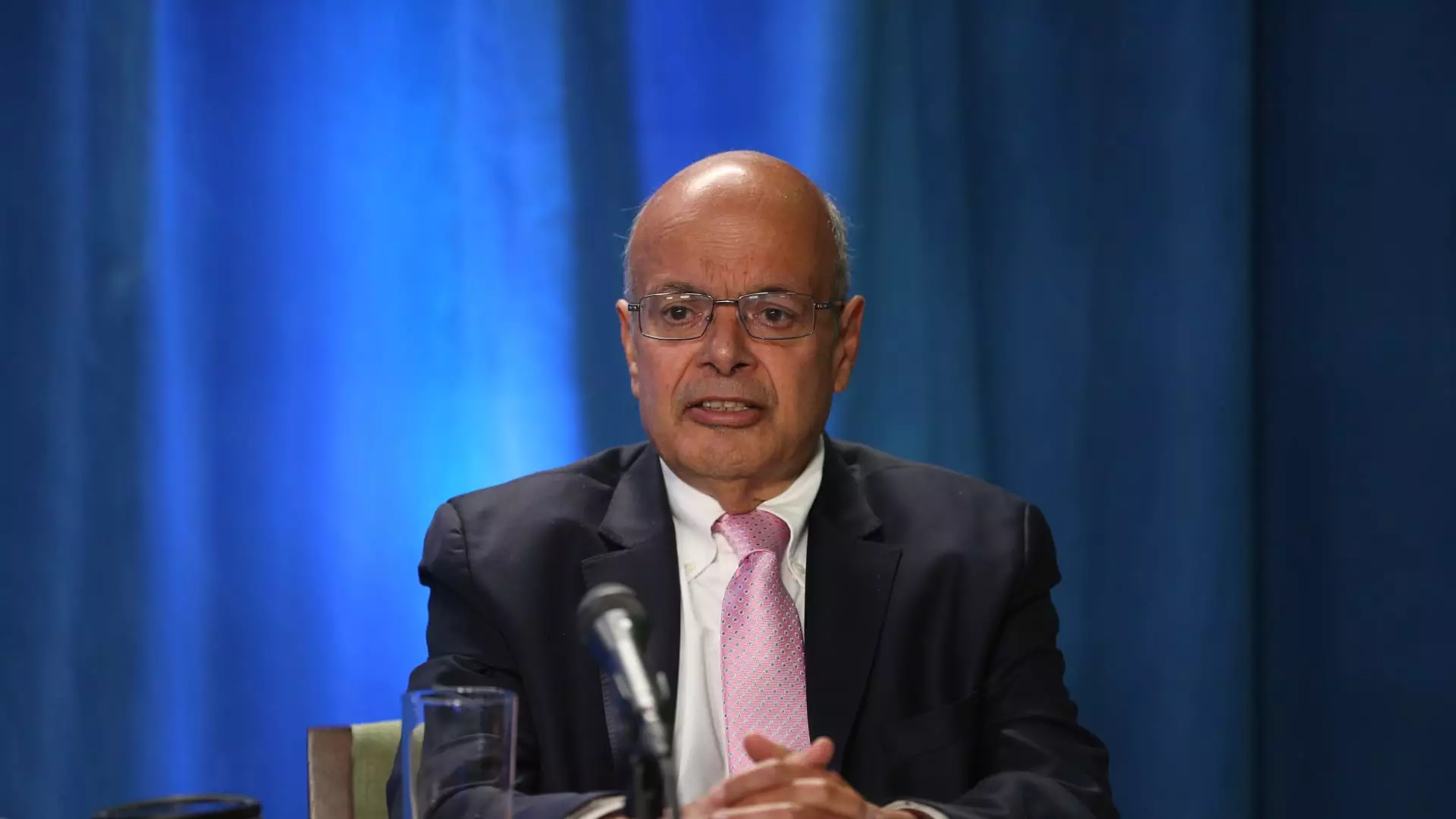

In a striking move that has caught the attention of investors and analysts alike, Ajit Jain, the vice chairman of insurance operations at Berkshire Hathaway, recently sold a substantial portion of his stake in the conglomerate. According to a regulatory filing, Jain, aged 73, divested more than half of his ownership in Berkshire Class A shares, selling 200 shares at an average price of approximately $695,418 each. This sale culminated in a transaction valued at roughly $139 million, leaving Jain with a mere 61 shares. Alongside this, the family trusts established for his descendants hold an additional 55 shares, and his nonprofit entity, the Jain Foundation, retains 50 shares. This transaction marks a notable 55% reduction in Jain’s total Berkshire stake, signaling a significant pivot in his investment strategy since joining the firm back in 1986.

While the exact motivations behind Jain’s sizable sell-off remain somewhat ambiguous, it is impossible to ignore the timing of the transaction. Berkshire Hathaway recently reached a market capitalization milestone, trading above the $700,000 mark, crossing the $1 trillion threshold by the end of August. Analysts interpret this move as reflective of Jain’s perception that Berkshire’s stock might be fully valued. As David Kass, a finance professor at the University of Maryland, noted, Jain’s decision could signify a belief that the stock’s current valuation does not present an attractive buying opportunity.

Moreover, this action is consistent with a noticeable slowdown in Berkshire’s share repurchase activity. The company redeemed only $345 million worth of its stock during the second quarter, a stark contrast to the $2 billion buybacks executed in each of the preceding quarters. Bill Stone, the CIO of Glenview Trust Co., further supports this perspective, suggesting that the stock’s current standing at over 1.6 times book value aligns closely with Buffett’s conservative estimate of intrinsic value. This raises questions about future share repurchases and the broader implications for Berkshire’s valuation trajectory.

A Legacy of Value Creation

Ajit Jain’s legacy at Berkshire Hathaway is rooted in extraordinary contributions to the insurance sector. His strategic insights and leadership have facilitated the company’s expansion into the reinsurance market and have played a crucial role in revitalizing Geico, Berkshire’s flagship automobile insurance division. In 2018, Jain ascended to the role of vice chairman of insurance operations and secured a position on Berkshire’s board. Buffett himself has recognized Jain’s unparalleled impact, once praising him for generating tens of billions in value for shareholders. The esteem with which Buffett holds Jain was evident in his 2017 letter, expressing that if a trade were possible, he would be willing to switch places with Jain without hesitation.

Despite speculation about Jain potentially succeeding Buffett, who is currently 94 years old, the Oracle of Omaha recently clarified that Jain has no desire to lead the conglomerate. This statement not only underscores Jain’s commitment to his current role but also dispels rumors of a competitive rivalry between Jain and Greg Abel, Berkshire’s vice chairman of non-insurance operations.

Jain’s decision to cut his stake carries broader implications for both Berkshire Hathaway and the market at large. Investors often view the actions of top executives as barometers of a company’s financial health. Consequently, Jain’s sale could trigger reconsideration among other shareholders regarding their positions, especially in light of the call for cautious optimism in a climate of evolving economic conditions.

It’s essential to reflect on the significance of such transactions in the context of investor psychology. Stake sales by influential figures can signal potential caution, instigating a ripple effect of reevaluation among investors and highlighting the need for due diligence in investment decisions. As the market remains volatile and uncertainties loom, this development accentuates the importance of analysts and investors maintaining vigilance regarding Berkshire’s stock value and overall market strategy.

While Ajit Jain’s divestment may reflect personal investment strategy and the current valuation of Berkshire Hathaway, it presents a multifaceted scenario indicative of larger market dynamics. As investors watch closely, the need for informed decision-making becomes ever more apparent in navigating the complexities of contemporary investing.