In an era where the Federal Reserve’s policy shifts have become unpredictable, the allure of high dividend stocks appears increasingly alluring. Investors, desperate to secure some semblance of stable income, flock towards familiar giants promising hefty payouts. But beneath the surface of these attractive yields lies a complex web of risks and false assurances, especially

In an era where financial products often promise the world but deliver a fraction of their allure, the surge in annual fees for premium travel rewards credit cards is a stark reminder that luxury has a price—one that consumers can no longer afford to ignore. Recently, major players like American Express and Chase have hiked

In a bold and seemingly reckless move, the Trump administration announced a staggering $100,000 annual fee on each H-1B visa, aiming to curb the inflow of highly skilled foreign workers into the United States. While framed as a measure to protect American jobs, this policy shift risks crippling the very innovation engine that has powered

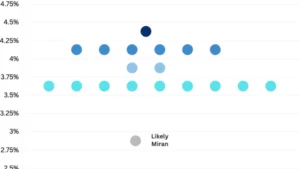

This week’s bond market movements cast a stark light on the fragile and often misguided optimism surrounding central bank interventions. While the Federal Reserve’s decision to slash interest rates appears to signal renewed stability, the reality beneath the surface suggests a far more complex and potentially perilous scenario. The surge in long-term Treasury yields, defying

Workday has long been heralded as a titan in the realm of enterprise cloud solutions, especially within human capital management and financial software. Its expansive client base, which includes over 60% of Fortune 500 companies, lends credibility to its dominant position. Yet, beneath this veneer of success lies a troubling reality: the company’s growth trajectory,

The so-called “20-4-10” rule attempts to serve as a financial blueprint for responsible car buying, aiming to shield consumers from dug-in debt and depreciating assets. At face value, it appears to be a sensible and disciplined approach, encouraging hefty down payments, shorter loan terms, and restrained monthly vehicle-related expenses. However, scrutinizing this framework reveals that

Recent developments in the United States’ approach to COVID-19 vaccination have signaled a troubling departure from the proactive, unified messages that once guided public health efforts. Instead of advocating for broad, universal vaccination, policymakers have veered toward a model rooted in individual decision-making. This paradigm shift undercuts the foundational principle that vaccination is a communal

The Federal Reserve operates under the guise of independence, a principle that supposedly insulates monetary policy from political pressures. Yet, recent events hint at a different reality—one where political influence, whether overt or subtle, threatens to undermine this vital autonomy. While Fed officials often insist they make decisions free from external meddling, the dynamics surrounding

When the Federal Reserve decides to cut interest rates, it often sparks a wave of cautious optimism. We hear arguments about how lower borrowing costs could stimulate the economy and provide consumers with some breathing room. But this narrative misses a fundamental point: rate cuts are mere Band-Aids on an inward bleeding wound—the persistent, often

The idea of shifting from quarterly to semiannual earnings reports is gaining momentum, but this proposal is fundamentally misguided. At first glance, proponents argue that less frequent reporting will allow companies to focus on long-term strategies, reduce costs, and boost managerial focus. However, this oversimplification ignores the core value that quarterly disclosures provide not only