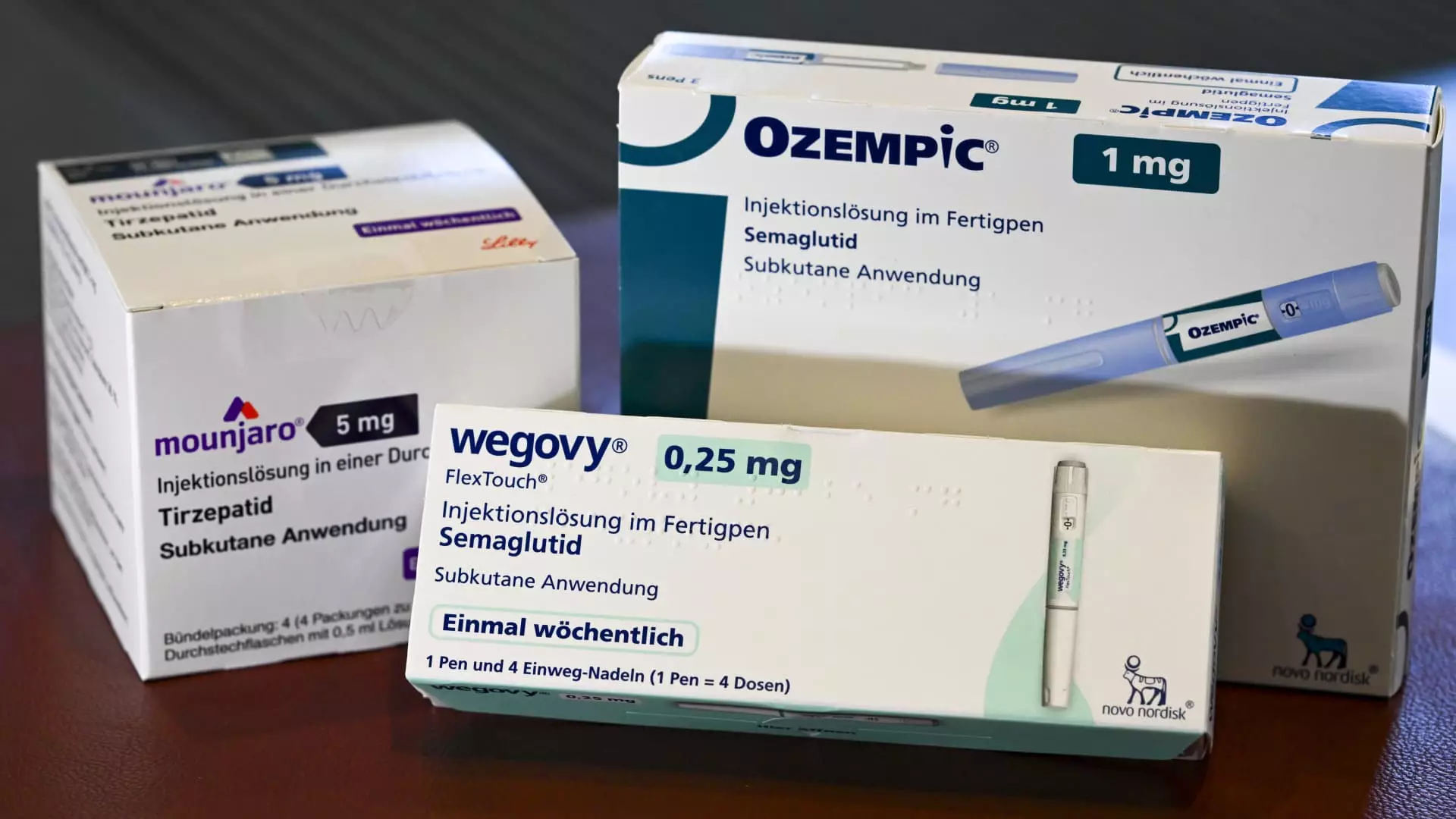

The healthcare landscape is rapidly evolving, with obesity and diabetes on the rise, leading to an unprecedented demand for specialized medications such as Mounjaro, Ozempic, and Wegovy. The glimmer of hope these GLP-1 receptor agonists provide is palpable, yet their high price tags—often exceeding $1,000 per dose—pose a significant concern for large employers struggling with escalating health costs. Many companies find themselves grappling with the question: do these costly medications justify their expense through improved workforce health and reduced long-term medical expenditures?

Greg Case, the CEO of Aon, paints a picture that is both enlightening and cautionary. According to Case, who spearheads an organization that specializes in employer benefit services, the observed results of GLP-1s are groundbreaking. A stunning 44% reduction in major cardiovascular incidents and significant decreases in conditions such as osteoporosis and pneumonia have been reported. Moreover, Aon’s research suggests that over time, the medical expenses associated with employees using GLP-1 drugs could actually diminish. But this path to financial prudence is riddled with high initial investment hurdles that employers must endure.

The Double-Edged Sword of GLP-1 Costs

As employers navigate the labyrinth of health costs, they are faced with a curious paradox. While the upfront costs associated with GLP-1 treatment are substantial, the promise of long-term savings lingers like a distant mirage. According to Aon’s analysis of medical claims data from 139,000 U.S. workers between 2022 and 2024, employees who partook in GLP-1 treatment incurred not just drug costs but also higher medical expenditures in their initial year due to a flurry of doctor visits. These consultations were often for related health issues—sleep apnea and acid reflux among them—that stem from the underlying causes of obesity.

The first year can be financially daunting, as patients increasingly seek recreational treatments at an alarming rate. This raises concerns about whether the hit to employers’ budgets in the short term is worth the potential pay-off in the long term. However, after the first 12 to 15 months of treatment, the narrative shifts; Aon’s findings suggest that by the two-year mark, overall healthcare costs for GLP-1 users drop by an average of 7% compared to non-users with similar health profiles, and those who strictly follow their prescribed regimen could see savings soar to 13%.

The Health Benefits: A glimmer of Hope

The reductions in adverse cardiac events, such as heart attacks and strokes, stand as the most compelling argument for advocating the widespread use of GLP-1 drugs. The evidence points to a more than 40% decrease in the occurrence of these life-threatening issues, along with a significant decline in diabetes prevalence. Case’s assertion that companies can find a financial return on their investment is grounded in tangible health outcomes, transforming the conversation around GLP-1s from one of merely conservative budgeting to an optimistic vision of a healthier workforce.

Such transformative promises have led Aon to take the leap, establishing their very own subsidized GLP-1 weight management program, mirroring the potential benefits that they advocate for their clients. The program includes amenities like weekly virtual wellness consultations and home blood tests, reinforcing not just adherence but overall health management for their employees. Aon is not just a passive observer in this healthcare revolution; they are actively engaged, bringing the findings of their study to forums such as the Milken Institute Global Conference, further emphasizing the urgency of addressing obesity through innovative health strategies.

The Future of Health Coverage in Corporate America

As we delve deeper into a future constrained by ever-rising healthcare costs, the ethical and economic implications of medications like GLP-1s become increasingly compelling. Are we witnessing the dawn of a new era in health management, or are we merely scratching the surface? The balancing act between upfront investment and potential long-term savings is one that each employer must navigate judiciously.

GLP-1 drugs represent more than a fleeting trend in medication; they embody a larger conversation about the role of employer health coverage in modern society. As the societal implications of obesity and insulin resistance continue to unfold, employers who take the plunge into GLP-1 coverage may not only see healthier employees but could rise above the fray in a competitive marketplace for talent. Unfortunately, this also highlights a troubling truth; those employers who cannot afford to invest in these innovative treatments may find themselves facing grim realities in health outcomes and employee retention.