The Consumer Financial Protection Bureau (CFPB), an agency established to safeguard consumer interests in financial sectors, faces significant upheaval. A recent memo from Chief Operating Officer Adam Martinez announced that employees would transition to remote work due to the closure of the Washington, D.C. headquarters until February 14. This closure, which comes in the wake of a tumultuous leadership transition, reveals underlying tensions about the agency’s direction and operational stability. Employees are being instructed to suspend nearly all activities, unsettling a workforce already on edge.

In any organizational context, a sudden shift to remote work can indicate deeper issues. For the CFPB, such a status change raises crucial questions about its function during an era marked by increasing financial complexities and consumer vulnerabilities. The memo also highlights the agency’s abrupt pivot away from its critical oversight duties, such as supervising financial entities. This raises concerns not just about operational capacity but also about consumer protection at a time when financial firms may seek to operate with less scrutiny.

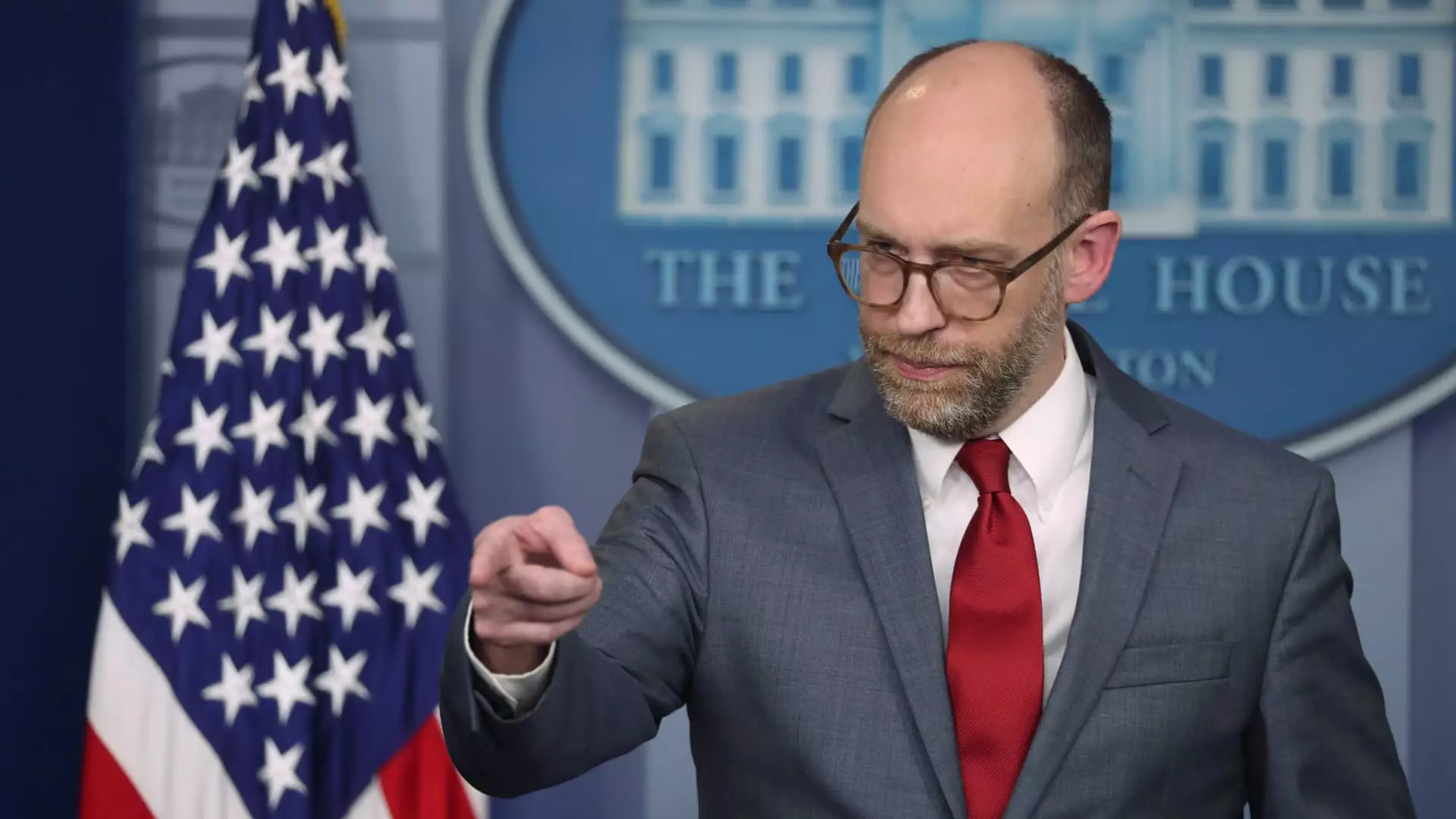

Leadership plays a pivotal role in shaping any institution’s mission and effectiveness. Newly appointed acting director, Russell Vought, has initiated a sharp reevaluation of the CFPB’s operations, eliciting concern among bipartisan observers. Vought’s memo, which effectively freezes agency activities, reflects an apparent agenda to curtail the CFPB’s reach—an objective that aligns with sentiments echoed by high-profile critics, including Elon Musk.

Musk’s recent comments, such as his “CFPB RIP” post, symbolize a growing skepticism regarding the CFPB’s legitimacy and purpose. The involvement of Musk’s operatives, referred to as DOGE, raises alarms about potential conflicts of interest and the agency’s integrity. If external actors gain access to sensitive data, including employee performance assessments, the CFPB’s autonomy may be compromised, making it a pawn in larger political and business agendas. This relationship speaks to the necessity of safeguarding public institutions from undue influence while maintaining transparency and accountability.

Accompanying the upheaval at the CFPB is a strategic decision by Vought to halt new funding to the agency. This move raises profound implications for the CFPB’s functionality and mission. With a history rooted in protecting consumers following the 2008 financial crisis, the agency’s ability to operate effectively relies on adequate funding. This cut presents an existential threat: devoid of essential resources, the CFPB may struggle to fulfill its guiding principles, abandoning millions of consumers to the whims of the financial industry.

Reports suggest that only a fraction of the CFPB’s workforce is legislatively mandated, prompting fears that mass layoffs could soon follow. The potential for administrative downsizing jeopardizes not just employees’ livelihoods but also the overarching mission to shield consumers from exploitation. This precarious situation is reminiscent of past attempts by political figures to dismantle or undermine regulatory bodies, posing the question of whether the CFPB can endure this onslaught.

The Broader Impact on Consumer Protections

At stake in this struggle is the fate of numerous consumer protection initiatives that could save Americans billions of dollars. Proposed regulations aimed at limiting credit card and overdraft fees, as well as measures to remove medical debts from credit reports, embody the CFPB’s commitment to advocating for consumers. The freezing of these efforts could significantly hinder progress and reverse years of hard-fought victories for consumer rights.

Historically, banks and financial corporations have opposed the CFPB’s regulatory framework, often resorting to legal challenges that question the agency’s constitutionality. As the agency’s ability to function is hampered by leadership and financial turmoil, corporate interests may take advantage of this weakness to lobby for even laxer regulations, thus placing consumers in jeopardy.

The current trajectory of the CFPB raises numerous concerns about accountability, transparency, and the safeguarding of consumer interests within the financial landscape. As the agency grapples with uncertainty, a grounded focus on its original purpose is paramount. Just as the CFPB was born out of the need for oversight during a turbulent financial period, so too must it evolve, navigating the complexities of a rapidly changing environment while remaining a steadfast advocate for consumers.

The future of the CFPB is anything but certain. The agency stands at a crossroads, requiring both public scrutiny and support to reaffirm its role as a protector of American consumers. The stakes are high, and the dialogue surrounding the CFPB’s mission must remain robust, as the effects of its potential dissolution would ripple throughout the fabric of everyday financial life for countless individuals.