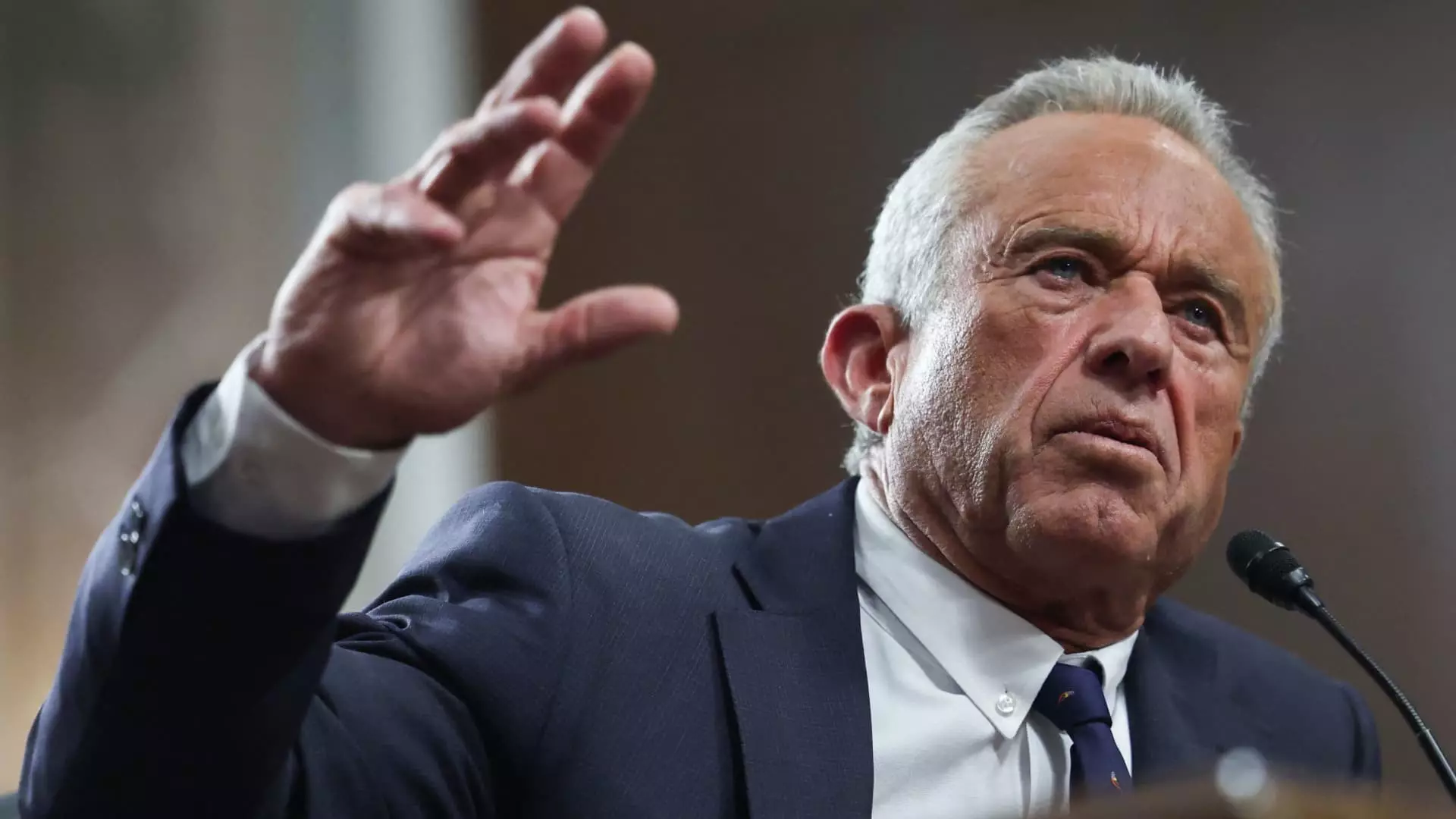

In a troubling reflection of the current economic climate, credit card debt in the United States has reached an astounding $1.17 trillion as of 2024. This statistic is disconcerting not just for the average consumer, but it also touches upon high-profile individuals, including the affluent. A striking example is Robert F. Kennedy, Jr., who has disclosed that his credit card debts range from $610,000 to as much as $1.2 million—an eye-watering figure for anyone, even for someone with a reported net worth of approximately $30 million. This revelation serves as a stark reminder that financial vulnerabilities can affect individuals across all socioeconomic strata.

The fact that even wealthy individuals are burdened by credit card debt introduces an arena of complexities regarding money management that many might overlook. Financial experts, including Ted Rossman from Bankrate, have pointed out that debt of this magnitude is extremely unusual. This begs the question of how someone with substantial resources could accrue such staggering balances.

The Cost of Debt: Analyzing Interest and Repayment Challenges

Americans have increasingly viewed credit cards as necessary fixtures for managing emergencies and everyday expenses. This shift has been exacerbated by ongoing inflation, which, as Matt Schulz from LendingTree emphasizes, has severely limited the financial leeway for many households. In Kennedy’s case, if he were to allocate $50,000 monthly toward his lower-end debt of $610,000, he’d take approximately 15 months to pay it off, accruing over $93,000 in interest. Conversely, addressing the higher figure would extend repayment to 33 months and result in approximately $434,000 in interest. The math presents a compelling case for exploring alternative methods for managing or even reducing debt.

Such alarming numbers are not exclusive to prominent figures; the average American credit card holder carries approximately $6,380 in debt according to TransUnion’s latest findings. When coupled with mounting unsecured debts—averaging $29,364 in 2024—it’s clear that many are navigating a dire financial landscape. Yet, despite the daunting realities of high-interest rates, the behavior of affluent individuals can sometimes obscure the wider public’s understanding of these financial traps.

The average credit card interest rate currently stands at 20.13%. This high figure cannot be ignored, as it incentivizes better financial habits, particularly prioritizing debt repayment over other financial goals, like investing. As Rossman posits, paying off credit card debt that accrues interest at 20% is akin to securing a risk-free return on investment—an appealing proposition in any financial strategy.

Interestingly, data indicates that higher-income individuals are more likely to carry substantial credit card debt. A staggering 59% of those earning $100,000 or more have been in debt for over a year. This scenario underscores a contradictory narrative: while higher income ostensibly provides more financial security, it can paradoxically lead to increased debt levels due to larger credit limits. Wealthy borrowers often face temptations that lead them to use credit cards for perks, as illustrated by the exclusive benefits provided by high-end cards like the American Express Centurion Card, which charges its users a hefty fee for luxurious privileges.

Financial experts propose that affluent individuals leverage different borrowing mechanisms more suited to their profiles. For example, establishing a line of credit is often recommended for high-net-worth individuals looking to finance large purchases, like real estate, without incurring capital gains taxes. This financial strategy emphasizes minimizing unnecessary interest expenses, promoting a more sustainable financial ecosystem.

Furthermore, the importance of maintaining a cash reserve equivalent to one year’s expenses cannot be overstated. Such a buffer negates the need to rely on credit in emergencies, fostering financial independence and reducing overall debt risk.

As the nation grapples with unprecedented levels of credit card debt, it is crucial for individuals—regardless of wealth—to reevaluate their financial strategies. While the allure of credit cards persists, understanding the long-term costs associated with high-interest debt could very well serve as a wake-up call for many. The importance of diligent financial planning, informed decision-making, and the prioritization of debt repayment over other financial pursuits cannot be emphasized enough to navigate this treacherous financial landscape. Addressing these issues holistically equips Americans, from all walks of life, with the tools necessary to foster a healthier financial future.