MongoDB saw a significant increase in its shares, rising as much as 16% in extended trading following the release of its fiscal second-quarter earnings report. The company reported earnings per share of 70 cents, surpassing the expected 49 cents. Additionally, MongoDB’s revenue reached $478.1 million, exceeding the projected $464.1 million. This growth represents a 13% increase year over year, demonstrating the company’s continued success in the market.

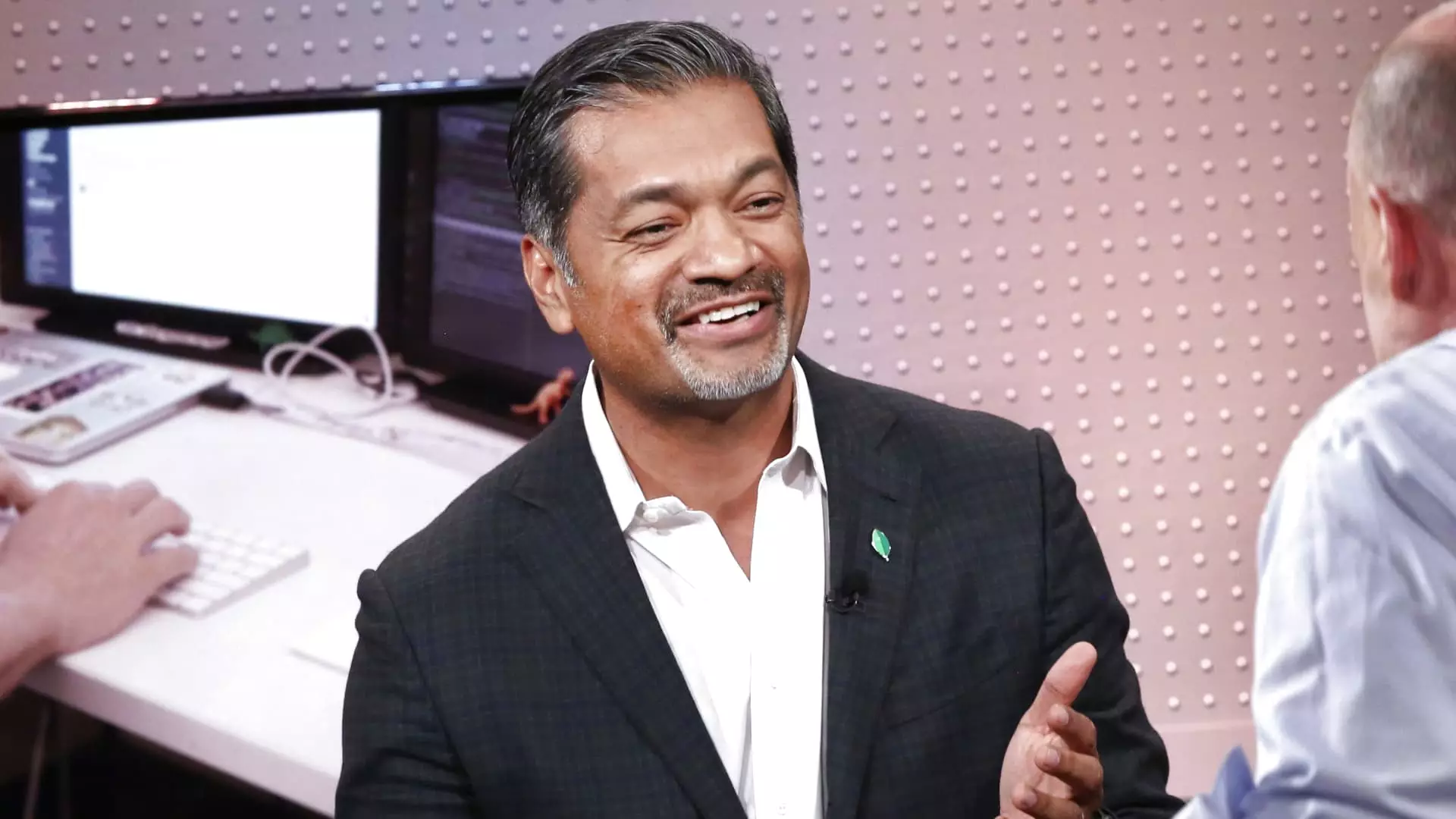

CEO Dev Ittycheria expressed confidence in MongoDB’s ability to assist customers in integrating generative AI into their business operations and modernizing their legacy applications. He highlighted the company’s Atlas cloud database service, which performed better than anticipated. Despite challenges in the economic landscape affecting consumption growth in the previous quarter, MongoDB remained resilient in securing new business opportunities.

In contrast, Elastic, another software maker, experienced a decline in client commitments, leading to a 23% drop in stock value after hours. During the earnings call, Ittycheria discussed the company’s efforts to support organizations in transitioning from Elastic products. Looking ahead, MongoDB provided guidance for the fiscal third quarter, forecasting adjusted earnings between 65 to 68 cents per share and revenue ranging from $493.0 million to $497.0 million. The company also revised its fiscal 2025 outlook, anticipating adjusted earnings of $2.33 to $2.47 per share and revenue of $1.92 billion to $1.93 billion.

Despite fluctuations in the market and economic conditions, MongoDB has demonstrated resilience and a strong growth trajectory. The company’s ability to exceed expectations and adapt to changing circumstances underscores its position as a key player in the database software industry. With a focus on innovation and customer-centric solutions, MongoDB continues to pave the way for future success. As the company navigates the evolving landscape of technology and business, its strategic vision and financial performance remain key indicators of its ongoing success.