As we step into 2025, the financial landscape is seeing notable volatility, reminiscent of the earlier market frenzies driven by speculative trading. Following a remarkable run in 2024—the S&P 500’s strongest two-year performance since 1998—investors are reinvigorated and eager to capitalize on emerging trends. The backdrop of this trading fervor stems from the substantial recovery from the pandemic, which has reinvigorated retail investor interest and, correspondingly, the stock market’s upward trajectory.

Among the key players in this speculative surge are stocks tied to cryptocurrencies. The bullish trend in the digital currency market, highlighted by Bitcoin crossing the $96,000 mark, has propelled stocks of companies linked to crypto trading.

In a dazzling display of the intertwining of cryptocurrencies and traditional equities, several companies saw their stock prices soar on January 1. Notably, Microstrategy’s stocks recorded a staggering gain of over 360% in 2024, and this momentum didn’t dissipate with the dawn of 2025. The rally benefited other crypto-centric firms like Coinbase, Robinhood, Marathon Digital Holdings, and Riot Platforms, each showcasing substantial gains, reflecting the underlying resurgence of interest in digital currencies.

Furthermore, the sudden emergence of quirky yet symbolic tokens like “fartcoin” illustrates the absurdity and unpredictability of the current market environment. With its value jumping by 45%—now sitting at a market capitalization of $1.38 billion—it serves as a stark reminder of how speculative trading can defy conventional market logic and investor sentiment.

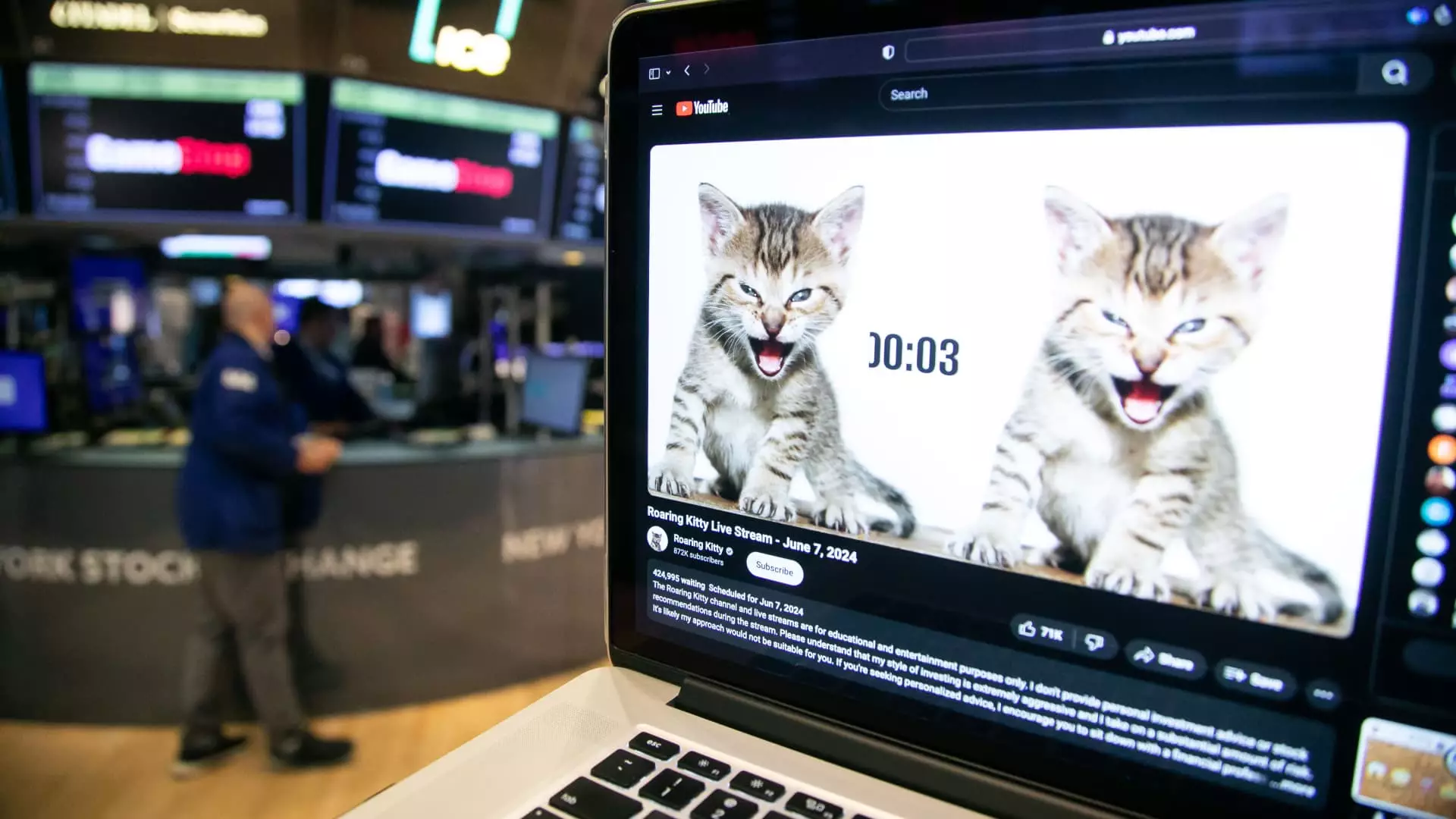

Amidst the chaotic trading environment, the concept of “meme stocks” has also resurfaced, with retail investors convening on social media platforms to share insights and predictions. The enigmatic figure known as Roaring Kitty, or Keith Gill, has returned to the spotlight, leading many to speculate about his intentions through cryptic messages. His recent post, featuring a clip of Rick James, has sparked debate over whether he is endorsing Unity Software or revisiting GameStop. This interplay of social media and stock trading exemplifies the democratization of investing—where traditional financial barriers are dismantled by collective retail engagement.

This surge in meme stock activity also highlights a psychological element in trading, where community sentiment can rapidly inflate or deflate stock prices based on fleeting social media interactions, rather than fundamental performance metrics. In this environment, it becomes increasingly evident that the fabric of stock trading is no longer solely woven by the machinations of institutional investors; rather, it is a richly complex tapestry intertwined with social influence and retail participation.

The Broader Market Context

The broader market is reflecting these dynamics too. The semiconductor sector, having been a major driver of growth throughout 2024, continues to lead the charge with corporations like Broadcom and Nvidia showing solid gains. The momentum from these stocks serves to backstop the S&P 500, which began 2025 on an optimistic note despite some inherent volatility.

This renewed enthusiasm echoes market behaviors seen during previous periods of economic optimism, such as post-Donald Trump’s election. The excitement of pro-business policies sparked substantial market rallies, reminiscent of the current trading landscape as investors anticipate the potential for deregulation and other expansionary measures from the new administration.

While the exuberance of the market may mirror earlier speculative phases, there is a palpable need for caution among investors. With inflation concerns looming and the Federal Reserve hinting at fewer interest rate cuts, the sustainability of such rampant speculation remains to be seen. Moreover, the impact of social media on stock trading introduces unprecedented volatility that can lead to sudden market corrections.

Ultimately, 2025 is shaping up to be a critical year, where the interplay of cryptocurrency trends, social media influence, and traditional market activities will define the trading environment. Investors would be wise to tread carefully, adopting informed strategies amid the shifting tides of retail and institutional trading landscapes. The era of speculative trading may be upon us, but understanding the fundamentals remains essential to navigating this new financial frontier.