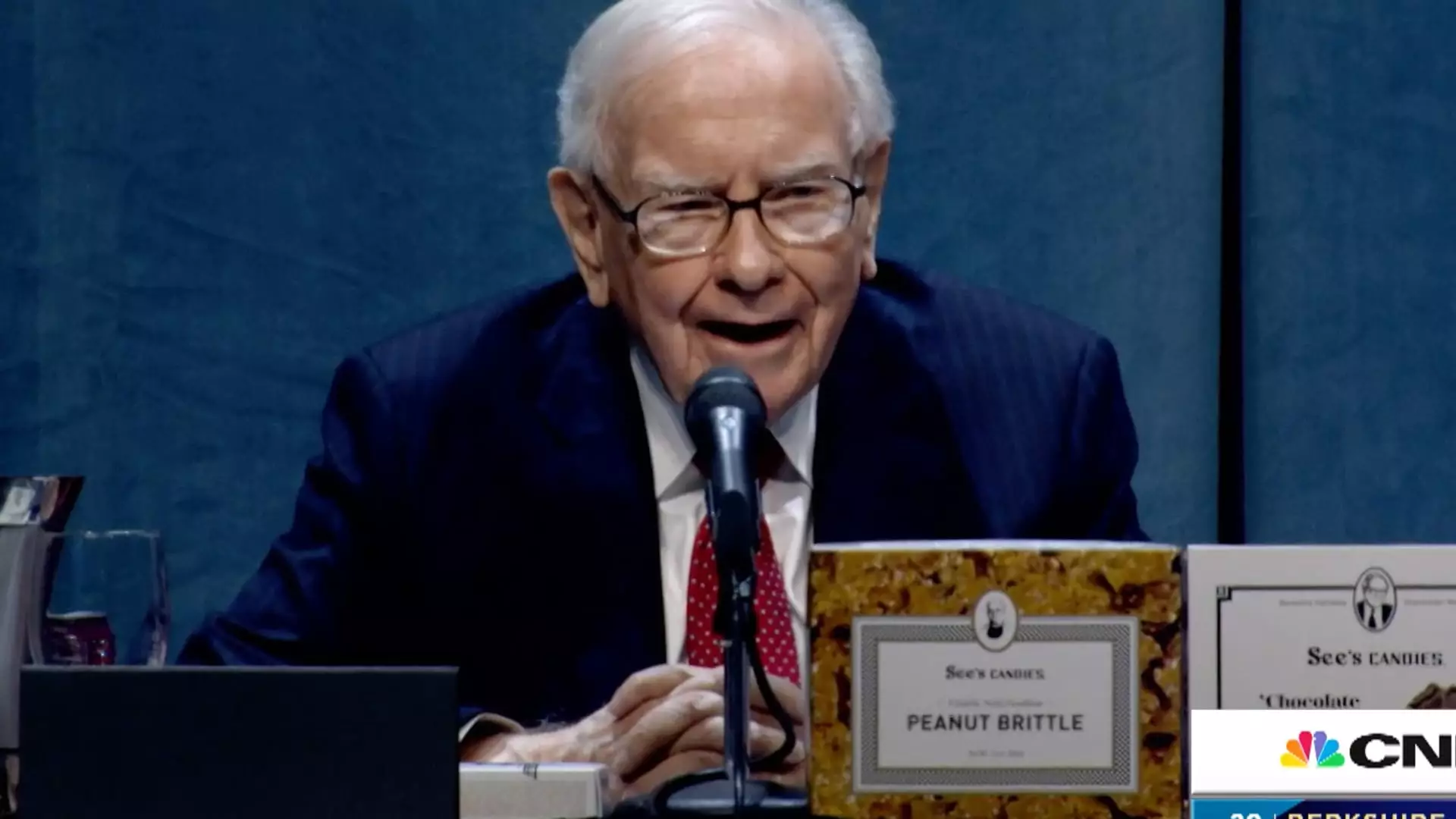

Warren Buffett, the esteemed CEO of Berkshire Hathaway and a titan in the investment community, recently made headlines with his thoughts on President Donald Trump’s tariffs. In a candid discussion, he articulated concerns that these punitive measures might lead to inflation, ultimately burdening consumers. He metaphorically described tariffs as being akin to an act of war, which underscores his belief in the significant economic fallout they could precipitate. Buffett’s stance emphasizes how tariffs can effectively function as a tax on all goods, shifting the cost burden directly onto consumers rather than being absorbed by producers.

His commentary arises from a seasoned understanding of market dynamics. As someone who has navigated multiple economic cycles, Buffett is privy to the complex interrelations of trade policies, consumer behavior, and inflationary pressures. By humorously questioning where the payment burden ultimately falls—asserting that even the Tooth Fairy isn’t footing the bill—he highlights a foundational economic principle: any increase in costs due to tariffs boils down to the consumer.

Buffett’s observations come at a crucial juncture as the economy grapples with trade tensions and a host of other issues. Recently, Trump announced significant tariffs on imports from Mexico, Canada, and China, igniting fears of retaliation that could escalate into a broader trade conflict. Market response has been cautious; with the S&P 500 rising only about 1% this year, traders and investors remain uncertain about the future. Buffett’s caution in managing Berkshire Hathaway’s portfolio—specifically his notable divestments and the accumulation of cash reserves—could be perceived as a pragmatic response to this uncertainty.

During an interview with CBS, Buffett notably avoided making direct comments about the current economic state, indicating a deliberate choice to refrain from forecasts or predictions. This aligns with his conservative investment philosophy, which leans toward waiting for clarity before making major financial commitments. His ability to sidestep direct predictions while still providing insight demonstrates the finesse with which he navigates public discourse on sensitive economic issues.

The contemporary financial landscape exhibits increased volatility, spurred by fears of a decelerating economy and fluctuating government policies. Buffett’s defensive positioning may suggest a bearish outlook on the market, or alternatively, it might be a strategic preparation for transitioning leadership within Berkshire Hathaway, as he rebalances the conglomerate’s assets in anticipation of his eventual succession.

His position as a market strategist is not only defined by investment choices but also by his capacity to influence public and corporate perceptions. By articulating his concerns about tariffs and their economic implications, Buffett steers a wider conversation that can have lasting effects beyond immediate market movements.

Warren Buffett’s views on tariffs encapsulate a broader narrative concerning economic policy realities and consumer impact. His seasoned perspective sheds light on the inherent risks of aggressive trade policies, particularly in a climate marked by uncertainty and volatility. Understanding his insights may encourage both policymakers and investors to consider the potential long-term consequences of their decisions in the complex world of global trade.