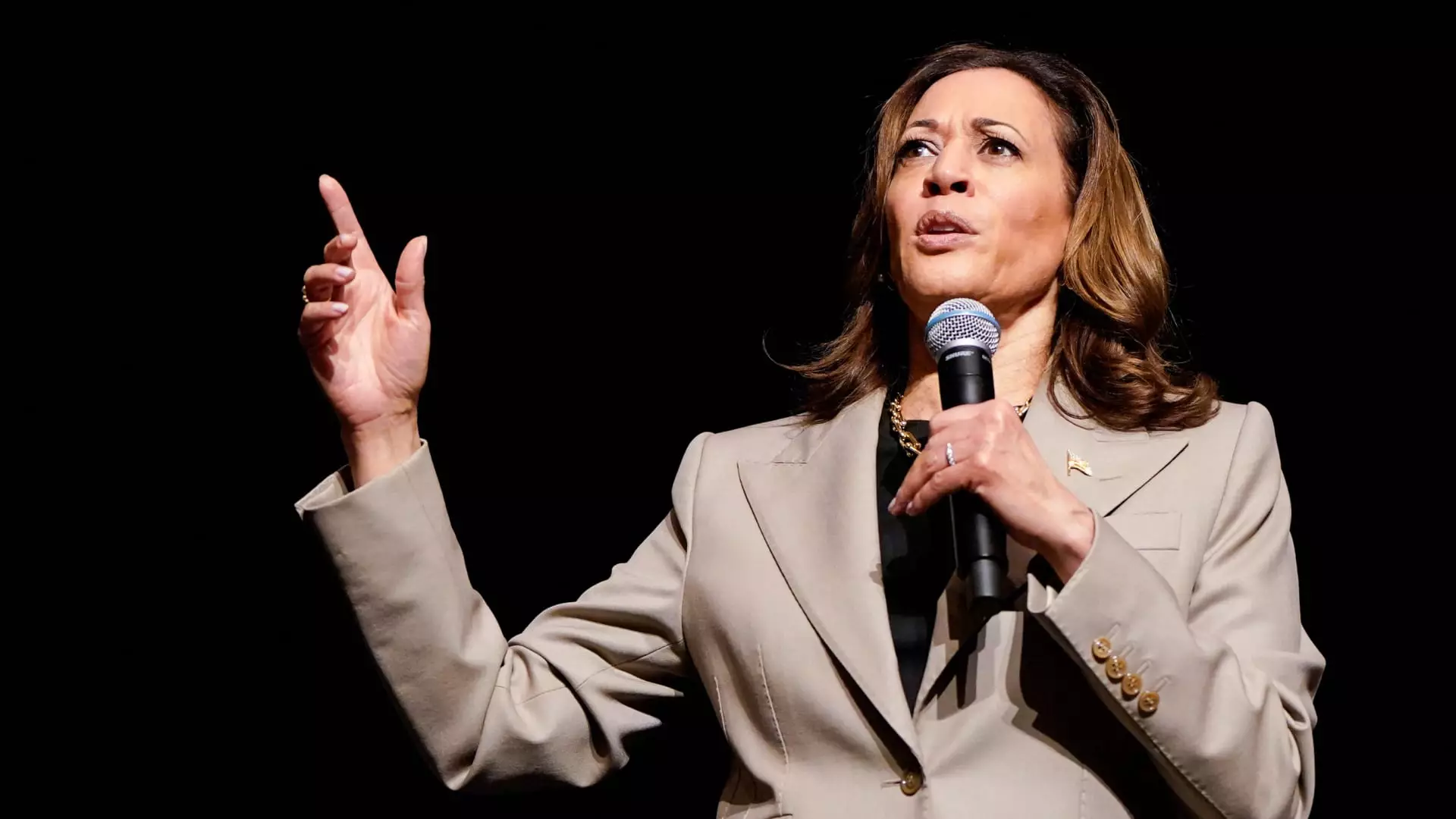

Vice President Kamala Harris recently introduced an economic plan that includes an expanded child tax credit, offering up to $6,000 in total tax relief for families with newborn children. This proposal aims to build on the higher child tax credit established through the American Rescue Plan in 2021. The plan has garnered both support and criticism, with experts weighing in on its potential impacts.

Harris’ plan seeks to provide $6,000 in tax relief to families during the first year of a child’s life. This proposed tax break would particularly benefit middle- to lower-income families, offering financial support during a crucial period. The $6,000 bonus for newborns is seen as a significant move in response to similar proposals put forth by other political figures.

The expanded child tax credit introduced by Harris could have far-reaching effects on families across the country. By increasing the financial support available to families with newborns, the plan aims to alleviate some of the financial burdens associated with childcare and raising children in the early years of their lives. This could potentially help reduce child poverty rates and provide much-needed relief to struggling families.

While there is bipartisan momentum behind expanding the child tax credit, some lawmakers have raised concerns about the potential costs associated with such a move. The size of the expansion and the design of the future credit will largely depend on which party controls the White House and Congress. Critics argue that the proposed expansion could be prohibitively expensive and may not be sustainable in the long run.

As discussions around the child tax credit expansion continue, it is essential to consider the long-term implications of such a move. While providing additional support to families with newborns is laudable, it is crucial to ensure that the plan is sustainable and does not exacerbate existing fiscal challenges. Harris’ economic plan also includes calls for higher taxes on wealthy Americans and large corporations, signaling a broader approach to addressing economic inequality.

Vice President Kamala Harris’ economic plan, including the proposed child tax credit expansion, has the potential to provide much-needed relief to families with newborn children. However, the long-term viability of such a plan and its potential impact on the economy are subjects of ongoing debate. As policymakers continue to explore ways to support families and address economic disparities, it is essential to strike a balance between providing assistance where needed and maintaining fiscal responsibility.