Despite AMD’s headline-grabbing revenue figures and optimistic forecasts, a closer examination reveals a shaky foundation beneath the company’s veneer of growth. The sharp decline in AMD’s stock following earnings reports underscores widespread investor unease—not just about short-term numbers but about the structural vulnerabilities that threaten its long-term viability. While the company boasts a 32% revenue increase year-over-year and exceeding analyst estimates, these figures obscure critical issues, notably uniform uncertainties related to international trade restrictions, geopolitical tensions, and operational sustainability. The illusion of a robust expansion disguises the reality that much of AMD’s recent performance and future outlook hinge on circumstances beyond its control, especially in the sensitive China market.

Geopolitical Headwinds and Regulatory Shackles

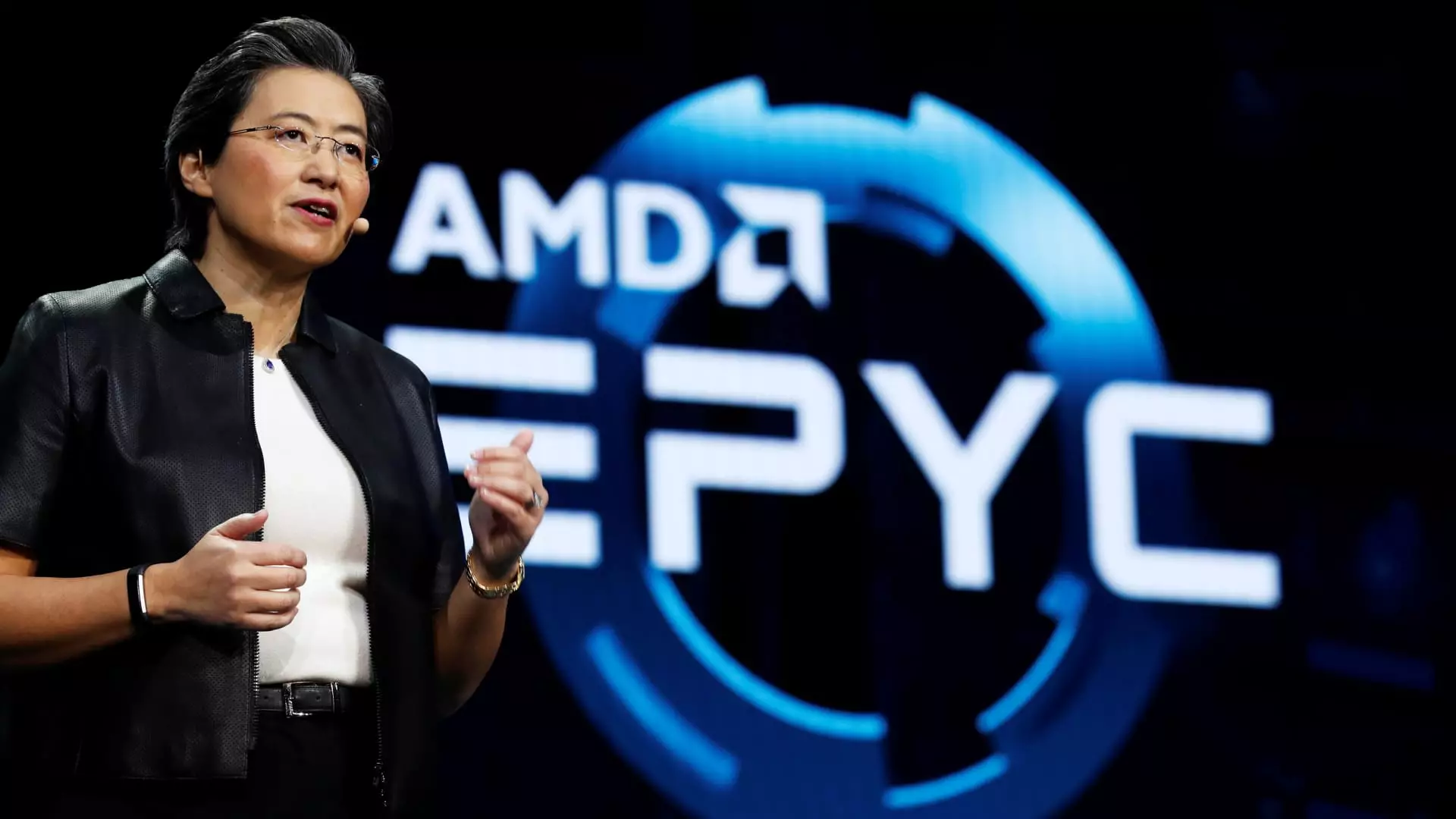

A significant source of distress for AMD is its entanglement with U.S.-China geopolitical tensions. The company’s exposure to China, historically a vital growth engine for semiconductor firms, is now fraught with risks stemming from export restrictions aimed at curbing AI chip sales. The CEO, Lisa Su, acknowledged this explicitly, pointing to declining revenues from flagship AI chips like the MI308 due to regulatory barriers. The manipulation of global markets through export controls is creating a “shadow zone” where AMD’s ambitions are thwarted by political agendas rather than market forces. While Su suggests the company is working with U.S. authorities to navigate licensing, the uncertainty surrounding these negotiations undermines confidence. What’s more troubling is the potential for these restrictions to become a permanent feature rather than a temporary hurdle, effectively freezing AMD’s growth prospects in China and forcing it to pivot elsewhere—an uncertain and risky proposition.

Overreliance on the Data Center’s Promise

AMD’s recent financials reveal that its strength is increasingly concentrated in the data center sector, which grew by 14% to $3.2 billion. While this segment appears promising, analysts express skepticism about the sustainability of this growth. The company’s ability to maintain and expand data center GPU sales is questionable amid concerns over the significant operational expenditures necessary to build a competitive ecosystem. Walstreet’s growing caution suggests AMD’s data center segment is more a reflection of the company’s aspirations than its assured triumph. Operating leverage is limited by rising expenses, and the sheer magnitude of investments needed to support software and systems growth might inhibit substantial profitability in the near term.

Overhyped Opportunities and Vague Timelines

Despite bullish comments from Su about the potential of the chip market—estimated in the hundreds of billions—the reality remains clouded by vagueness about the timing of crucial shipments and license approvals. The announced “soon” resumption of shipments to China still appears distant, with analysts warning that waiting for regulatory clearance could take months, if not longer. The narrative around “tens of billions” in market opportunity seems more aspirational than actionable, especially when the actual execution of strategic plans is hindered by external political factors. Investors are increasingly wary of pulling forward revenues based on optimistic projections that, due to the complex regulatory environment, might never materialize fully.

The Hidden Fragility Beneath the Illusory Lift

What becomes starkly apparent upon a critical review of AMD’s latest earnings is that the company’s narrative of growth depends heavily on tactical moves—such as navigating export restrictions and expanding data center capabilities—that are inherently uncertain. The recent earnings surge, while impressive statistically, masks underlying vulnerabilities: dependence on a geopolitical climate that worsens each quarter, mounting operational costs, and a capacity for rapid obsolescence in a fiercely competitive market. It’s a fragile glass house built on aspirations rather than assured ground—one that could shatter as soon as the political winds shift or demand for its products in key markets stalls. Investors must grapple with whether AMD’s current momentum is a genuine reflection of strength or a mirage driven by short-term boosts amidst an increasingly unstable global landscape.