The appointment of Billy Long as the incoming head of the Internal Revenue Service (IRS) under President Trump has sparked a heated debate within Washington and the larger tax community. As an experienced former congressman from Missouri with a background in tax advising for small businesses, Long’s nomination signifies a potential pivot in the agency’s direction, especially in light of its recent comprehensive reforms. However, this move raises questions about the future of taxpayer service, enforcement, and overall agency integrity.

The Context of Change at the IRS

The IRS has undergone significant overhauls in recent years, driven in large part by an infusion of nearly $80 billion in funding approved by Congress in 2022. These funds were earmarked for advancements in technology, improved customer services, and a new initiative for free filing. Additionally, the agency has ramped up its efforts to tackle tax evasion, specifically targeting high-income earners and complex corporate partnerships. Long’s nomination could either bolster these initiatives or lead to a slowdown in their implementation, particularly given the contentious political landscape surrounding tax policy.

With the Trump administration’s historical skepticism toward government agencies, Long may face pressure to reassess these priorities. There is a strong sentiment among Republicans suggesting that the IRS has become too focused on enforcement rather than assisting taxpayers, a view that Senator Mike Crapo has articulated in response to Long’s appointment. Consequently, the appointment raises a pressing question: will Long prioritize the modernization of the agency or revert to a more punitive approach?

Long’s Background and Experience

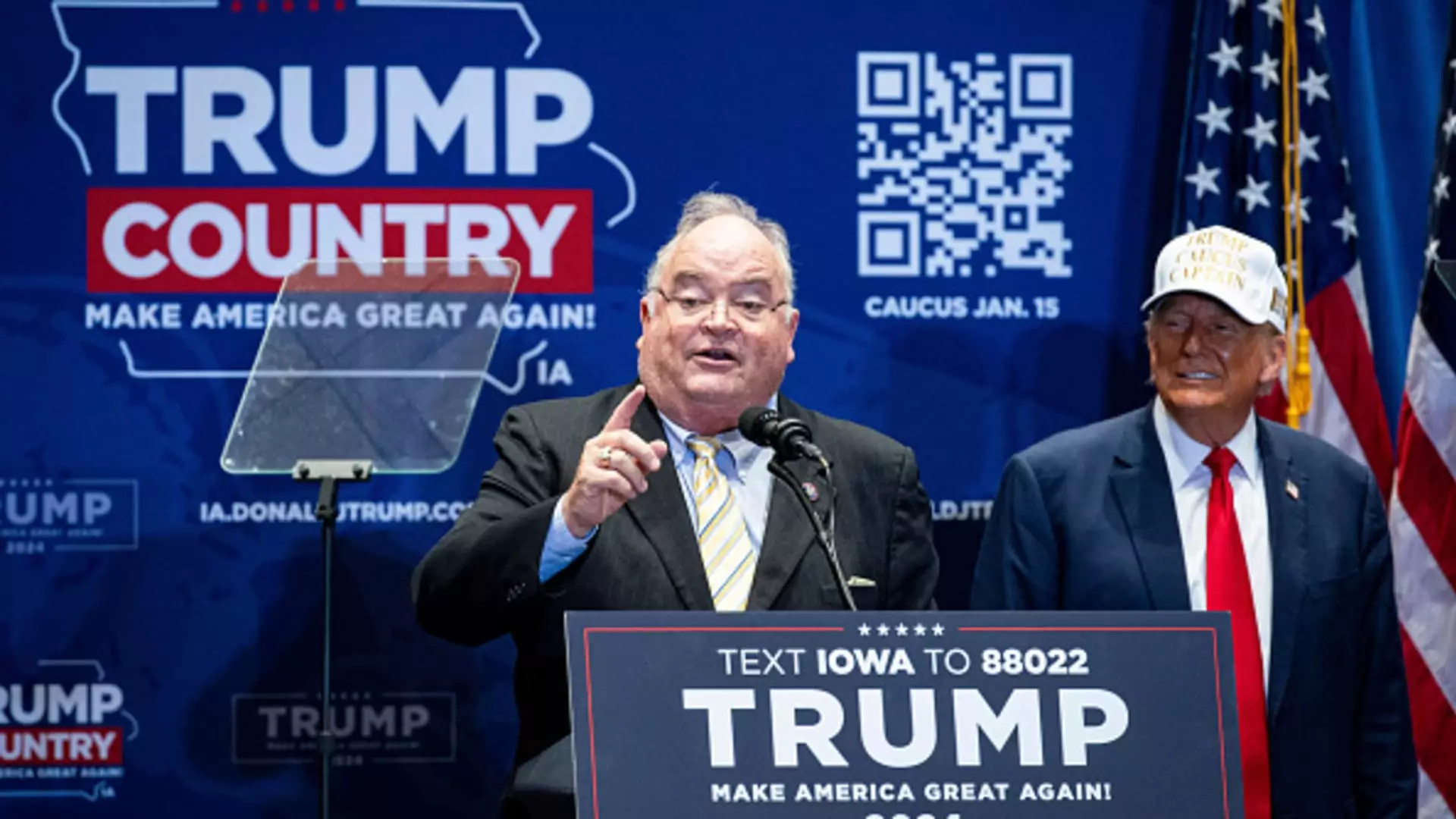

Billy Long, who previously served six terms in Congress from 2011 to 2023, brings a unique perspective to the IRS. His transition from a business and tax advisor to a federal agency head illustrates a blend of legislative experience and practical insight into the complexities of the tax system. Trump’s assertion that “taxpayers and the wonderful employees of the IRS will love having Billy at the helm” suggests an expectation that Long will prioritize the needs of both parties.

However, there are voices of skepticism. Former IRS commissioner Charles Rettig expressed uncertainty about Long’s ability to navigate the intricacies of the agency’s operations effectively. Concerns linger about Long’s immediate impact and the possibility that his legislative experiences may not translate into effective leadership at an agency facing multidimensional challenges, from technological updates to public skepticism.

The nomination has received a divided response. While Republicans like Sen. Crapo express optimistic support for Long, emphasizing the need for agency improvements, Democrats are worried. Senate Finance Committee Chair Ron Wyden’s critique of Long as “a bizarre choice” stems from the recent controversy surrounding the Employee Retention Tax Credit, a pandemic-era tax scheme. Allegations have emerged that this program has been exploited, leading to rampant fraud. This context casts a shadow on Long’s credibility, given that his post-congressional career has been connected to this problematic industry.

This pushback reflects a broader concern about the implications of having someone in charge who has ties to sectors mired in controversy. As the IRS prepares for a new leader, the balance between maintaining accountability and ensuring taxpayer trust is of utmost importance.

As Billy Long prepares for what could be a contentious confirmation and potential leadership role, the future of the IRS hangs in a delicate balance. While his experience might enhance the agency’s credibility and improve relations with funds appropriated for the IRS, the efficacy of his strategies will ultimately dictate taxpayer satisfaction. Achieving a blend of modernization, enforcement, and support for everyday taxpayers will be paramount.

In a landscape marked by partisan divides and evolving public opinions regarding taxation, the IRS under Long’s oversight may face unprecedented scrutiny. The choices made during this pivotal transition could shape tax policy and agency reputation for years to come, making this an appointment worth close observation. Ultimately, the efficacy of Long’s leadership will hinge on his ability to navigate both the internal complexities of the IRS and the broader political environment.