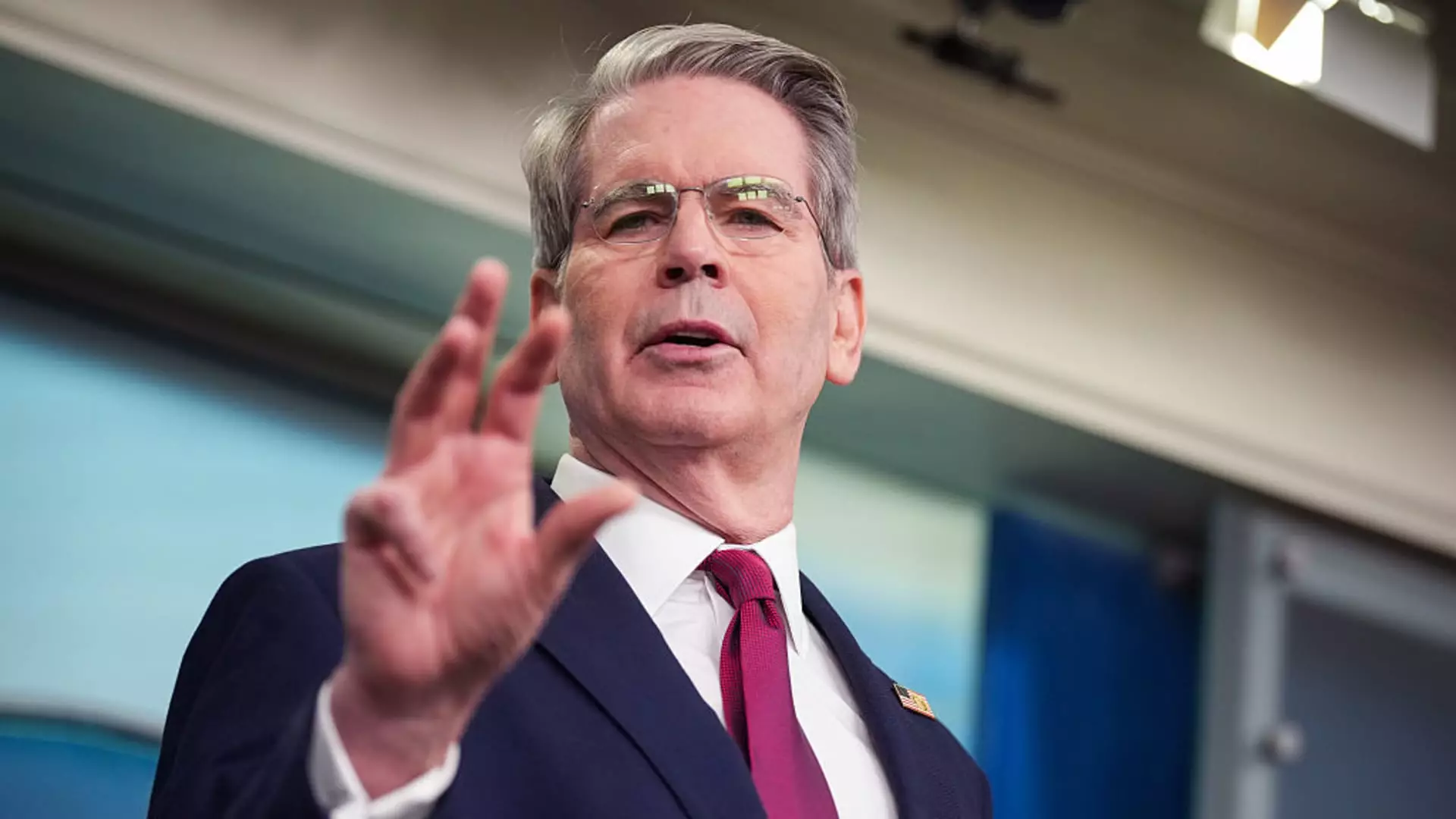

In an astonishing display of steadfastness, individual investors are choosing to weather the storm unleashed by President Donald Trump’s controversial tariff policies. According to Treasury Secretary Scott Bessent, a significant 97% of Americans have decided to stick with their investments despite the turbulent market conditions. This statistic, highlighted during a press briefing, underscores a fascinating dichotomy between lay investors and institutional players. While retail traders exhibit trust in the political machinations of the Trump administration, institutional investors are panicked, signaling a turbulent phase in our economic landscape.

Bessent’s remarks hinge on a crucial point: individual investors are not simply passively holding positions; they exhibit a profound faith in the direction the administration is taking, especially regarding trade negotiations. This perspective is intriguing because it reflects a form of grassroots confidence that stands in stark contrast to the growing unease among professional traders and hedge funds. Whereas the latter are fleeing to safer bets, retail investors are capitalizing on the downturn to acquire stocks at distressed prices, showing a resilience that could very well define the future of these markets.

The Tariff Tug-of-War: Economic Risks Loom Large

However, this unwavering faith might be misplaced. Trump’s strategy of levying steep tariffs has led to the most significant stock market drop since the pandemic’s initial shock. Analysts fear that these tariffs could push the economy toward a recession — a real possibility underscored by chief economist Torsten Slok of Apollo, who anticipates that American consumers will soon face trade-related shortages. The looming specter of scarcity could transform the bullish spirit of everyday investors into palpable fear, leading to a sudden shift in sentiment.

Furthermore, the implications for the United States’ global economic reputation are stark. Ken Griffin, CEO of Citadel, articulated concerns that Trump’s aggressive trade policies risk tarnishing the “brand” of the United States, which has long been a beacon of stability for global investors. The implications of such a situation are dire, particularly for US Treasury bonds, which have historically been deemed safe havens. If the allure of American investments starts to fade, we could be on the precipice of an economic crisis more severe than anticipated.

The Future of National and Individual Financial Trust

There is a paradox at play here: while the institutional investors seem to be correctly reading the tea leaves and preparing for potential economic hardship, the individual investor remains unyielding in their conviction. This divergence raises a pivotal question: are these retail investors exhibiting a commendable loyalty to the national narrative crafted by Trump, or are they dangerously ignoring the signs of an impending downturn? Their belief in Trump’s ability to navigate through turbulent economic waters could either signify a level of optimism that is refreshing or a misguided faith that threatens their financial security.

As the market churns and political winds shift, one must wonder if this level of confidence can be sustained. It seems that the stakes are incredibly high; retail investors’ unwavering trust may soon be put to the ultimate test as economic realities clash with political ambitions. This period of uncertainty unveils a profound commentary on the relationship between faith, politics, and economic stability, revealing both the strength and fragility of the American investment landscape.