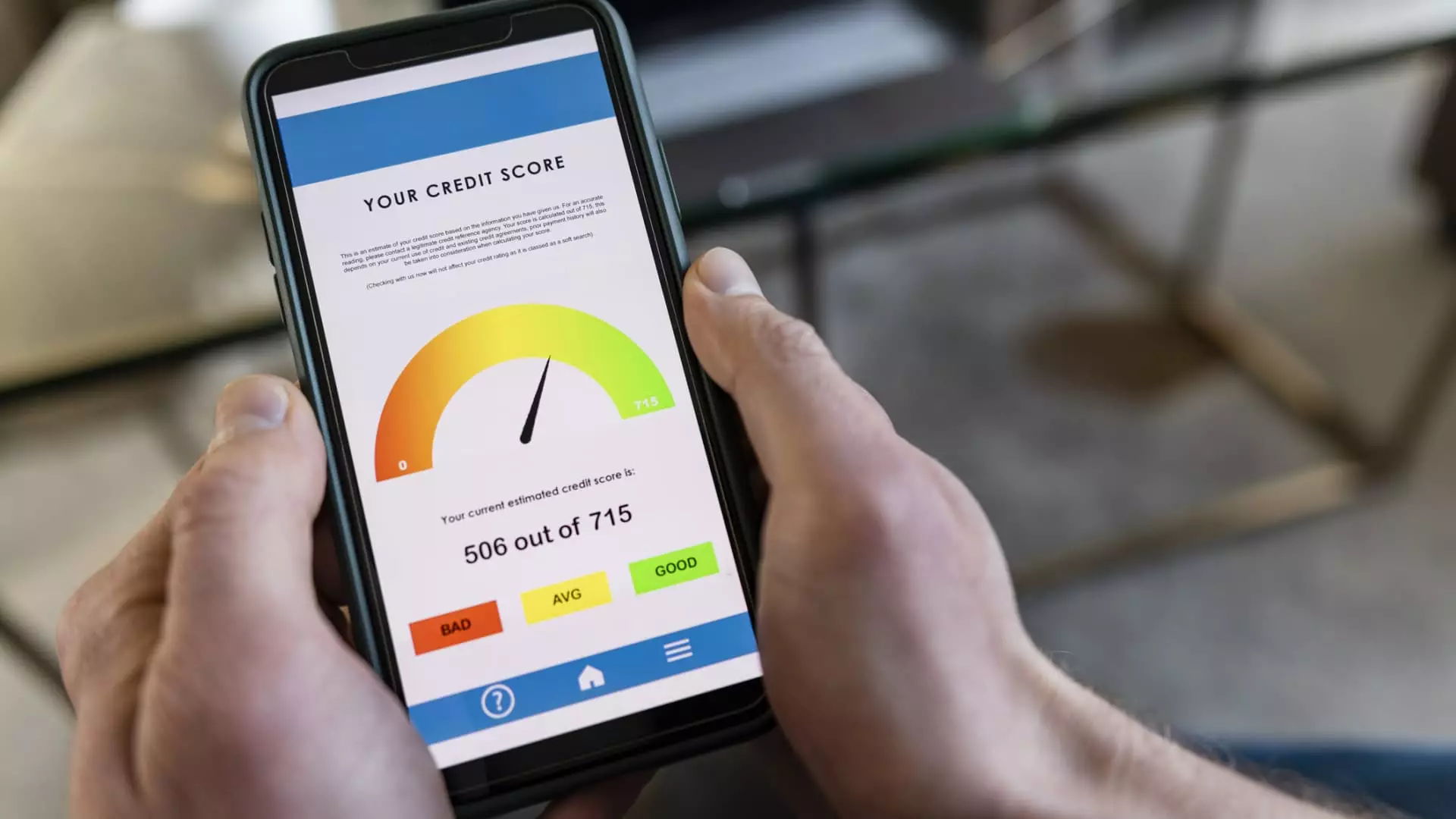

The latest report from FICO starkly exposes a troubling trend: the collapse of America’s once steadily improving credit scores. Once a symbol of financial responsibility and upward mobility, the national average now languishes at 715—taking a nosedive from recent highs of 718 and 717. This decline isn’t an anomaly; it’s a reflection of systemic economic wounds that have been festering for years. High-interest rates, relentless inflation, and a relentless job market squeeze have severely compromised Americans’ ability to sustain sound financial habits. The fact that average credit scores are falling despite widespread liberal efforts to promote financial literacy and support is a sign that our economy is unravelling faster than policymakers recognize.

Far from being an isolated statistic, this decline signifies a broader crisis of confidence in economic stability. It demonstrates that in a society where debt has become normalized—even celebrated—many are sinking deeper into financial instability. As consumers max out credit cards and delay payments out of necessity, the credit scoring models capture the chaos—not the resilience—of American households. The data makes it clear: the social safety nets and policy buffers haven’t been enough to shield Americans from the storm of economic distress. It is a sobering reminder that the pursuit of economic equity must include genuine reforms that address the root causes of persistent financial hardship, rather than superficial fixes.

The Resumption of Delinquency Reporting: A Harbinger of Hardship

The end of pandemic-era forbearance for federal student loans was a catalyst, sharply revealing how fragile financial recovery can be. During the pandemic, many borrowers benefited from temporary relief—loans marked as current despite missed payments, artificially inflating credit scores that were already precarious. Once that relief evaporated on September 30, 2024, the true picture emerged: vast numbers of struggling borrowers plunged into delinquency, dragging down average scores and exposing the flawed optimism of federally mandated forbearance programs.

This shift highlights the inconsistency of American economic policy. While some see temporary relief as a solution, the reality is that fundamental issues—rising student debt, stagnant wages, and the high cost of living—remain unaddressed. Delinquencies now spike, not necessarily because borrowers are reckless, but because they are overwhelmed by a system that benefits the wealthy at the expense of the lower and middle classes. The growing wave of missed payments underscores a core truth: many Americans are living on the edge, forced to choose between mounting debt and essential living costs, without a safety cushion to absorb shocks.

Wealth Disparities Mirror the Credit Divide

Amid the overall decline, a stark divide is emerging. While the median scores for struggling consumers plummet, those fortunate enough to have benefited from the boom in stocks and booming real estate markets are not only surviving—they are thriving. These individuals are witnessing record high assets and are arguably insulated from the turbulence that afflicts the broader economy.

This dual reality underscores a critical flaw within our financial ecosystem: wealth concentration is increasingly rewarding a select few while condemning most to precarious financial footing. In this context, credit scores serve as a proxy for access and opportunity. Those on the lower end grapple with higher rates, reduced borrowing capacity, and a perpetual cycle of debt, while a wealthy minority capitalizes on market gains. This disparity exposes the systemic inequities that a liberal-centered economic approach must confront more aggressively—ensuring that opportunities for credit advancement aren’t gatekept by wealth but are part of a broader social contract aimed at economic justice.

Real Solutions or Pearls of Wisdom for a Sinking Ship?

Despite the gloom, experts insist that individuals still hold some control over their financial destinies. But it’s not enough to merely tell people to pay bills on time or manage credit utilization; this advice glosses over the deeper structural deficiencies. In a country where wealth inequality directly impacts credit health, individual actions can only go so far. True reform must address the systemic failures that disproportionately penalize the less fortunate.

Yet, the message remains: improving credit isn’t just about maintaining better habits; it’s a survival strategy. For those caught in the current economic maelstrom, these tips—pay on time, keep balances low—are lifelines. But these should be viewed through the lens of social responsibility. As a society, we should question whether the current credit system—designed to penalize risk—actually exacerbates inequality, or if it can serve as a catalyst for more inclusive economic empowerment.

In the end, the ongoing deterioration of America’s credit profile signals more than personal finance troubles. It underscores the urgency for a balanced, center-left approach that promotes economic justice, regulates predatory lending, and expands opportunities for financial mobility. If we continue down this path of neglect, the divide will only deepen, creating a nation where privilege, rather than merit, dictates one’s creditworthiness and, ultimately, one’s life chances.