Philadelphia Federal Reserve President Patrick Harker recently expressed his strong support for an interest rate cut during an interview with CNBC at the Fed’s annual retreat in Jackson Hole, Wyoming. Harker’s stance marks a significant shift in the central bank’s monetary policy, signaling that easing measures are likely to be implemented when officials convene next month. Harker emphasized the need for a methodical approach to rate cuts, urging the Fed to signal its intentions well in advance to avoid any market disruptions.

Harker’s comments come in the wake of the Fed’s growing confidence in the direction of inflation and its efforts to address potential weaknesses in the labor market. With markets already pricing in a high probability of a quarter-point rate cut, and some speculating on the possibility of a more aggressive 50-point reduction, Harker’s cautious approach underscores the uncertainty surrounding the upcoming decision. While he refrained from committing to a specific rate cut size, Harker emphasized the importance of analyzing additional data before making a final decision.

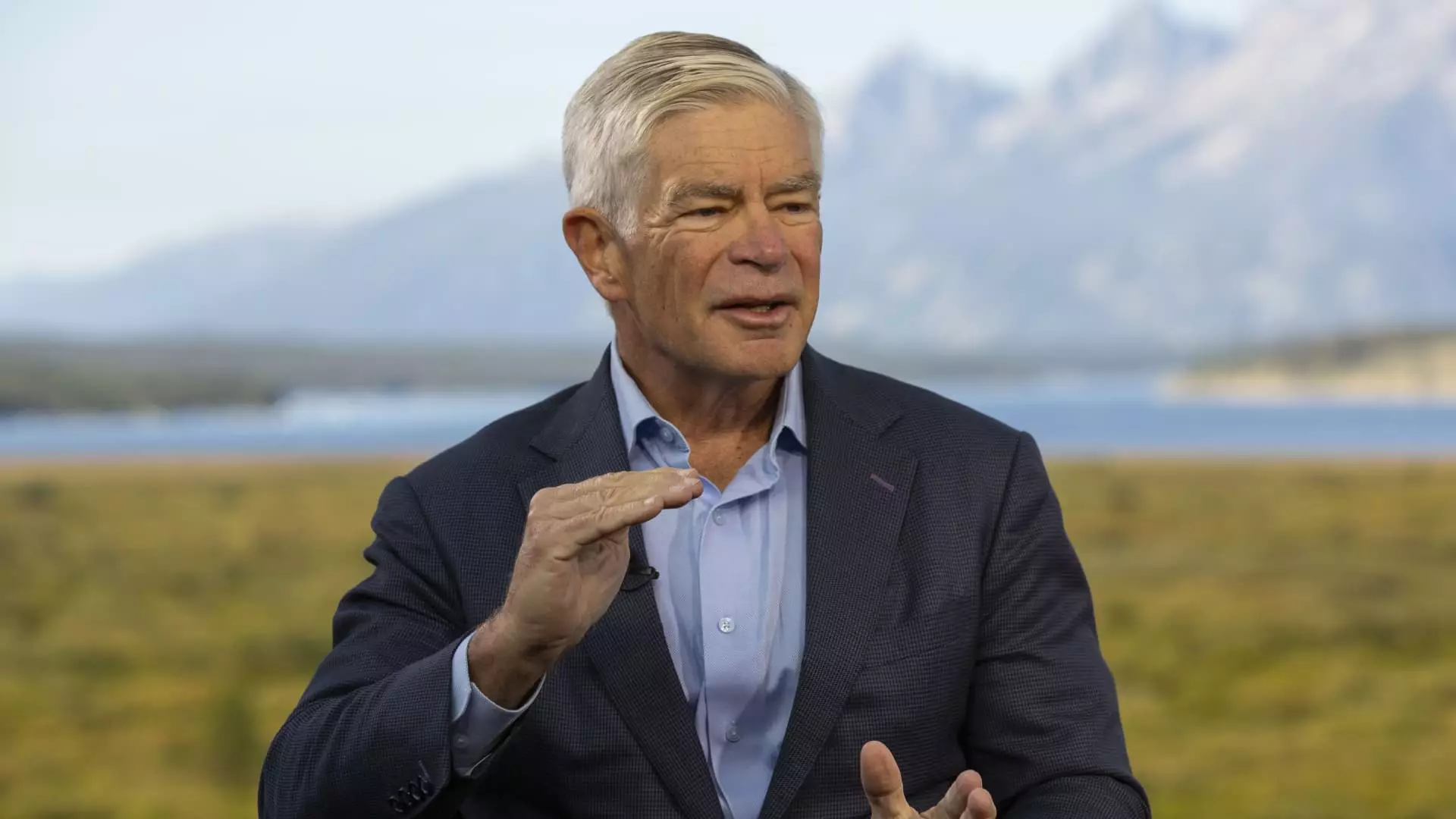

Kansas City Fed President Jeffrey Schmid also shared his insights on the current economic landscape during a CNBC interview. While Schmid did not explicitly endorse an interest rate cut, he hinted at a potential shift in policy direction due to mounting concerns about the labor market. Schmid pointed to the rising unemployment rate as a key indicator of underlying economic challenges, suggesting that the Fed may need to reassess its stance on monetary policy.

Schmid acknowledged the role of the labor market dynamics in influencing inflation trends, noting that a previous imbalance between supply and demand had fueled inflationary pressures. However, recent data signals a cooling off in job indicators and a gradual uptick in the unemployment rate, prompting policymakers to consider the need for intervention. Despite these challenges, Schmid expressed confidence in the resilience of banks under the current high-rate environment and dismissed concerns about monetary policy being overly restrictive.

As the Federal Reserve prepares for its upcoming policy meeting, the views of key officials like Patrick Harker and Jeffrey Schmid offer valuable insights into the complex decision-making process. While Harker advocates for a cautious and methodical approach to interest rate cuts, Schmid highlights the evolving challenges in the labor market that could warrant a shift in policy direction. The delicate balance between inflation management and labor market stability underscores the Fed’s ongoing challenge to navigate uncertain economic conditions.

Ultimately, the forthcoming decision on interest rates will depend on a careful assessment of economic data and emerging trends. Both Harker and Schmid emphasize the importance of data-driven decision-making and the need to respond proactively to changing economic conditions. As the Fed continues to uphold its mandate as an independent and data-focused institution, the implications of its policy decisions will reverberate throughout the broader economy. Stay tuned for further developments as the Federal Reserve approaches its next policy meeting and grapples with the complexities of monetary policy in a dynamic economic environment.