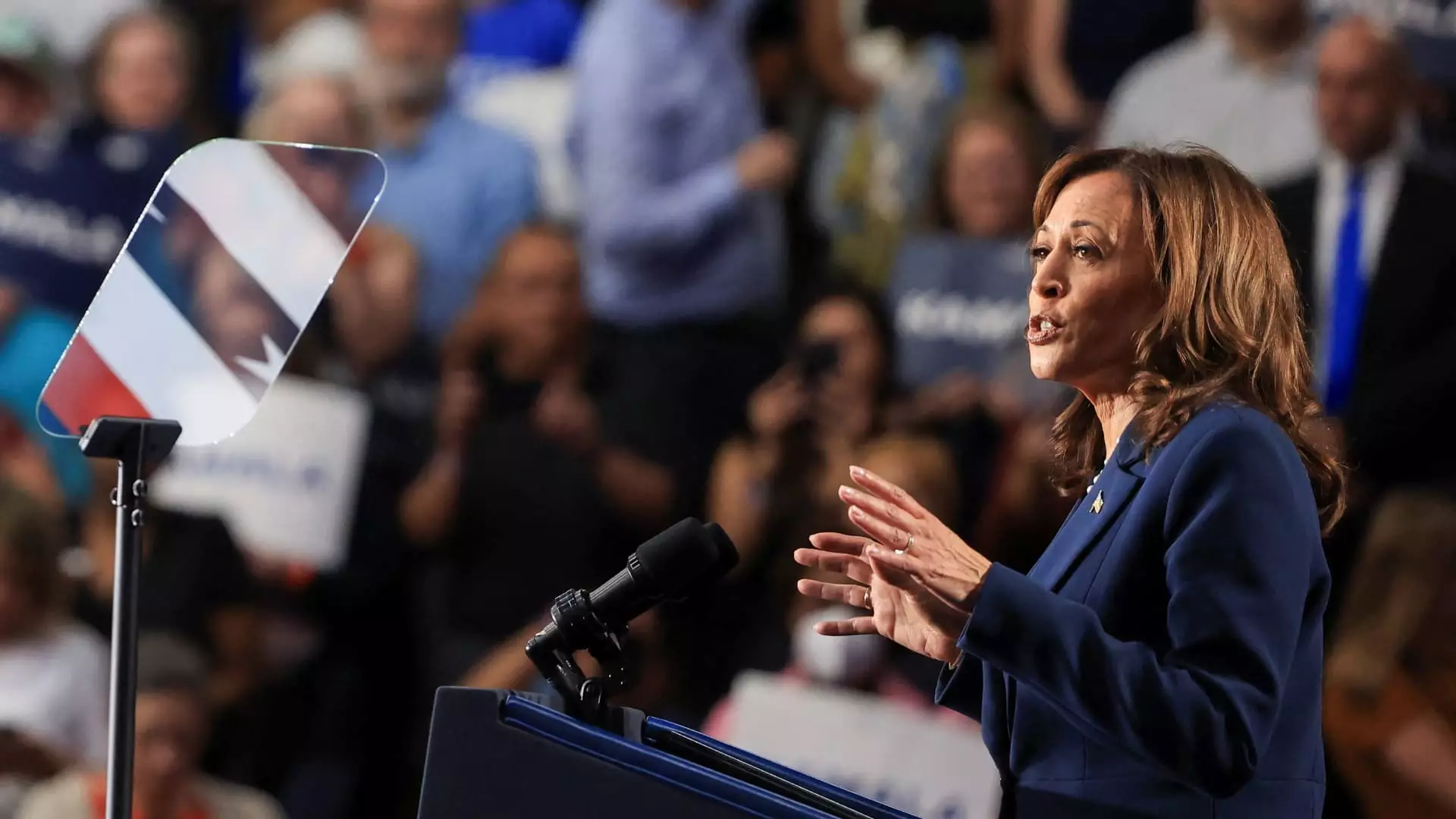

In a pivotal speech in West Allis, Wisconsin, Vice President Kamala Harris declared that strengthening the middle class would be a cornerstone of her presidential campaign, particularly as she emerges as a leading contender to succeed President Joe Biden as the Democratic candidate. Harris’s assertion encapsulates a long-standing concern: a flourishing middle class is essential for a thriving society. Her remarks signal a shift in focus to address the growing wealth gap, a theme that resonated powerfully with many voters who feel economically marginalized in contemporary America.

Harris’s commitment to the middle class is not merely a talking point; it is an integral part of her political ideology. She believes that when the middle class flourishes, it provides a stabilizing force for the economy and the nation, implying that the welfare of this demographic is intrinsically linked to the nation’s broader economic health.

One of Harris’s hallmark proposals is the LIFT (Livable Incomes for Families Today) Act, which aims to deliver significant financial support to lower- and middle-income families through substantial tax credits. Specifically, it proposes an annual tax credit of up to $3,000 per individual, or $6,000 for couples, effectively injecting vital funds into households that struggle to make ends meet. This measure could serve as a critical lifeline for many American families facing a stark economic landscape, particularly with rising costs and stagnant wages.

Economic experts highlight that such a tax credit could provide immediate relief to renters specifically, a demographic often squeezed by escalating housing costs. In an environment where traditional housing legislation, like the rent cap proposal introduced by Biden, may unintentionally lead to market distortions, the LIFT Act appears to offer a more straightforward solution. Critics argue that imposing limits on rent increases might result in landlords withdrawing properties from the market, ultimately exacerbating housing shortages and driving up prices. In contrast, the LIFT Act directly addresses the financial burden faced by renters without risking negative market consequences.

As the cost of living continues to surge, many households are grappling with the erosion of real incomes, a scenario exacerbated by rising inflation. This financial strain fosters significant discontent with current economic policies, particularly those of the Biden administration. The implications are daunting; as uncertainty regarding job security mounts—partly fueled by the rise of artificial intelligence—there is a pressing need for renewed social safety measures. Experts argue that introducing tax credits targeting those under specific income thresholds could provide not just financial relief, but also bolster confidence among a workforce facing unprecedented volatility.

Laura Veldkamp, a finance and economics professor at Columbia University, underscores the increasing necessity for a robust social safety net, emphasizing that citizens are increasingly questioning the security of their employment in a rapidly changing job market. A well-designed tax credit could effectively mitigate these fears, helping to stabilize incomes during times of economic uncertainty.

However, implementing a proposal as ambitious as the LIFT Act is fraught with challenges, particularly concerning funding amid rising federal budget deficits. Harris initially suggested offsetting the costs by amending provisions of the previous Tax Cuts and Jobs Act, specifically targeting higher earners. Yet, the current fiscal landscape poses even greater challenges, particularly as Congress prepares for the expiration of substantial tax cuts enacted during the Trump administration.

Additionally, since the LIFT Act’s introduction, new priorities have emerged, notably the child tax credit enhancements implemented during the COVID-19 pandemic. These updates not only reinforced financial security for families but also contributed to an extraordinary reduction in child poverty rates. While the effectiveness of these measures provides a compelling case for expanding support for families, it raises the question of whether Harris will prioritize the LIFT Act or adopt a renewed focus on child tax credits moving forward.

The intricacies of the current political climate make it difficult to chart a definitive course for either proposal. The ambition to strengthen the middle class through targeted economic reforms is laudable, yet the path to implementation is riddled with obstacles. As Harris endeavors to appeal to a diverse electorate, the challenge lies in balancing immediate economic aid with sustainable fiscal practices.

Kamala Harris’s proposed economic agenda embodies a deep recognition of the challenges faced by many American families. By focusing on the revitalization of the middle class and proposing substantial financial support through initiatives like the LIFT Act, she aims to confront the systemic issues that have long benefitted the wealthy at the expense of working-class Americans. As her campaign unfolds, it remains to be seen how she will navigate the complexities of this agenda and its reception among voters.