Super Micro Computer, Inc., a key player in the server manufacturing industry, has recently found itself embroiled in a financial crisis that has significantly impacted its market position and investor confidence. The company’s shares plummeted by 22% on Wednesday, marking a stark decline to a price that hasn’t been seen since May of the previous year. This drop can be attributed primarily to the company’s disclosure of disappointing unaudited financials and an alarming lack of clarity regarding its plans to maintain its listing on the Nasdaq exchange.

As of the early afternoon of that disheartening Wednesday, Super Micro’s stock traded at $21.55, which is an astonishing 82% decrease from its peak of $118.81 in March. This precipitous decline has resulted in an estimated market capitalization loss of about $57 billion. Such financial turmoil places the company under considerable pressure as it faces the potential risk of delisting—a scenario that looms even larger given its unfiled audited financials since May.

The stock’s recent performance is not merely a blip; it represents a cumulative fallout following significant events, including the resignation of its auditor, Ernst & Young. This is not the first time Super Micro has undergone this turmoil; it marks the second auditor to withdraw within two years, raising crucial questions about the company’s internal controls and governance structure. Following this supervisory lapse, Super Micro has attracted scrutiny from both investors and activist groups, who have raised allegations about possible accounting irregularities and violations of export controls related to the shipment of sensitive technology to sanctioned nations.

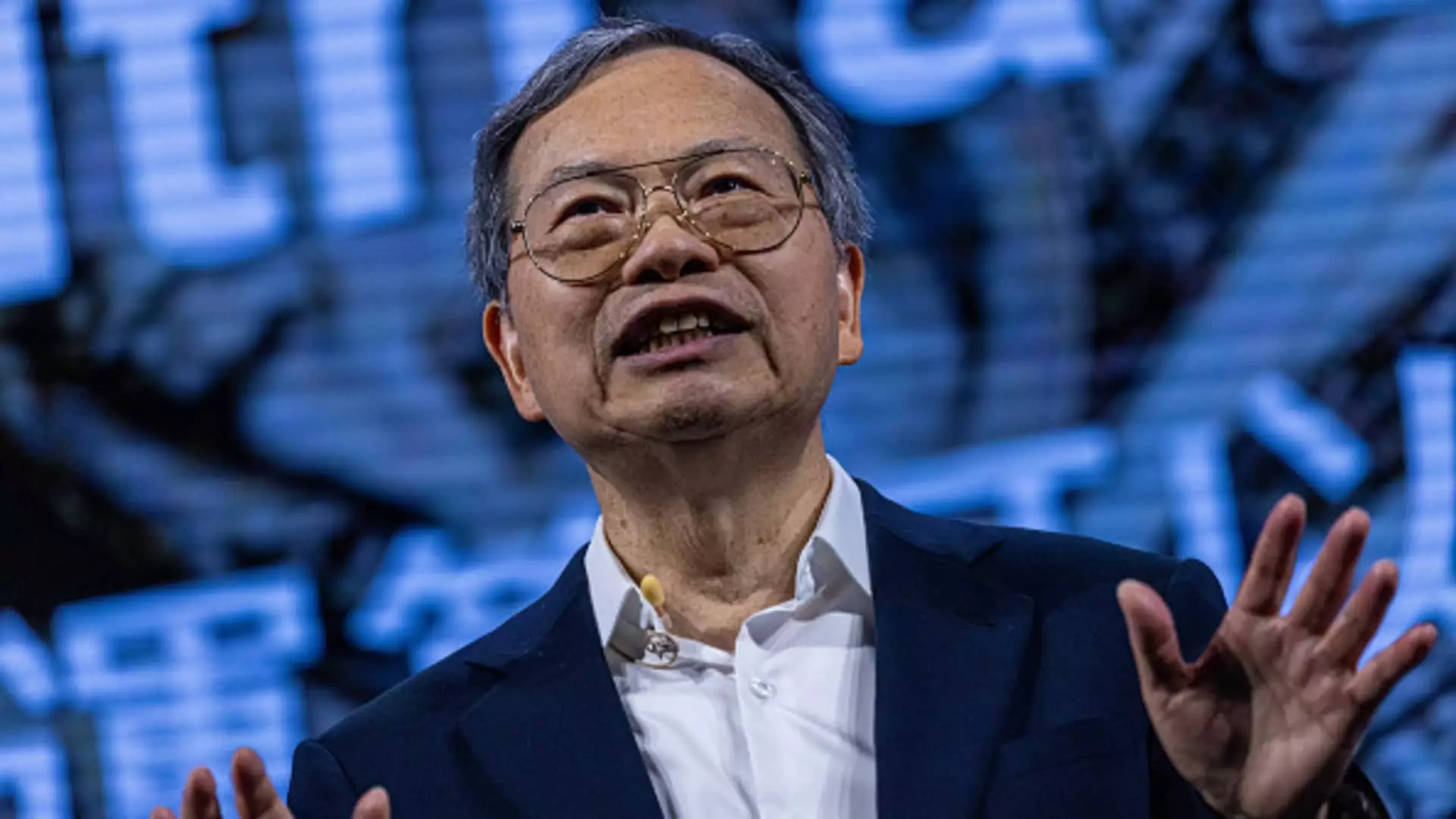

Amid these challenges, CEO Charles Liang and his management team have faced intense criticism regarding their handling of corporate governance and communication with shareholders. On an analysts’ call, Liang chose to sidestep discussions related to Ernst & Young’s resignation, opting instead to focus on the recruitment of a new auditor. While the urgency of securing an auditor is clear, this lack of transparency regarding the executive decision-making process has further exacerbated investor unease.

Analysts covering the stock have also reacted strongly to the company’s opaque financial reporting. Mizuho, for instance, suspended its coverage due to the insufficient detailing of financial metrics and a lack of verified audited statements. Wedbush analysts, retaining a cautious outlook with a ‘hold’ rating on the stock, expressed concern that the leadership seems overly focused on rectifying audit issues rather than addressing the more fundamental aspects of the business model and financial strategies.

Financial Performance vs. Market Expectations

Despite these governance issues, Super Micro reported net sales estimates between $5.9 billion and $6 billion for the quarter ending September 30, albeit falling short of analyst expectations of $6.45 billion. Yet, this figure still reflects a remarkable annual growth of 181%. The firm has thrived recently by leveraging the robust demand for servers that incorporate Nvidia’s advanced processors tailored for artificial intelligence applications.

Indeed, the surge in demand for AI-driven technology seems paradoxically positioned against the financial background of Super Micro. While the market sent indications of optimism in previous quarters, it appears that confidence has now unraveled amid auditor resignations and governance scrutiny. Liang affirmed that demand for Nvidia’s latest GPU, the Blackwell, remains strong, leading to questions about the timing of revenue generation from this product line. However, the critical dependency on Nvidia suggests a precarious position for Super Micro if its production schedules do not align with inventory availability.

Looking forward, Super Micro has projected revenues for the December quarter to range between $5.5 billion and $6.1 billion, falling short of the analyst consensus of $6.86 billion. This misalignment in expectations can further disrupt investor sentiment and stock performance unless the company manages to course-correct effectively. With adjusted earnings per share anticipated at 56 to 65 cents—significantly below the consensus estimate of 83 cents—Super Micro is under mounting pressure to restore confidence in its operations and financial practices.

In a bid to address potential governance failures swiftly, the company’s board of directors established a special committee to investigate Ernst & Young’s concerns. However, the committee’s findings—reporting no evidence of fraud or misconduct from management—while positive, may not be sufficient to quell the underlying fears that have taken root among investors.

Super Micro’s current state reflects a complex interplay of market turmoil, governance challenges, and financial performance limitations. As the company embarks on a journey towards stabilization, the outcomes of their upcoming financial disclosures and ongoing auditor negotiations will be pivotal in determining whether they can regain investor trust and secure a feasible path forward in this rapidly evolving sector.