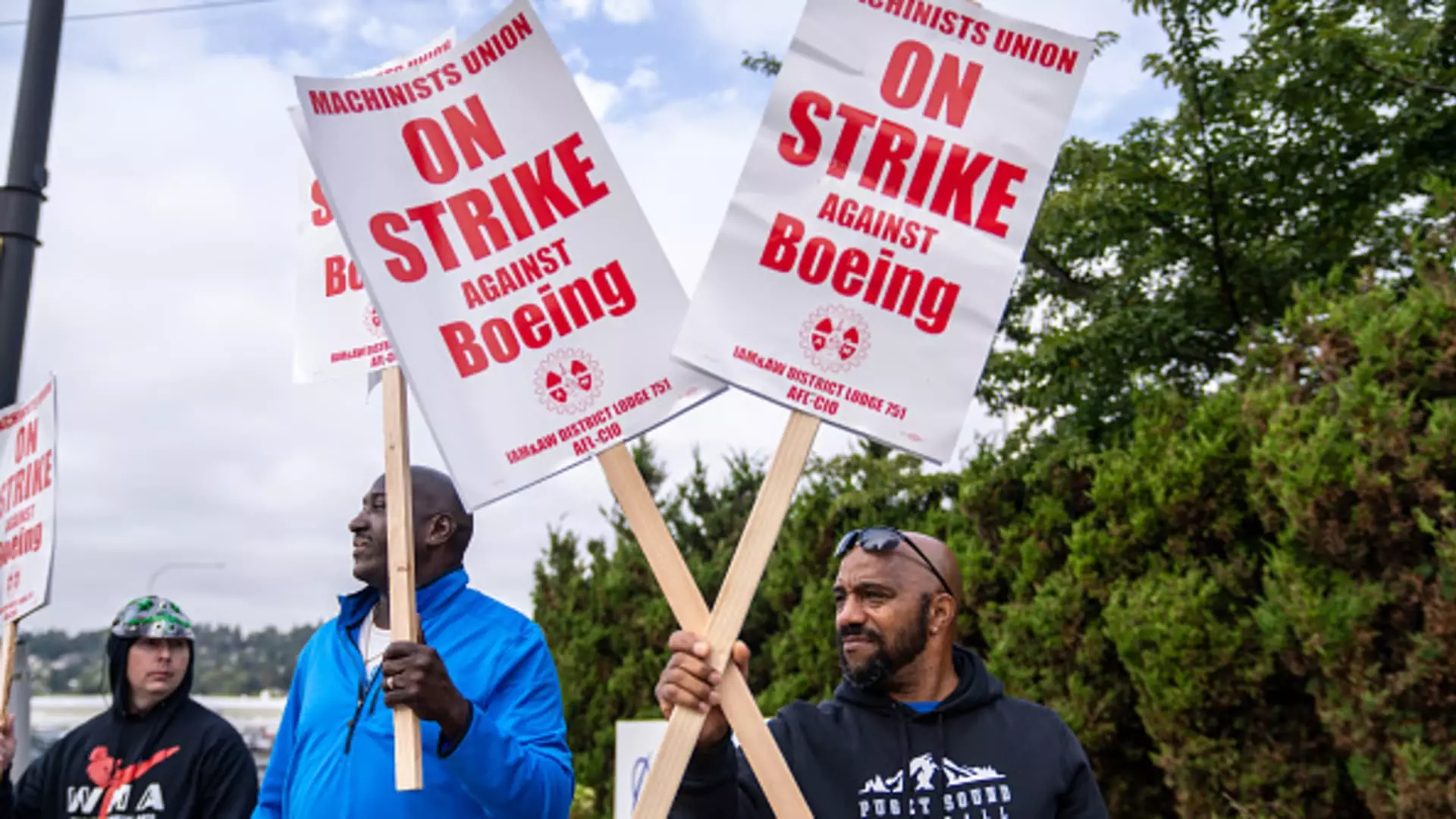

Boeing, once hailed as a titan of the aerospace industry, finds itself in a precarious situation following the departure of over 30,000 machinists who launched a strike after rejecting a tentative labor agreement. This event marks a significant escalation in labor tensions at Boeing, adding considerable pressure on its new CEO, Kelly Ortberg, who took the helm during a tumultuous period in the company’s history. The ramifications of this strike are multifaceted, affecting both the company and the broader aerospace sector.

The strike comes on the heels of a challenging year for Boeing, one that began with severe operational setbacks, including a major incident involving the 737 Max. This latest labor dispute represents a culmination of years of instability for the manufacturer, which has been grappling with the fallout from two tragic Max crashes that occurred six years ago. In a precarious financial climate, the company already faces an estimated loss of over $1 billion a month due to the strike, further complicating its recovery efforts.

With production facilities in the Seattle area and beyond idled, Boeing’s cash flow is suffering as the company struggles to resume operations. Last week, Boeing chose to withdraw a revised contract offer that had previously been rejected by the union, citing a lack of negotiations. This decision signals exacerbating tensions and highlights a breakdown in trust between the union and the management, which has previously expressed optimism about reaching a resolution.

Harry Katz, a labor relations expert, commented that Boeing will inevitably need to enhance its contractual offer to appease the machinists. However, the prospects of reinstating a traditional pension plan appear bleak. Many experts caution that the strike could persist for a protracted period, likely extending several weeks, which would keep Boeing in a state of financial distress.

Negotiations have become more contentious, particularly after the international union filed a complaint alleging that Boeing was engaging in unfair labor practices and negotiating in bad faith. Amid this impasse, union leader Jon Holden has encouraged a return to negotiations and called for a collaborative approach that could lead to a mutually agreeable outcome. He emphasized that it is ultimately the union members who will decide whether to accept any future proposals put forth by the company.

The financial implications of the ongoing strike are dire. Without paychecks and company-backed health insurance since the end of September, many machinists find themselves in precarious situations. However, unlike the previous strike in 2008, there are alternative job opportunities available in the Seattle area, including gig economy jobs and temporary work. This could serve as a buffer for workers, lessening the immediate financial impact of the strike.

Despite the hope that alternative job sources may cushion the blow, Boeing has made alarming announcements regarding its workforce. Ortberg informed employees that the company would initiate a 10% reduction in its global staff, including layoffs of various levels of management. Furthermore, delays in the production of key aircraft models, such as the 777X, continue to dent the company’s reputation and finances.

Boeing has not recorded a profit since 2018, and the present situation could further strain its relationship with investors. The company’s share value plummeted by 42% within a year, a stark reflection of the erosion of confidence in its leadership and operational stability. In the face of potential downgrades to junk status by S&P Global Ratings, the pressure will only intensify for Ortberg to execute strategic plans that stabilize the company’s financial standing.

Analysts are concerned that the issues plaguing Boeing—ranging from labor relations to program execution—have created a “doom loop” from which the company struggles to escape. Richard Aboulafia, an aerospace advisor, notes that labor costs only account for a small fraction of overall expenses in aircraft production, yet the current labor strife is directly hindering efforts to stabilize production of the 737, a vital cash generator for Boeing.

As the labor strike unfolds, Boeing stands at a critical crossroads. The company’s future hinges on Ortberg’s ability to not only restore operational capacity but also to reestablish trust with its workforce. The stakes are high, with implications extending beyond corporate walls to the entire aerospace supply chain and its myriad stakeholders. As Boeing navigates this complex landscape, the outcomes of these negotiations will likely echo for years, shaping the trajectory of one of America’s foremost industrial giants.