Oracle Corporation experienced a notable surge in its stock price, increasing by approximately 6% in after-hours trading, following the company’s announcement of an optimistic fiscal 2026 revenue forecast. This upward trend can be attributed not only to the raised guidance but also to a strategically timed analyst meeting during the Oracle CloudWorld conference in Las Vegas. The tech giant revealed an expectation of at least $66 billion in revenue for fiscal 2026, surpassing the $64.5 billion projected by analysts according to LSEG. This strong outlook has contributed to a remarkable 15% growth in Oracle’s shares over the last three trading days, driving the stock to a record high and realizing a staggering 55% increase year-to-date—placing Oracle among the top tech performers, trailing only behind Nvidia.

Long-Term Projections and Strategic Partnerships

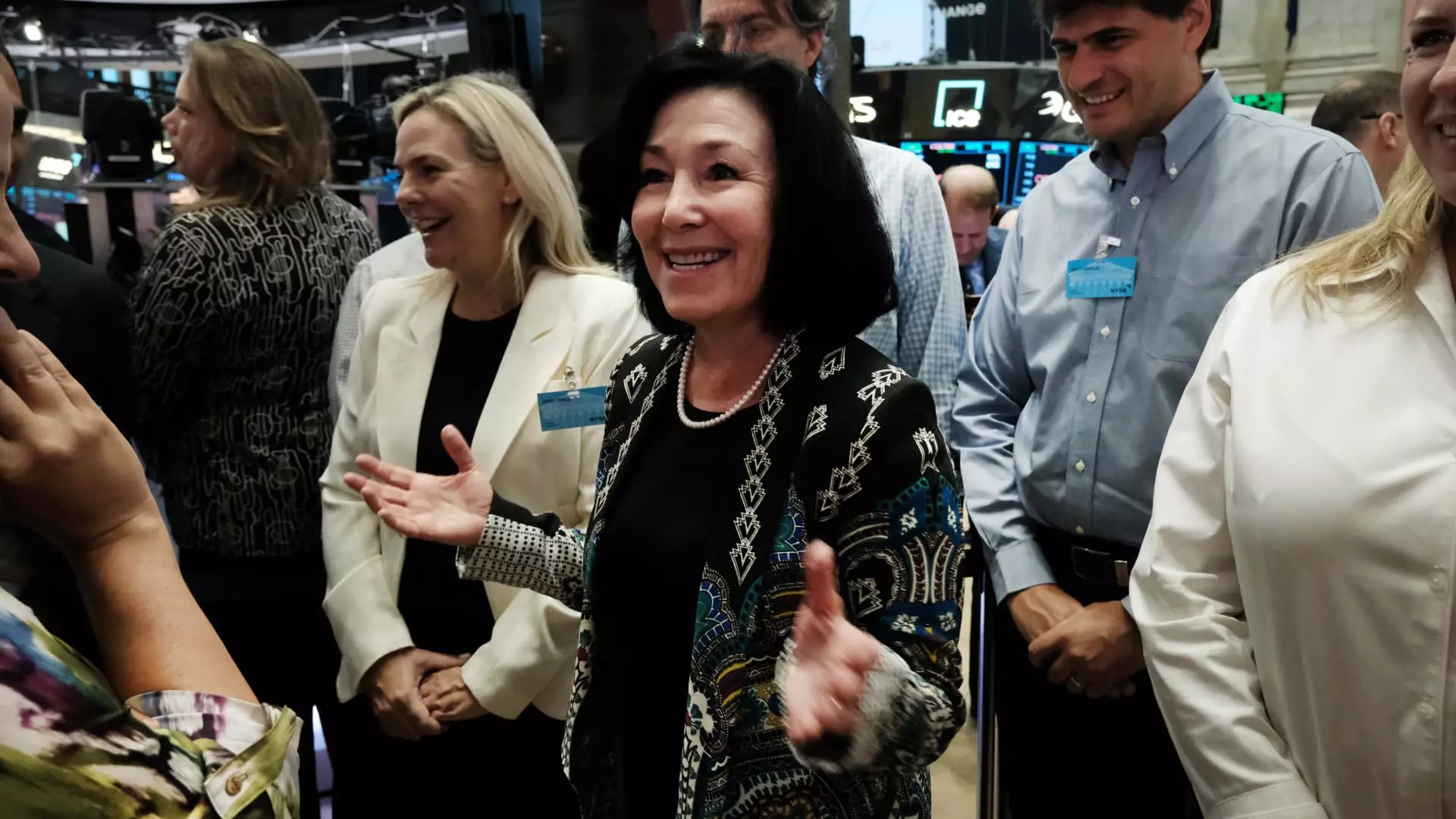

During the same meeting, Oracle outlined ambitious long-term revenue projections for fiscal 2029, setting its sights on generating over $104 billion. The company also forecasted a robust year-over-year growth in earnings per share at a rate of 20%. Such confidence expressed by CEO Safra Catz, who asserted that meeting those targets “should not be a problem,” showcases Oracle’s strategic positioning in a competitive market. Key to this optimistic outlook are partnerships with leading cloud service providers, including Amazon, Google, and Microsoft. Oracle’s recent collaboration announcement with Amazon underscores its commitment to integrating with major players to enhance its database software’s accessibility through high-profile cloud platforms.

Oracle has made significant strides in cloud infrastructure, boasting a 45% growth in this sector in the most recent quarter—a faster rate than that of its competitors such as Amazon, Google, and Microsoft. This growth illustrates Oracle’s successful transition from traditional database solutions to cloud-based services, capitalizing on the broader trend of enterprises migrating their data workloads to the cloud. As more businesses shift operational workloads from physical data centers to cloud environments, Oracle stands to benefit immensely from this transformative shift in technology usage.

Venturing into Artificial Intelligence

In addition to its cloud ambitions, Oracle is positioning itself to capitalize on the burgeoning artificial intelligence (AI) market. The company recently announced the commencement of orders for a cluster of over 131,000 next-generation “Blackwell” graphics processing units from Nvidia, marking a significant entry into the AI sector. As organizations increasingly invest in AI capabilities, Oracle’s strategic moves could not only bolster its cloud offerings but also provide additional revenue streams as they enhance product capabilities.

As Oracle navigates its growth trajectory, CEO Safra Catz has indicated an expectation for the company’s capital expenditures to double in the current fiscal year. This commitment to investing in infrastructure and technology illustrates Oracle’s long-term vision for sustaining growth and maintaining competitive advantages in an ever-evolving technological landscape. Oracle Corporation’s bullish revenue forecasts, strategic partnerships, and investments in both cloud and AI technology signify a strong positioning aiming to meet market demands and accelerate growth in the years to come.