Nvidia, the prominent tech company renowned for its advancements in graphics processing units (GPUs) and artificial intelligence (AI), is set to unveil its fiscal third-quarter earnings report in the upcoming market close. Analysts are eagerly awaiting the figures, with consensus estimates forecasting a revenue of approximately $33.16 billion and an adjusted earnings per share (EPS) of 75 cents. However, the real excitement lies not solely in these figures but rather in Nvidia’s outlook for the coming quarter, as investors are keenly focused on the company’s capability to sustain its remarkable growth trajectory amid an ever-evolving AI landscape.

Central to Nvidia’s future growth strategy is its next-generation AI chip, Blackwell, which is designed for data centers and is already in the hands of major clients such as Microsoft, Google, and Oracle. As AI technology increasingly dominates the tech industry, the performance and demand for these chips will largely dictate Nvidia’s competitive positioning and success. Estimates suggest that Nvidia is aiming for 82 cents in EPS with projected sales of $37.08 billion in the next quarter. This represents a significant leap driven by technological advancements that could redefine market expectations.

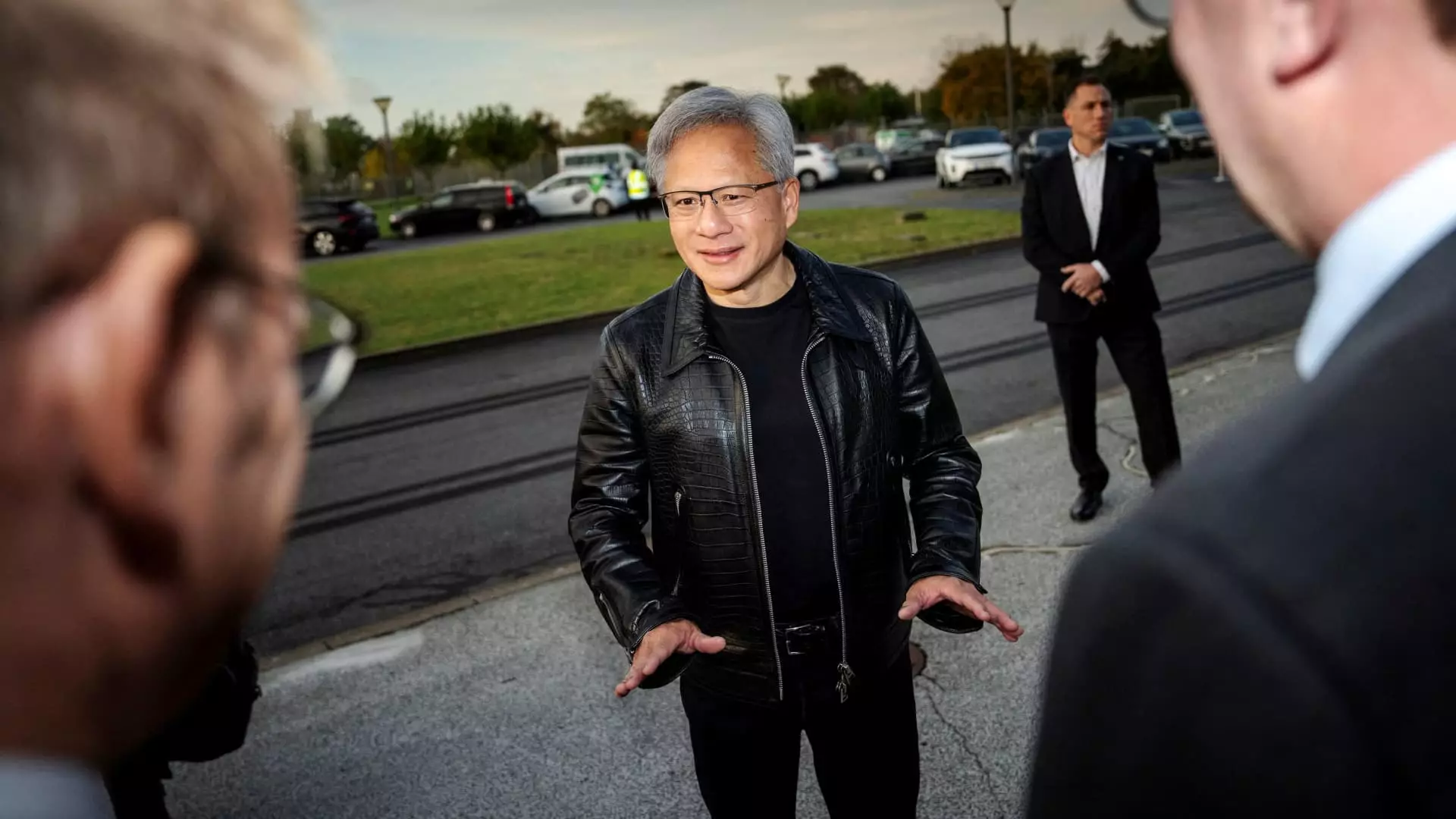

Yet, with innovation often comes challenges, and Nvidia faces critical scrutiny regarding reports of overheating issues related to systems utilizing Blackwell chips. Such concerns may pose risks not just to short-term revenue but also to long-term brand equity. Investors will be particularly attuned to comments from CEO Jensen Huang regarding these potential setbacks and how they might affect demand going forward. Transparency about these issues during the earnings call could significantly influence investor sentiments and stock performance.

Nvidia has witnessed an astonishing increase in its stock value, nearly tripling since the beginning of 2024, which exemplifies the market’s confidence in its growth potential. However, this dramatic surge puts additional pressure on the company to deliver results that meet or exceed expectations. While the most recent quarter reported a commendable 122% growth in sales, this figure marks a noticeable deceleration compared to the staggering 262% and 265% year-over-year growth reported in the prior two quarters. Thus, while Nvidia remains a powerhouse in the industry, it must continuously innovate and address emerging challenges to maintain investor enthusiasm.

As Nvidia faces the formidable task of managing investor expectations while simultaneously pushing toward greater market saturation with its AI technologies, its forthcoming earnings report will be pivotal. With the AI boom now entering its third year, Nvidia’s ability to adapt and evolve amidst changing market conditions will define its path forward. Observers will be closely monitoring how the company articulates its strategy for overcoming obstacles while capitalizing on growth opportunities. Excitement and caution exist hand-in-hand as Nvidia prepares to share its future vision.