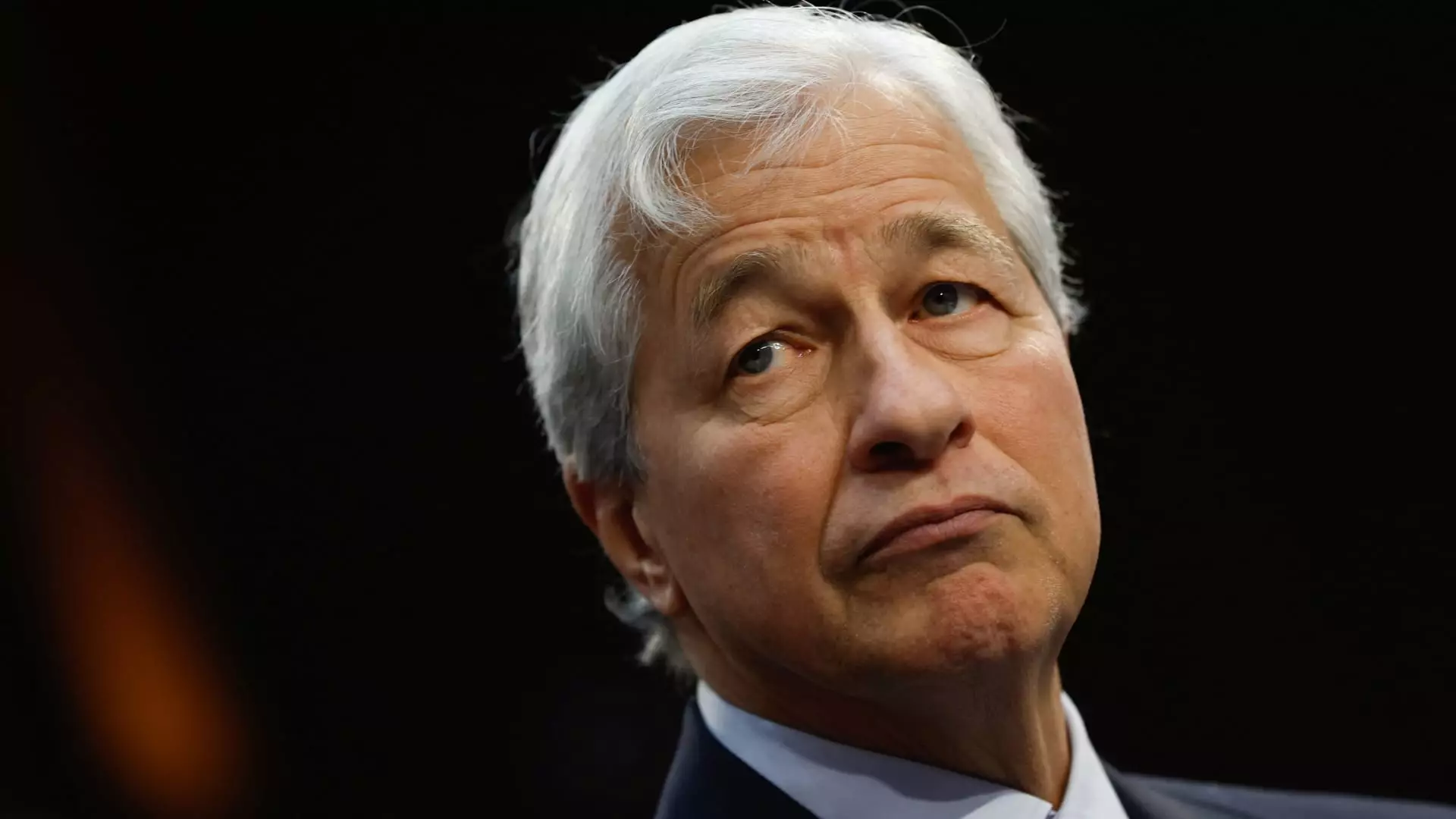

In a landscape fraught with geopolitical tensions, Jamie Dimon, CEO of JPMorgan Chase, has voiced serious concerns regarding the ramifications of escalating conflicts. Drawing attention to the Middle East and the ongoing ramifications of Russia’s invasion of Ukraine, Dimon highlights a deteriorating international order characterized by instability and human suffering. He stresses that these developments not only threaten immediate economic conditions but also pose a long-term threat to the course of global history.

The complacency that typically accompanies discussions of international relations is losing ground to a more urgent conversation about global security. According to Dimon, the relationships that underpin today’s geopolitical scenarios are unraveling. Heightened military tensions, particularly between the U.S. and China, as well as the looming specter of nuclear threats from countries such as Iran and North Korea, have exacerbated this precarious situation. His remarks serve as a wake-up call for global leaders, urging them to adopt strong and decisive strategies to curb these rising tensions.

The human toll of the ongoing Israel-Hamas conflict has reached alarming levels, with significant casualties marking the one-year anniversary of the outbreak of hostilities on October 7, 2023. The situation has escalated to a multi-faceted war involving Hezbollah and Iran, showcasing an increasingly complex battlefield that defies simple resolution. With airstrikes and missile attacks becoming daily occurrences, the prospect of further conflict looms large. The brutal nature of this warfare raises ethical questions about civilian safety and global responsibility in addressing humanitarian crises.

This vast suffering is more than just a humanitarian issue; it reverberates across economic channels, impacting global markets, supply chains, and resource distribution. Dimon emphasizes the complexity of these conflicts and the urgent need for strong leadership that prioritizes humanitarian solutions and economic stability. The fallout from these disturbances could reshape not just regional dynamics but the world economy as a whole.

As banks and financial institutions navigate these turbulent waters, uncertainties loom large over the global economy. Dimon suggests that even amidst signs of a soft landing for the U.S. economy, notable risks persist. The specter of persistent inflation, bloated fiscal deficits, and ongoing infrastructure needs underscore the fragility of economic stability. Furthermore, the urgency for restructuring global trade practices and remilitarization intensifies, challenging the existing socioeconomic paradigms.

The juxtaposition of improving economic metrics against the backdrop of geopolitical unrest illustrates a complex reality. While some factors indicate potential resilience within the economy, the underlying vulnerabilities highlighted by Dimon require vigilant attention. It becomes imperative for policymakers and businesses alike to adapt to this shifting landscape, balancing immediate recovery efforts with long-term strategies aimed at mitigating risks.

The interplay between geopolitical tensions and economic stability embodies one of the most pressing challenges of our time. As leaders navigate this complicated terrain, it is crucial that they integrate humanitarian considerations with strategic economic policies. Dimon’s insights underscore the need for cohesive global action amid rising threats, emphasizing that the choices made today will undoubtedly shape the world of tomorrow.