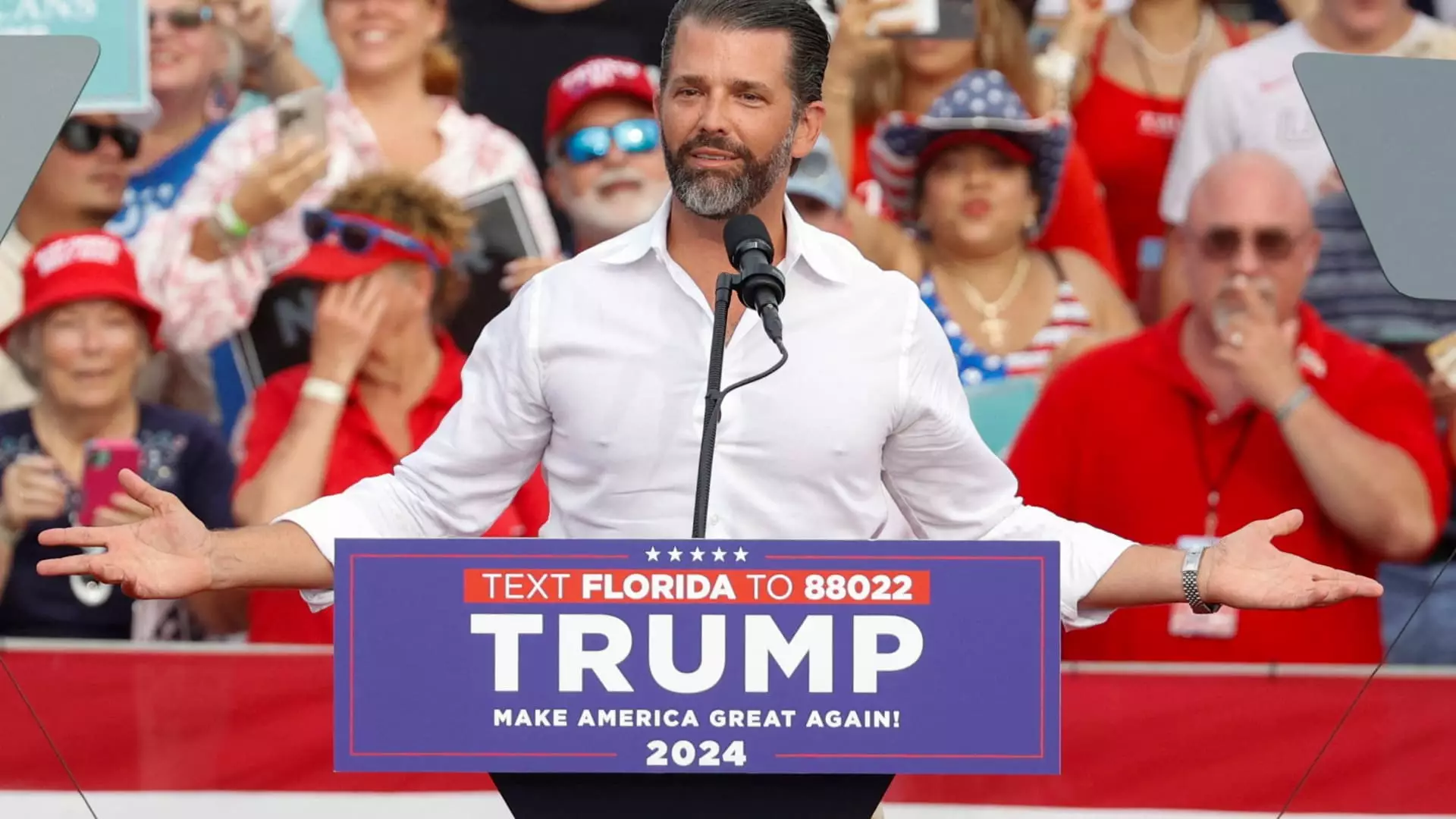

The announcement of Donald Trump Jr. joining the board of PSQ Holdings has created a seismic shift in market dynamics, particularly for the online marketplace PublicSquare. This sudden injection of high-profile leadership into an emerging firm is not just a celebrity endorsement; it opens the door to a multifaceted analysis regarding investor sentiment, market positioning, and the future prospects of PSQ Holdings.

On the day the news broke, shares of PSQ Holdings soared, achieving an astonishing 185% increase during afternoon trading. This astronomical rise underscores the powerful influence that high-profile figures can have on market performance. The implications of Trump’s involvement cannot be overstated, especially given his established brand recognition and political connections. PSQ Holdings, with a market capitalization of merely $72 million before this surge, now stands at the forefront of investors’ attention and curiosity.

PublicSquare’s mission emphasizes themes of “life, family, and liberty,” which harkens back to conservative values that resonate deeply with a segment of the U.S. populace. Michael Seifert, the company’s chairman and CEO, articulated a vision where Trump’s experience and his commitment to a ‘cancel-proof’ economy can provide critical strategic insights. This focus on creating a marketplace insulated from ‘cancel culture’ reflects a growing consumer demand for alternative platforms that align with specific ideological beliefs.

Financial Landscape of PSQ Holdings

Despite the surge in stock price, it is essential to scrutinize the financial health of PSQ Holdings. For the third quarter, the company’s net revenue rested at $6.5 million, accompanied by extensive operating losses exceeding $14 million. This juxtaposition of growth potential against deep financial challenges may raise eyebrows among more cautious investors. The injections of capital due to heightened interest, spurred by Trump’s board membership, could help breathe new life into PSQ’s financial strategy.

Trump Jr.’s Broader Investment Strategy

Trump Jr.’s recent moves in the business realm also signal a broader strategy to align with conservative enterprises. His previous ventures, including his partnership with Unusual Machines and involvement with 1789 Capital, emphasize products and services that cater to conservative audiences. These initiatives illustrate a clear trajectory towards building a portfolio that not only has financial returns but also ideological significance.

Moreover, Trump Jr.’s acceptance into the PSQ board poses inherent risks. The association with such a politically charged figure could alienate investors and consumers who oppose his ideology. However, for those aligned with his beliefs, this connection could enhance brand loyalty and increase competitive differentiation in the marketplace.

The ascension of Donald Trump Jr. to the board of PSQ Holdings symbolizes more than just a shift in leadership—it represents a potential recalibration of the economic landscape focused on values-based commerce. As investors continue to react to this dynamic development, the ripple effects on market strategy and consumer behavior warrant close watching in the upcoming quarters. The unfolding narrative surrounding PSQ may serve as a microcosm for larger shifts in how businesses engage with differing political and ideological landscapes.