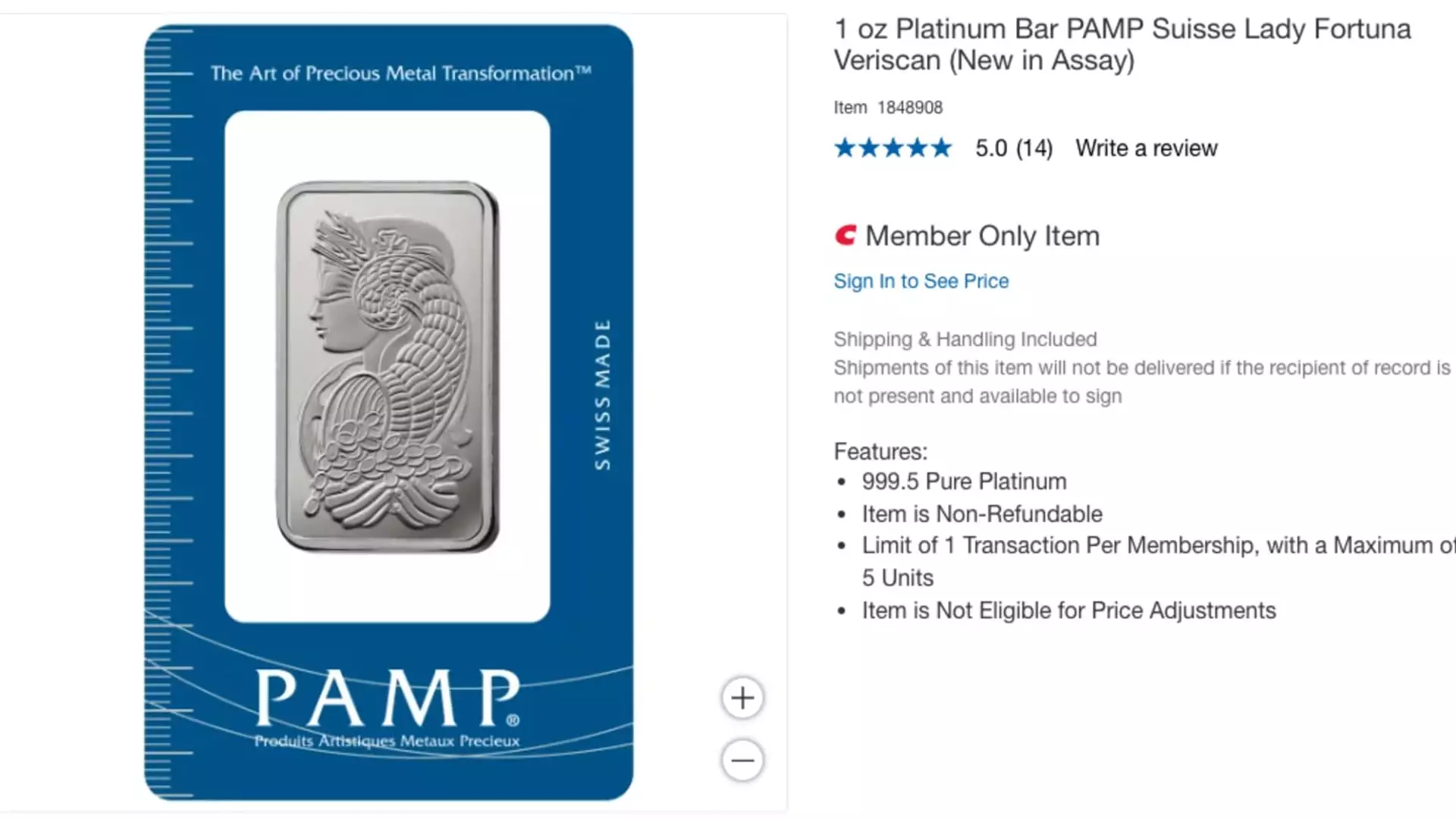

Costco has established itself as a formidable player in the wholesale market, and its recent entry into the precious metals sector is indicative of a strategic expansion that caters to a growing interest in alternative investments. On Wednesday, the company unveiled its latest offering: Swiss-made platinum bars, each weighing one ounce and priced at $1,089.99. This addition aligns with Costco’s previously successful launch of gold bars, which saw tremendous demand shortly after their introduction in August 2023. As consumer interest in tangible assets increases, Costco’s diversification into platinum presents both opportunities and challenges.

The allure of precious metals like gold and platinum is often rooted in their perceived stability and value retention during economic fluctuations. For Costco, tapping into this market is not just about sales, but also about meeting the evolving needs of its customer base. Recent trends indicate that as inflation concerns loom and traditional investment strategies face uncertainties, more individuals are seeking refuge in physical assets. These 1-ounce platinum bars are not only a hedge against economic volatility but also an enticing option for collectors and investors alike. However, Costco’s online-only selling approach, coupled with membership requirements, may limit accessibility for some potential buyers.

While gold has seen an explosive increase in value—over 40% in the past year and approximately 70% within the last five years—the trajectory of platinum has been more unpredictable. Despite a 15% rise over the last year, platinum’s journey has been marred by fluctuations, particularly after peaking above $1,100 earlier in 2024. This dissimilarity reflects broader market trends and the distinct dynamics influencing each metal’s valuation. For investors, understanding these nuances is critical when deciding which asset to include in their portfolios.

Costco’s experience with its gold bars provides useful insights into consumer behavior. Reports indicate that these gold bars often sell out within hours of restocking, and limits on quantity purchased per member (two per individual) underscore a robust demand. Richard Galanti, then-CFO of Costco, noted the call volume from interested customers indicated a strong public appetite for these tangible investments. The market’s voracious demand, coupled with limited supply, not only drives prices up but also highlights an emerging trend in consumer purchasing behaviors—an inclination toward investing in precious metals.

Ultimately, Costco’s foray into the precious metals market is a reflection of both their adaptive business strategy and a growing consumer demand for physical investments. As more customers flock to options that promise stability and intrinsic value, wholesalers like Costco are strategically positioning themselves to benefit from these trends. However, potential buyers should carefully consider market conditions and the long-term viability of their investments. With the fluctuations in platinum’s pricing and the meteoric rise of gold, staying informed and making prudent investment choices will be essential in navigating this new terrain. As the market landscape continues to shift, the role of physical precious metals in investment portfolios will likely become increasingly significant.