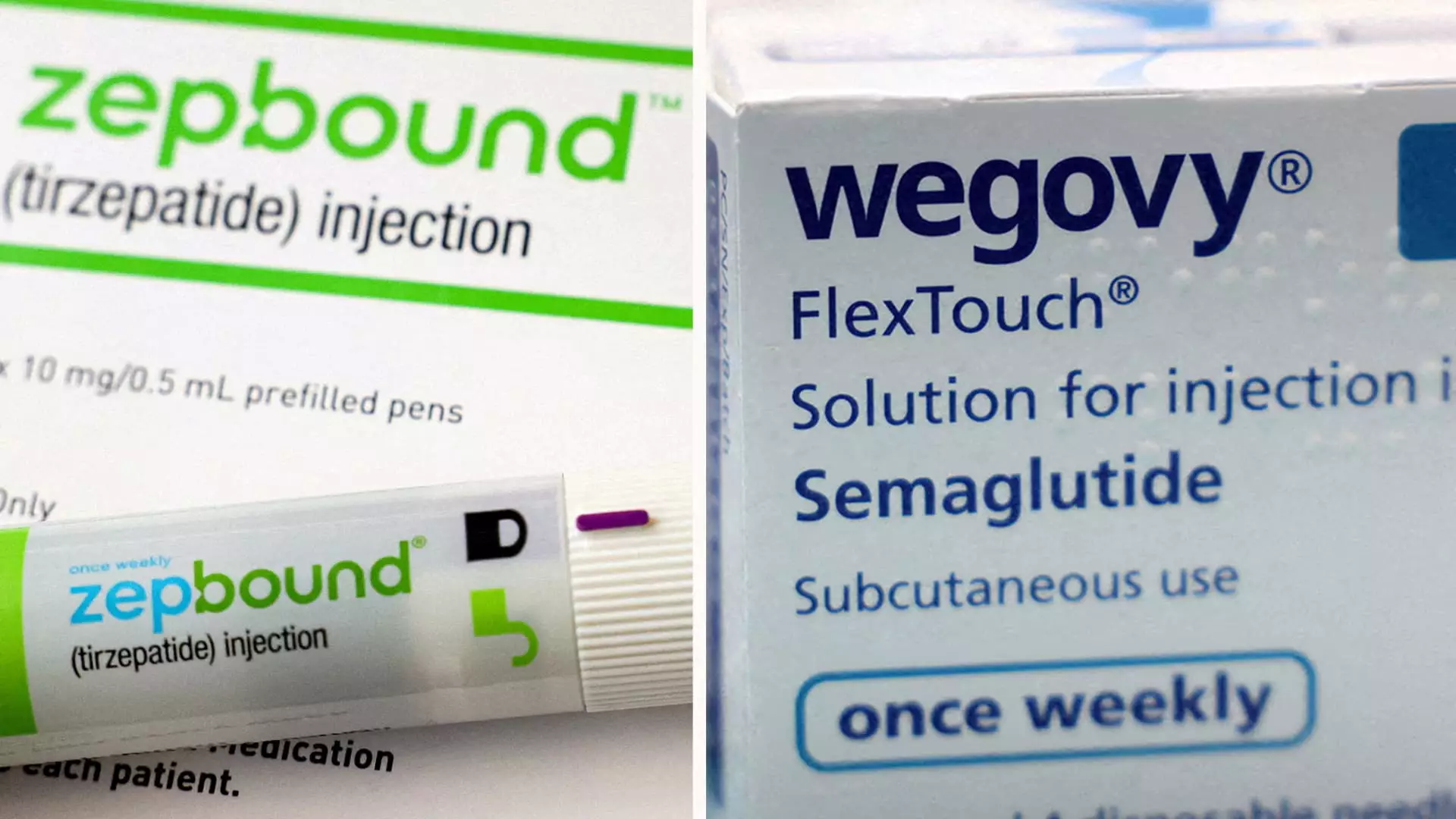

Obesity is emerging as one of the most pressing health issues globally, and the pharmaceutical industry is keenly responding with innovative treatments. Recent findings from Eli Lilly have illuminated promising results for its obesity drug, Zepbound, particularly in comparison to Novo Nordisk’s widely known Wegovy. This article delves into the clinical trial outcomes, the implications for healthcare, and the broader market dynamics surrounding these treatments.

In a landmark head-to-head clinical trial involving 751 patients, Eli Lilly announced that Zepbound demonstrated superior weight loss results compared to Wegovy. Over a span of 72 weeks, individuals using Zepbound lost an average of 20.2% of their body weight, approximately 50 pounds, while those on Wegovy experienced an average weight loss of 13.7%, or about 33 pounds. This definitive evidence positions Zepbound not just as a viable contender but potentially as the new gold standard in obesity medication.

Moreover, the trial results revealed even more dramatic impacts of Zepbound, with over 31% of participants losing at least a quarter of their body weight. In contrast, Wegovy saw only about 16% of its users achieve similar outcomes. These figures suggest a significant relative weight reduction, quantified as 47% higher with Zepbound. Such results are not just statistically noteworthy; they may represent a transformative leap in effective treatment for obesity and related health conditions.

Dr. Leonard Glass from Eli Lilly emphasized that the study serves as a valuable resource for healthcare providers and patients seeking informed decisions about weight loss treatments. The trial specifically targeted individuals who are obese or overweight and who possess at least one weight-related health issue, distinctively excluding those with diabetes. This focus raises the prospect for Zepbound to potentially address a broader spectrum of weight-related challenges, thereby extending its target patient population and clinical relevance.

While Zepbound’s results are promising, it remains essential to consider the long-term implications of these drugs on patient health, especially concerning potential side effects. Both Zepbound and Wegovy exhibited common adverse effects predominantly relating to gastrointestinal discomfort, typically classified as mild to moderate. Understanding the full range of side effects remains crucial for healthcare professionals when prescribing these medications.

The obesity medication market is experiencing explosive growth, with projections indicating it could be valued at $150 billion annually by the early 2030s. Zepbound’s entrance into this market, especially following Wegovy’s initial launch about two years earlier, has sparked intense competition. The robust sales forecasts predict Zepbound could generate $27.2 billion by 2030, outpacing Wegovy, which is forecasted to reach around $18.7 billion.

However, the trajectory for both drugs is not without challenges. The demand has long outstripped supply for these obesity treatments, prompting both Eli Lilly and Novo Nordisk to invest heavily in manufacturing capabilities. Recently, the availability status on the FDA’s drug shortage database shows improvements, yet disparities in insurance coverage still limit access for many patients in the U.S. Given the monthly cost of approximately $1,000 for both drugs, the financial barrier remains a significant hurdle for widespread adoption.

Understanding the pharmacological mechanisms underlying these treatments is essential to appreciate their unique benefits. Zepbound operates through the activation of two gut hormones—GIP and GLP-1—targeting both appetite control and blood sugar regulation. Conversely, Wegovy focuses on GLP-1 activation alone. The involvement of GIP in Zepbound could contribute to its pronounced effects on weight loss, potentially offering more robust metabolic benefits in the process.

Zepbound’s recent clinical trial results position it as a compelling option in the fight against obesity. Its ability to achieve greater weight loss than Wegovy not only elevates Eli Lilly’s standing in a lucrative market but also points to a potentially brighter future for patients struggling with obesity. As these dynamics unfold, ongoing scrutiny and analysis will be key to navigating the evolving landscape of obesity treatment options.