Warren Buffett, the renowned investment magnate, has recently executed a significant reduction in Berkshire Hathaway’s holdings of Apple Inc., marking the fourth consecutive quarter of this trend. By the end of September, the conglomerate’s stake in Apple was valued at $69.9 billion, indicating that Buffett has sold off approximately 25% of his original investment, which now consists of around 300 million shares. This reduction represents a staggering 67.2% drop from the same period last year, leading to speculation about the motivations behind such aggressive divestiture.

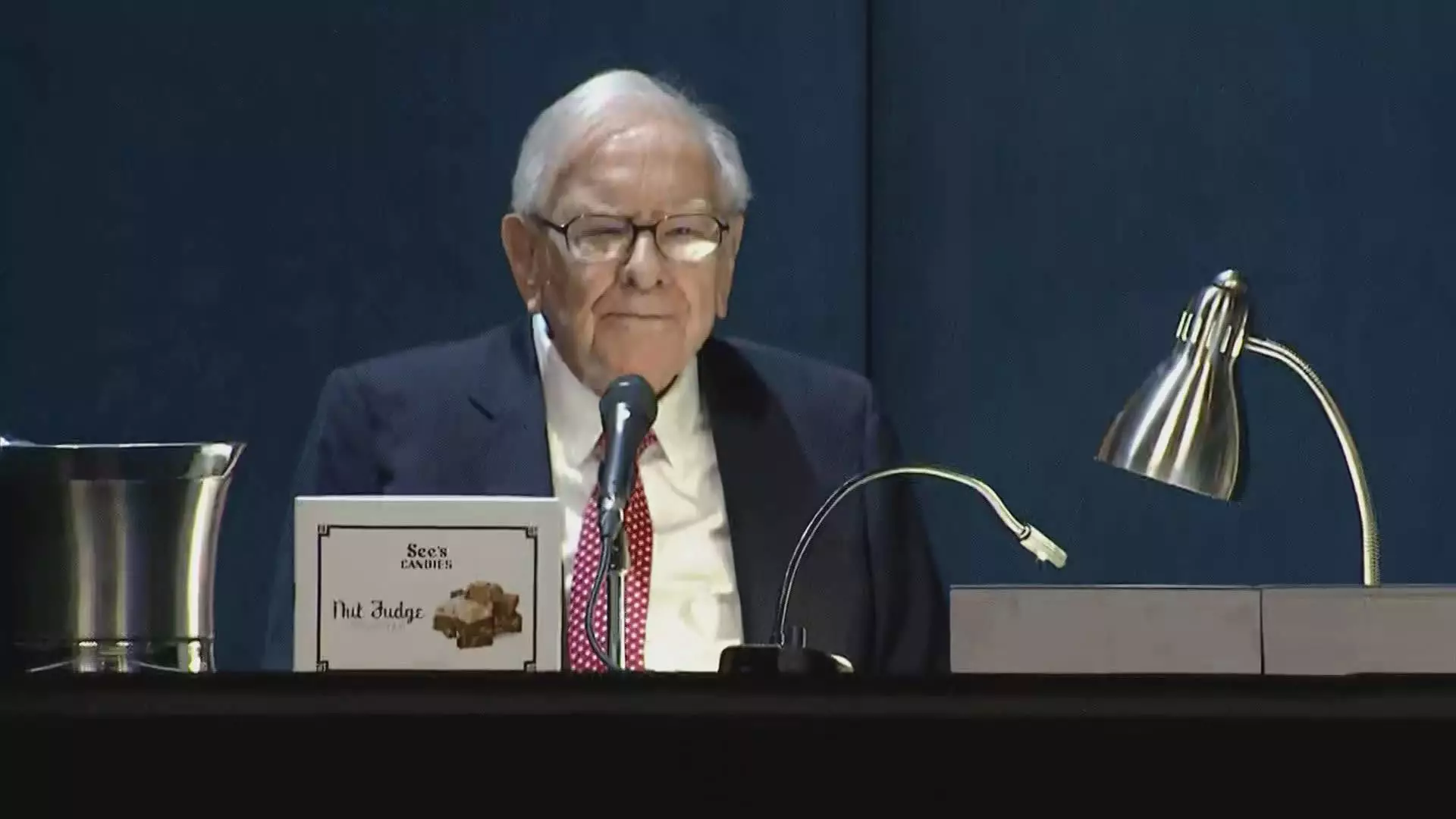

Buffett’s strategic selling raises questions about the underlying reasons. Analysts and investors alike have pondered whether high stock valuations or the need for better portfolio management are influencing factors. Indeed, at one point, Apple constituted a massive 50% of Berkshire’s equity portfolio, which is an untenable concentration for any investor. During the Berkshire Hathaway annual meeting in May, Buffett hinted that potential tax increases on capital gains might be a contributing factor to his sales strategy. This notion of a future tax hike reflects an acute awareness of changing fiscal landscapes and suggests that Buffett is proactively positioning Berkshire to mitigate potential tax liabilities.

Moreover, the sheer volume of shares sold has led many to wonder if there are deeper motivations at play than merely tax considerations. Buffett has historically been cautious with technology investments; however, his affinity for Apple, cultivated over years of appreciation for the company’s loyal customer base, has transformed the tech giant into a significant part of Berkshire’s identity.

Buffett’s initial investment in Apple from 2016, driven by his investing protégés Ted Weschler and Todd Combs, marked a notable departure from his long-standing aversion to technology stocks. The Oracle of Omaha has regarded Apple not just as an investment but as a business model that revolutionizes consumer loyalty—something he has valued throughout his career. Nonetheless, his recent actions seem to indicate a shift in thought; is it prudent to remain overly committed to a single corporation, even one with the market strength of Apple?

As these holdings decrease, the emotional and strategic attachment that Berkshire Hathaway had to Apple seems to be diminishing alongside its fiscal stake. The sale also coincides with an unprecedented cash reserve of $325.2 billion for Berkshire Hathaway as recorded in the third quarter, signaling a potential pivot towards new opportunities or investments. With Apple shares rising 16% in the same year, trailing the S&P 500’s gains, this shift may also indicate Buffett’s desire to capitalize on diversified investments rather than hunker down on a single tech entity.

Buffett’s significant trimming of his Apple position encapsulates a complex blend of financial strategy and market perception. While the traditional investment wisdom espoused by Buffett advocates for long-term commitment to superior companies, the context surrounding the current economic environment and potential changes in taxation seems to have catalyzed a reevaluation of this strategy. As Berkshire Hathaway continues to sit on an unprecedented cash reserve, it remains to be seen how this liquidity will influence future investments, and whether Buffett will venture further into other sectors, embracing a broader investment philosophy as he navigates the evolving financial landscape.