Nvidia, the titan of graphics processing units (GPUs), has garnered attention and admiration over the years for its remarkable sales in both consumer and enterprise sectors. Riding on the coattails of the artificial intelligence (AI) boom, Nvidia has cemented its status as a powerhouse, with demand for its chips rocketing skyward. However, the landscape across which this company strides is no longer unfettered. With geopolitical tensions tightening, particularly between the United States and China, the company is encountering not just challenges but formidable barriers that could stymie its growth trajectory.

The rise of AI has been nothing short of revolutionary, spurring a quest for computational power that has driven Nvidia to new heights. Companies around the world are clamoring for advanced chips to handle the demands of AI workloads, enabling everything from autonomous driving to real-time language processing. Yet, as the sector explodes, Nvidia finds itself in the crosshairs of political maneuvering, raising existential questions not just for the company but for the entire semiconductor industry.

China: The Unyielding Elephant in the Room

Nvidia’s fortunes are intricately linked to its relationship with China, where it previously boasted an astonishing 95% market share in graphics processing units. However, under the pressurized conditions of trade restrictions and export licenses mandated by the U.S. government, this figure has plummeted to a mere 50%. The repercussions are severe. Nvidia has already recorded a staggering $5.5 billion write-down on its specialized H20 chips designed for Chinese customers. This step has been characterized by analysts as the largest write-off in the history of chipmaking, indicative of how deeply geopolitical considerations can infiltrate the corporate sphere.

The Trump administration’s insistence on requiring export licenses for specific high-tech products aimed at the Chinese market is rooted in national security concerns. The U.S. government fears that the very technology that Nvidia produces could be repurposed to bolster military capabilities in rival nations. But as we grapple with the implications of these decisions, we must ask ourselves: Is America snipping the strings that tether it to innovation?

Revving Up Uncertainty and Revenue Impact

The specter of the H20 chip debacle looms heavily over Nvidia’s financial forecasts. Analysts project that the company may suffer a revenue hit upwards of $15 billion over the next 12 months, which raises eyebrows about the long-term sustainability of its business model. For a company that once basked in growth rates surpassing 250% year-over-year, any suggestion of a revenue slowdown is alarming. Expectations for the current quarter estimate growth around 53%—a remarkable number but still a shadow of its former glory.

The situation is further exacerbated by the fact that Nvidia’s oversight of its market positioning in China appears to have been shortsighted. Recent reports from Morgan Stanley illustrate that the company was caught off-guard by the abruptness of the restrictions around H20, suggesting that Nvidia had operated under the delusion that their exports would remain unimpeded.

Strategizing Amidst Stiff Competition

In a world where technological advancement is a race against time, the options for both Nvidia and the U.S. government are narrowing. New players are emerging from China, with engineers motivated to innovate their own processing solutions in light of the restrictions imposed by Washington. This trend spells trouble for Nvidia, which could find itself not just competing with domestic firms but fighting against a well-funded and increasingly capable adversary abroad.

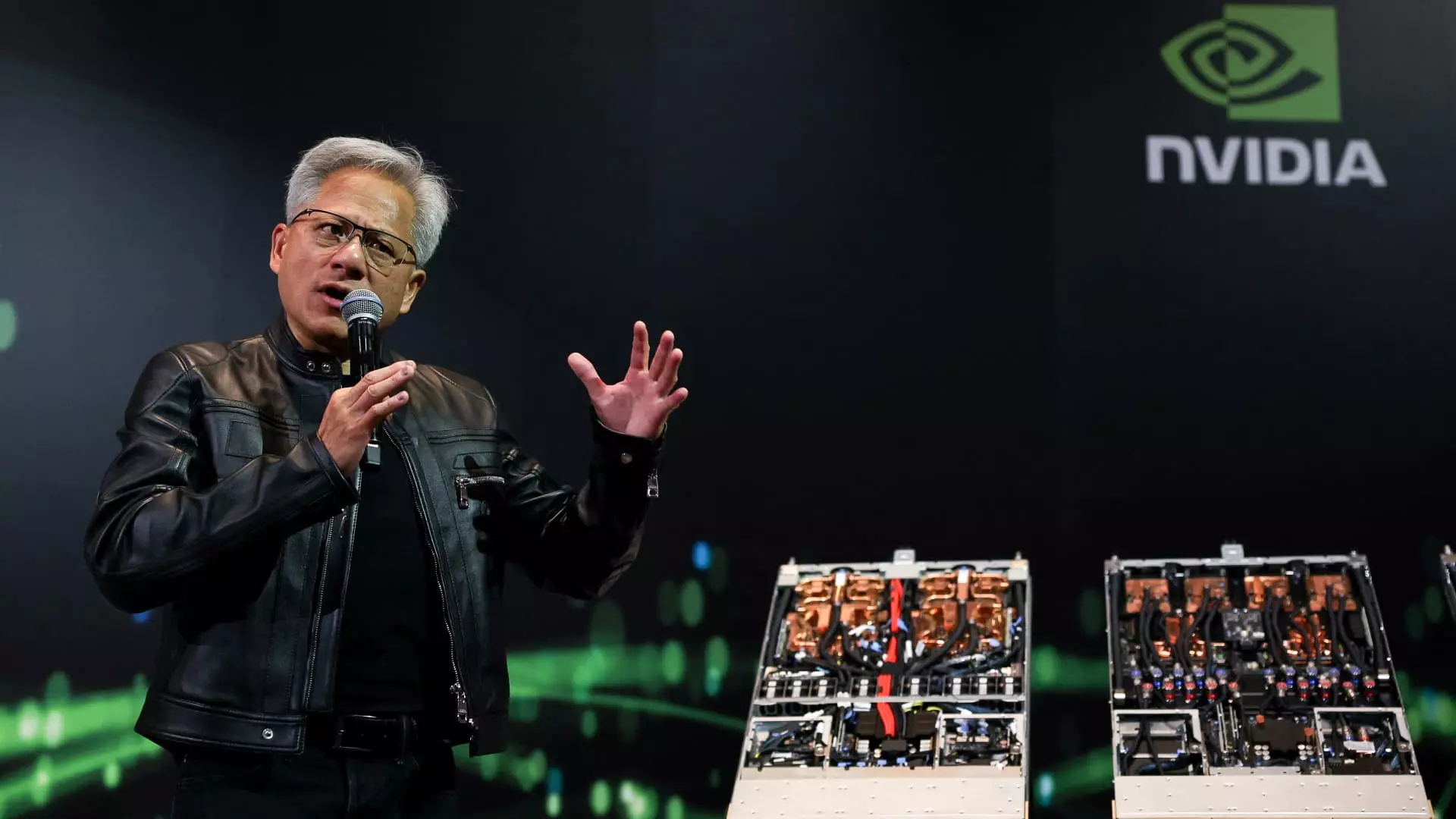

Nvidia CEO Jensen Huang’s assertions regarding the inevitability of innovative computing arms within China resonate with significant implications. If U.S. firms are not careful, they might watch from the sidelines as other countries develop robust ecosystems that could rival—and ultimately eclipse—the American tech landscape.

While optimism reigns regarding announced changes to export regulations, the undercurrent of uncertainty remains. Nvidia’s hopes hinge on whether these regulations will be conducive to enabling them to reclaim their foothold in a crucial market. The so-called “AI diffusion rule” may have been revoked, but the question still lingers: What will the future regulations look like, and will they allow Nvidia to be as competitive as it once was?

The Call to Innovate or Abdicate

As Nvidia grapples with these complex dynamics, the push for self-reliance in semiconductor technologies becomes paramount. In a climate fraught with challenges, innovation should remain a priority for U.S. firms. What is clear is that Nvidia must adapt or risk ceding ground not just to rivals abroad but also to a shifting global landscape that prioritizes local advancements over imports. In this intricate chess game of technology and diplomacy, the stakes are not just high; they are critical for the future of innovation. The question that remains is whether Nvidia will emerge stronger from this turmoil, or if it will be relegated to a retrospective footnote in the annals of semiconductor history.