In the ever-fluctuating landscape of finance, Jim Cramer has shown considerable interest in BlackRock, the largest asset manager globally. Following impressive third-quarter earnings that exceeded analysts’ expectations, the stock is gaining attention as a significant contender in the market. BlackRock has demonstrated a remarkable capacity for growth, reaching a staggering $11.5 trillion in assets under management (AUM) — a figure that echoes the firm’s substantial market influence. This surge in AUM reflects a broader trend in the financial sector and signals strong investor confidence amidst a recovering stock market.

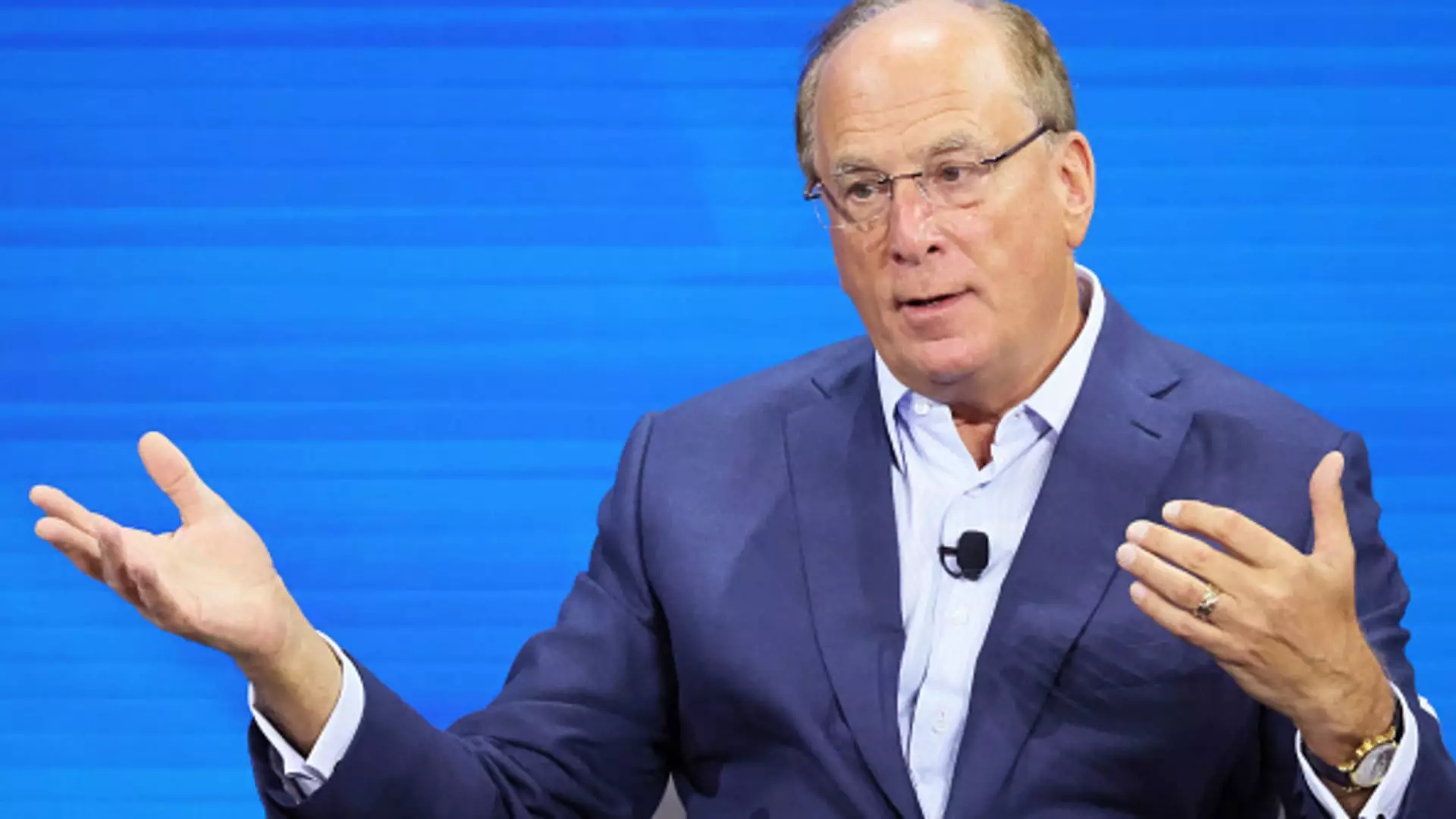

BlackRock’s financial performance speaks volumes; the company has seen organic growth of $2 trillion over the past five years, which is a formidable achievement in the competitive asset management sphere. CEO Larry Fink highlighted this growth alongside the successful acquisition of Global Infrastructure Partners for $12.5 billion, which bolstered BlackRock’s assets by an impressive $100 billion. Such strategic maneuvers are indicative of BlackRock’s aggressive approach to expansion and innovation within its investment strategies. It’s a nuanced balancing act: on one hand, they are thriving despite external challenges, and on the other, they are positioning for future growth through acquisitions.

The financial sector recently reported robust earnings, with BlackRock alongside notable names like Wells Fargo and Morgan Stanley. These results come as Wall Street grapples with a complicated economic backdrop characterized by persistently high interest rates. The Federal Reserve’s recent decision to lower rates has played a critical role in shaping market sentiments, and the anticipated further cuts will likely influence investor strategies. The debate over the Fed’s next steps signals that while the market may have initially braced for aggressive cuts, current sentiments align more closely with a conservative 50-basis-point drop.

Given the current climate, the consistent performance of BlackRock offers a strategic counterpoint to uncertainties in other sectors. Jim Cramer’s inclusion of BlackRock in the Bullpen, the stocks-to-watch list, is a calculated decision. He acknowledges the stock’s significant price appreciation—an over 12% increase recently, contrasting with the S&P 500’s 4% gain—which suggests that BlackRock is outperforming its peers. However, Cramer remains cautious, emphasizing the need for a calculated approach rather than impulsive trading.

Furthermore, Cramer’s hesitancy to quickly initiate a position reflects a broader principle in investment strategy: the importance of thorough analysis and timing. This level of introspection illustrates a steady hand amidst market volatility, teaching investors the value of patience over rash decision-making.

Cramer’s investment philosophy extends beyond attraction to numbers; it emphasizes informed participation. Subscribers to the CNBC Investing Club gain a unique advantage through real-time alerts prior to Cramer executing trades. This system underlines a disciplined approach to investing, ensuring that decisions are not only strategic but informed through a comprehensive analysis. Cramer’s waiting periods for trade execution post-alert serve to mitigate risk and avoid potential market fluctuations that could adversely affect stock performance.

To encapsulate, BlackRock’s recent performance is a beacon of resilience in an otherwise tumultuous financial landscape. With significant asset inflows and a strategic expansion policy, the company has solidified its standing in the asset management sector. As Jim Cramer contemplates potential investment in BlackRock, the case for considering this stock appears robust. It embodies a combination of strong fundamentals and strategic foresight. While the stock’s previous gains may prompt caution, the underlying growth drivers suggest that BlackRock could pursue further upward momentum.

Investors interested in growth opportunities might find BlackRock to be a promising addition to their portfolios, provided they align with Cramer’s principles of informed, strategic trading. The future of BlackRock seems bright, making it a stock worth watching closely as developments unfold in the economic environment.