In recent months, the Chinese economy has faced a myriad of challenges, particularly within its real estate sector, which has been experiencing a significant downturn. This slump is attributed significantly to the government’s previous regulatory crackdowns aimed at controlling the rampant debt levels among property developers. As a result, the once-booming real estate market, which once constituted over a quarter of China’s economy, has undergone a substantial contraction, impacting local government revenues and household wealth alike.

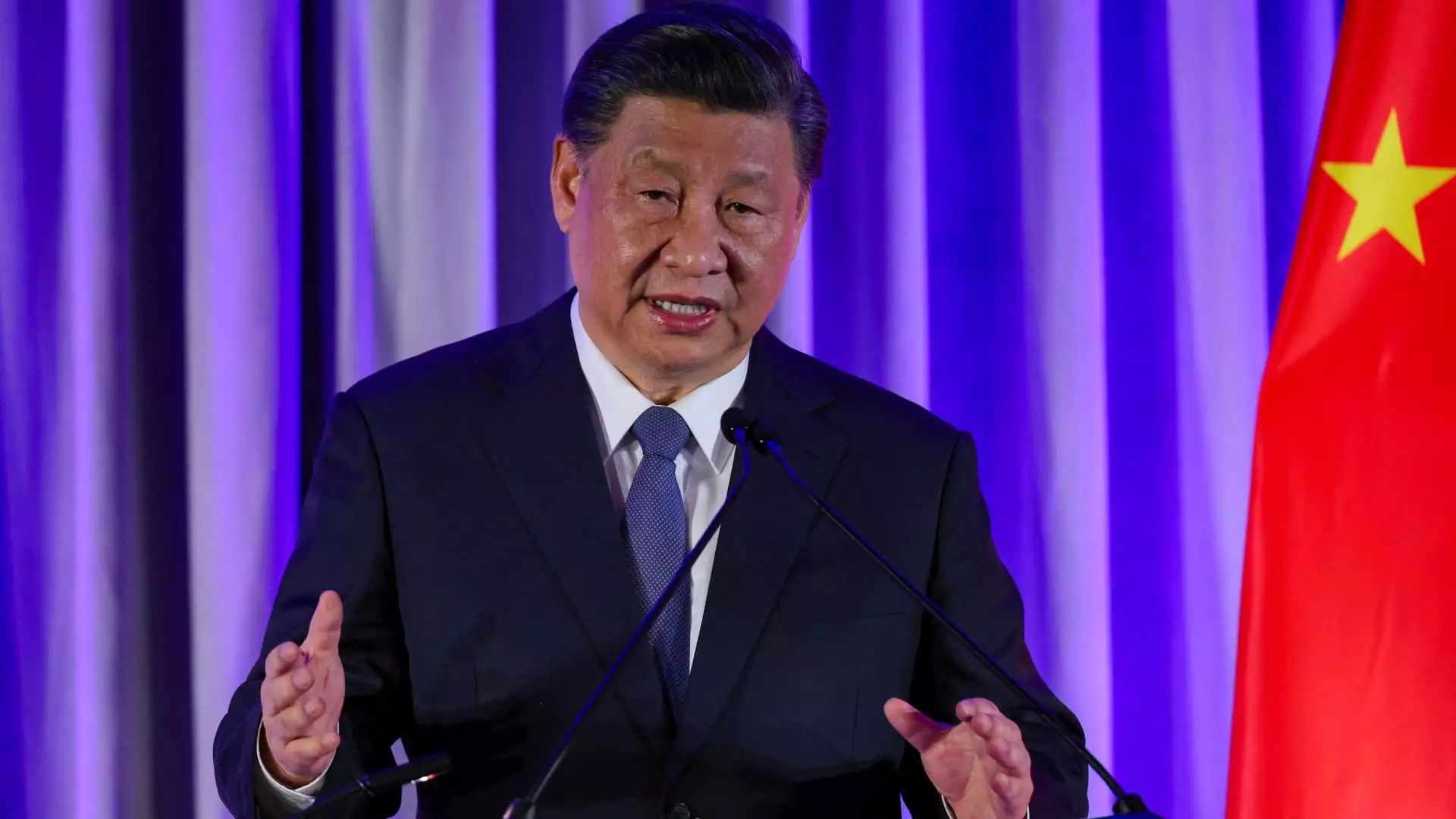

During a pivotal meeting led by President Xi Jinping, senior leaders of the ruling Communist Party convened to discuss strategies to reverse this economic decline. The official meeting minutes emphasized the urgent need to “halt the real estate market decline and spur a stable recovery,” signaling a shift in policy priorities which includes addressing public concerns regarding employment and the aging population.

Leaders have indicated the urgency of reinforcing both fiscal and monetary policy. While specifics regarding the timing and scale of these measures remain undisclosed, the call for immediate action reflects a growing recognition of the precarious state of China’s economy. Leading economists, such as Zhiwei Zhang from Pinpoint Asset Management, have described these developments as a constructive sign but stress that the implementation of a comprehensive plan will take time.

Following the announcement of these initiatives, stock markets experienced sharp increases, particularly in Hong Kong, where property stocks surged by nearly 12%. This immediate market reaction underscores a degree of optimism amongst investors regarding the effectiveness of the proposed measures. However, analysts maintain a cautious outlook, noting the necessity for more substantial fiscal support to ensure a meaningful economic turnaround.

Current State of the Real Estate Market

Recent data highlights the extent of the property market’s decline. For instance, new home sales witnessed a staggering 23.6% drop in value year-on-year through August, a slight improvement compared to the figure reported in July. Furthermore, average home prices decreased by 6.8% in August alone, although this figure was an improvement compared to July’s 7.6% decline.

Yue Su, an economist at the Economist Intelligence Unit, underscores that stabilizing the housing market is crucial for reviving consumer purchasing behavior. The focus of policy direction is shifting away from merely boosting housing prices for wealth accumulation, towards stimulating purchasing activity by alleviating the burdens on prospective homebuyers. The readout from the Politburo meeting has called for increased loans for select projects and reduced mortgage interest rates—actions designed to ease financial pressure on consumers and rejuvenate market confidence.

Stock market analysts and economists are interpreting the recent high-level meeting as a turning point, indicating a shift towards more proactive governmental initiatives. While some firms, including HSBC, suggest that this new policy wave signifies the potential for increased support, others, like Capital Economics, argue that it remains ambiguous whether the government will embrace large-scale fiscal measures.

The adjustment in rhetoric regarding growth targets has spurred discussions about the realistic expectations for economic recovery. The government’s current position seems to indicate a tolerance for growth below the 5% threshold previously anticipated. Projections from organizations such as Goldman Sachs suggest that actual growth rates may only hover around 4.7% in 2024, revising forecasts to accommodate what appears to be a more cautious approach to economic recovery.

Looking Ahead: Balancing Stability and Growth

What emerges from the Politburo meeting is a delicate balancing act between ensuring short-term economic stability and addressing more profound structural issues within the economy. The attempt to stabilize growth at this early juncture, indicated by the atypically timed meeting, reflects policymakers’ acute awareness of the urgent need for a clear strategy to navigate these economic uncertainties.

As various stakeholders continue to assess the implications of the meeting’s outcomes, it may just be the beginning of a series of adaptations in China’s economic policy landscape. The emphasis on stabilizing the housing market and fostering consumer confidence may ultimately play a vital role in the broader recovery trajectory. The commitment to addressing these issues not only provides insights into China’s political maneuvering but also sets the stage for potential long-term recovery strategies designed to transition towards a higher quality of growth characterized by innovation and sustainability.