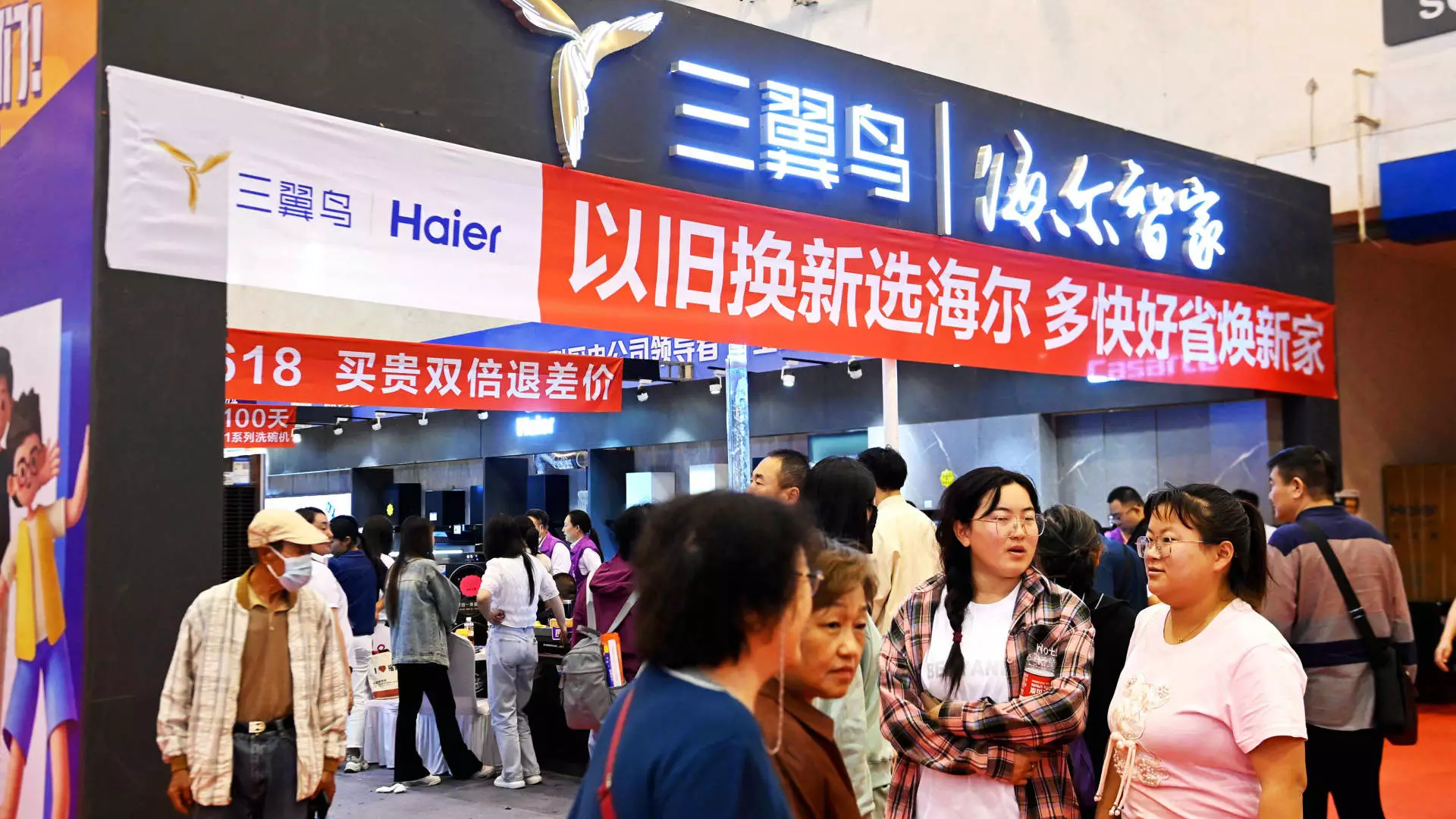

In July 2023, the Chinese government unveiled an ambitious plan aimed at revitalizing consumer spending, particularly through an expansive trade-in and equipment upgrade initiative. With a budget of 300 billion yuan (approximately $41.5 billion) allocated in ultra-long special government bonds, this program seeks to subsidize the trade-in of high-value items like vehicles and home appliances. However, despite the government’s well-intentioned efforts, reports from various businesses indicate that tangible benefits are yet to materialize.

The essence of China’s trade-in policy revolves around enticing consumers to upgrade their existing products in exchange for newer models. This strategy is particularly aimed at sectors heavily influenced by larger ticket items, including automobiles and household appliances. The government has earmarked half of the proposed budget to support these trade-ins, while the remainder is directed at upgrading large-scale equipment, reflecting a concerted effort to stimulate multiple sectors at once. However, analysts are concerned that the program may not achieve its intended impact due to a range of barriers, primarily consumer hesitancy and ambiguity surrounding the operational specifics of the initiative.

Chinese consumers are exhibiting considerable caution, a trend observed in purchasing behaviors since the pandemic. The trade-in initiative comes with stipulations requiring participants to spend upfront—something that many may not be willing or able to do. Jens Eskelund, president of the EU Chamber of Commerce in China, expressed skepticism regarding the immediate efficacy of the program, highlighting a lack of visible incentives translating into consumer action. The need for an existing item to trade in may also dissuade potential customers who do not have suitable products to exchange. This creates a critical bottleneck in delivering the program’s promised benefits.

Despite the ambitious intentions behind the trade-in program, China’s macroeconomic landscape does not inspire significant optimism among analysts. Recent reports indicate that retail sales growth remains sluggish, exemplified by a mere 2% increase in June—the lowest rate since the onset of the Covid-19 pandemic. Although July saw a marginal uptick of 2.7%, UBS Investment Bank’s Chief China Economist, Tao Wang, suggested that the trade-in initiative could only potentially bolster retail sales by around 0.3% for 2023—a figure that starkly illustrates the program’s limited immediate impact. The rise in sales of new energy vehicles by nearly 37% amid an overall decline in passenger car sales further complicates the narrative surrounding consumer confidence and spending.

Notably, the trade-in initiative has led to substantial increases in subsidies for both new energy automobiles and traditional fuel-powered vehicles. However, industry leaders express concerns about the immediate effects of the policy. For instance, major players in the elevator sector, like Otis and Kone, have reported that the anticipated influx of new orders has yet to materialize substantially. Otis’s sales in China fell sharply during the second quarter of 2023, illustrating a disconnect between government policy announcements and corporate performance on the ground.

Kone’s CFO acknowledged the potential benefits of the government’s funding, yet emphasized the unpredictability of how quickly these changes would surface in the market. This points to a broader challenge in the execution of government initiatives and emphasizes how critical localized implementations can be to their success.

While immediate benefits remain elusive, some industry stakeholders are cautiously optimistic about the long-term ramifications of the trade-in program. For companies like ATRenew, which specializes in secondhand goods, the initiative may lay the groundwork for a more robust secondhand market in China. With rising trade-in volumes particularly in mobile devices and computers, there are signs that the market could expand as local governments clarify the operational aspects of the program. However, the general sentiment remains that comprehensive support and clarity from the government are essential for maximizing the effectiveness of this initiative.

While China’s trade-in program was developed with the objective of stimulating consumer spending and broader economic recovery, significant challenges remain apparent. The cautious consumer sentiment, lack of detailed execution strategies, and mixed economic conditions could undermine the program’s success in the short term. Stakeholders across various industries are watching closely, hoping for clarity and measurable results that could ultimately define the long-term impact of this ambitious government initiative. Only time will tell whether these efforts will bear fruit in the dynamic landscape of China’s economy.