In recent months, the Federal Reserve has become entangled in a web of political influence that threatens the core independence essential for stable economic stewardship. The appointment of Stephen Miran to the Fed Board exemplifies this troubling trend. His bold dissent—calling for a half-point rate cut, double what the majority favored—reveals a disturbing willingness to inject partisan interests into an institution traditionally insulated from political swings. Such moves not only question the impartiality of the central bank but also highlight the dangerous precedent of a President leveraging appointments to sway monetary policy for short-term political gains.

Miran’s stance, aligned with calls for aggressively lower interest rates, underscores a pattern where political figures prioritize populist or campaign-related objectives over sound economic management. When a new member of the Fed publicly advocates for a rate cut that deviates significantly from consensus, it signals a shift toward politicization—an erosion of the checks and balances that protect the economy from impulsive policy decisions driven by electoral cycles rather than economic fundamentals.

Partisan Battles and the Fight for Federal Reserve Independence

The recent controversy over Miran’s appointment and his dissent must be understood within a broader partisan landscape. President Trump’s vocal efforts to influence the Federal Reserve—calling for rate reductions of two to three percentage points—are unprecedented in their blatant manipulation of an institution designed to be apolitical. The ongoing battle to fire or appoint members aligns with an unsettling ambition to tilt monetary policy toward specific political ends, rather than adhering to objective economic assessment.

The court ruling preventing the firing of Lisa Cook, another Fed Governor, underscores the judiciary’s role in safeguarding the institution’s independence. Yet, headlines highlight how political actors continue to challenge these boundaries, risking systemic instability. When monetary policy becomes a pawn in the broader political chess game, it undermines the credibility of the Fed and jeopardizes the economy’s capacity for steady growth, inflation control, and financial stability.

The Consequences of Politicizing Monetary Policy

A politically driven Federal Reserve risks fostering long-term economic damage. When policymakers favor aggressive rate cuts to appease short-term political objectives, they undermine the tools needed to combat inflation or recession effectively. Miran’s call for deeper rate reductions reflects a dangerous assertion that monetary policy should serve partisan interests—regardless of the potential inflationary pressures or economic overheating this could cause.

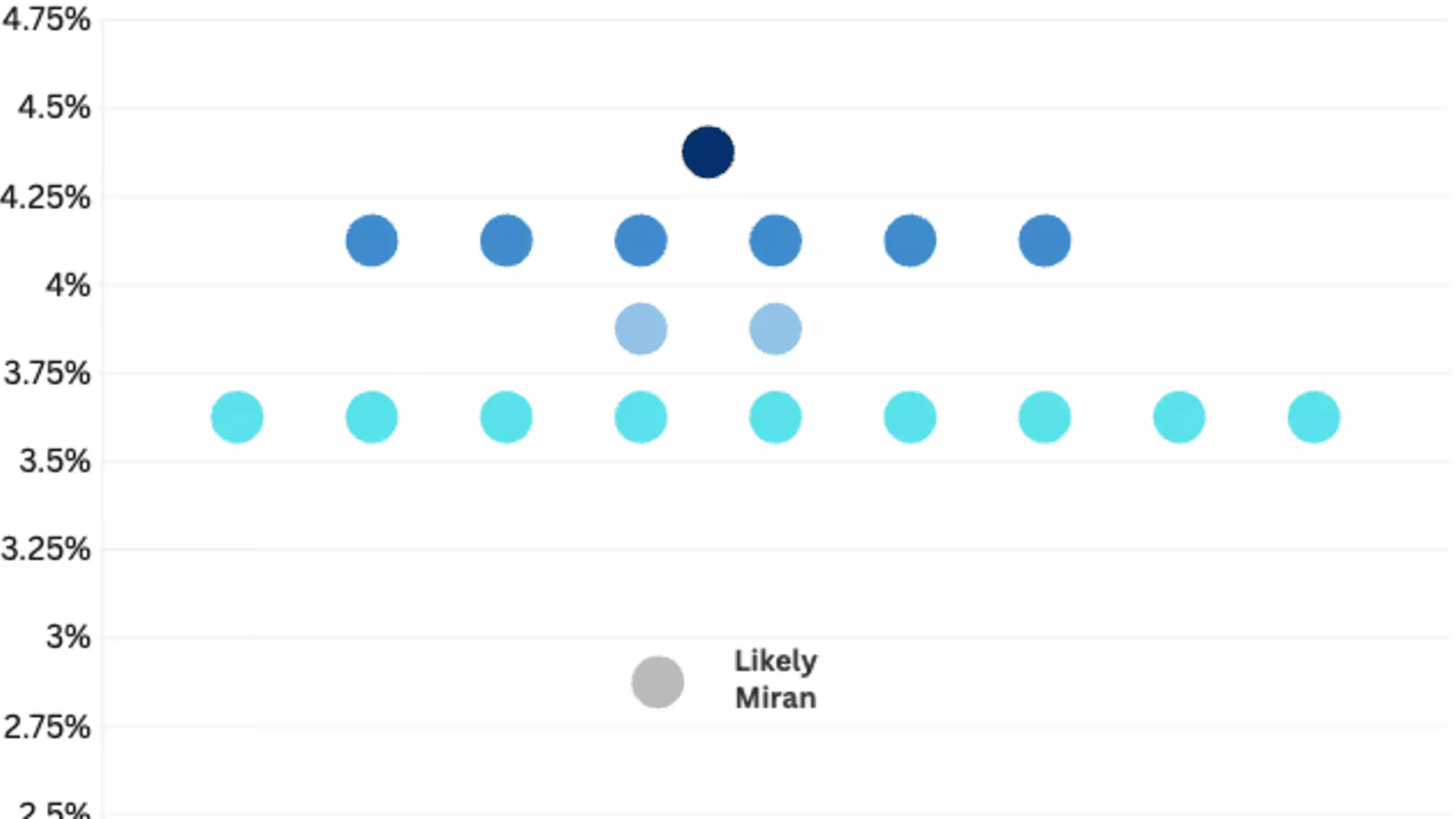

Furthermore, the divergence among Fed members—illustrated by the varying dot plot forecasts—signals internal instability. If monetary policy becomes a battleground for political influence, the resulting inconsistency erodes confidence in the central bank’s ability to function as a stabilizing force. Citizens and markets alike deserve an institution that operates free from partisan tug-of-wars, but recent developments suggest that this ideal is increasingly compromised.

The Long-Term Danger for Democratic Governance

Allowing political figures to influence or threaten to influence core economic policy undermines democratic principles of accountability and institutional integrity. When presidents seek to appoint ideological allies or exert pressure for specific rate cuts, they threaten the fiduciary duty the Fed has to serve the broader public interest—not narrow political agendas. The recent legal protection for Governor Lisa Cook exemplifies the necessity of targeted legal frameworks to defend independence, yet these measures are only palliative if political pressure persists.

Finally, the danger lies not merely in specific rates or individual appointments but in the fundamental shift in the balance of power. The Fed’s capacity to act independently is vital for managing inflation, promoting employment, and sustaining economic stability. When political actors see monetary policy as a leverage point, long-term economic health becomes collateral damage—eroded by a short-sighted focus on electoral gains.