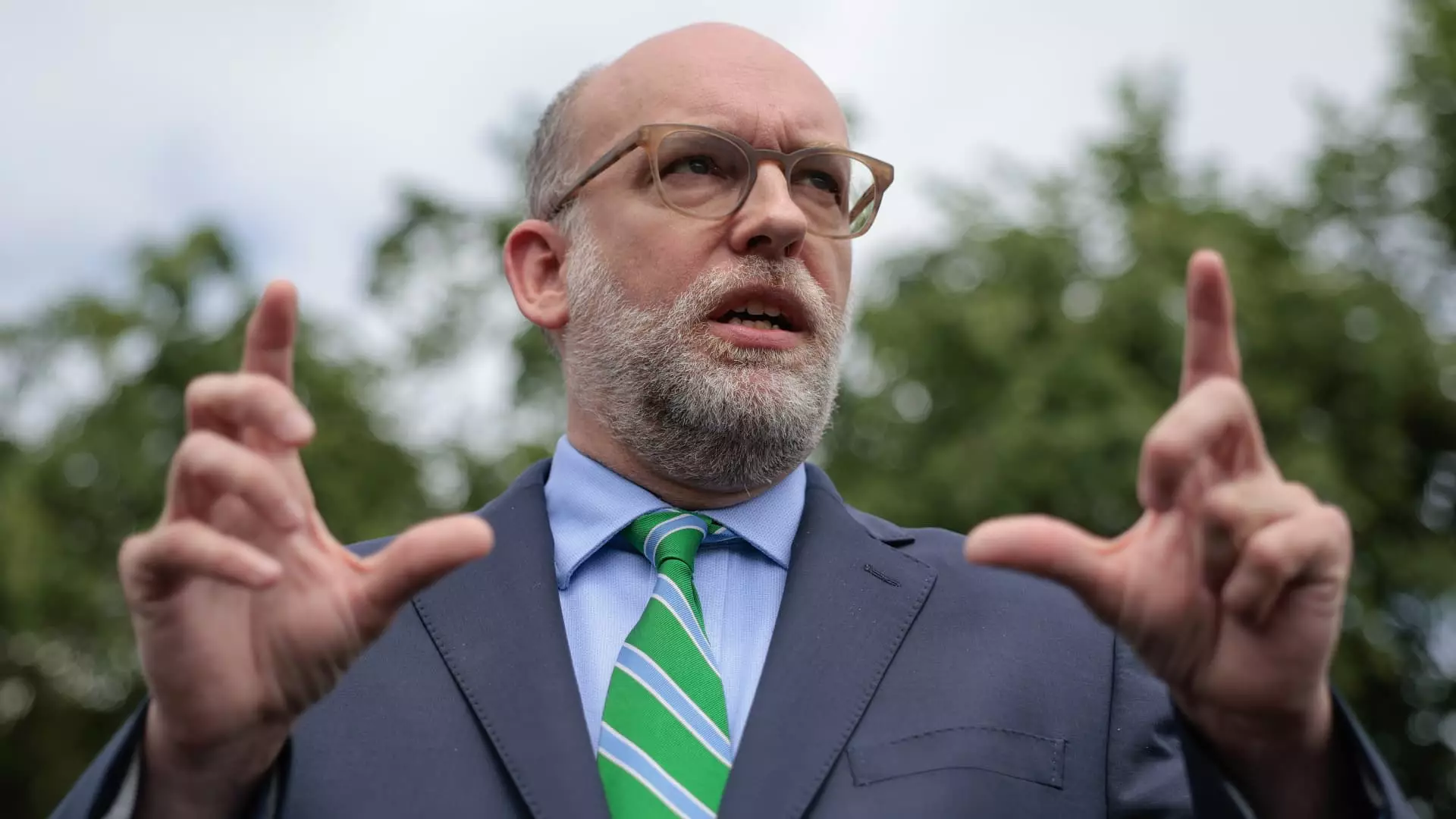

In recent political exchanges, a familiar narrative is emerging—one that frames the Federal Reserve as an opaque institution led astray by elements of excess and potential misconduct. The attack on the Fed’s headquarters renovation, portrayed as a “palace” on a reckless spending spree, is less about fiscal responsibility and more about a broader attempt to undermine the central bank’s legitimacy. This attack, spearheaded by figures like Russell Vought, is emblematic of a broader discourse that seeks to scrutinize the Fed’s independence, question public spending decisions, and use these issues as leverage for political gain.

What’s troubling in these claims isn’t just the assertion of poor financial management but the underlying implication that the Fed’s propriety should be subject to political whims. The “palace” metaphor is intentionally inflammatory, designed to suggest excess and misrule, but it ignores the complex and often necessary costs of maintaining a central bank with national responsibilities. The emphasis on the renovation’s mounting costs, whether justified or exaggerated, becomes a convenient rallying cry for those seeking to weaken the institutional independence needed for effective monetary policy.

It’s crucial to recognize that such politicization doesn’t serve the broader public interest but rather fosters mistrust in a vital financial institution. When government officials invoke grandiose allegations of mismanagement—without transparent, substantive evidence—they risk diverting attention from systemic issues like the way public funds are allocated and the importance of an independent Fed capable of resisting political pressure.

The Politics of Economic Fear: Weaponizing Fiscal Discontent

The confrontational tone of the current rhetoric paints the Fed as a rogue entity, ensnared in “mismanagement” and “misleading” Congress. These accusations are less about financial oversight and more about sowing doubts about the central bank’s honesty and motives. The mention of a “$2.5 billion palace” is a symbol used to rally populist sentiment against entrenched economic elites, fostering conspiracy theories about lavish government spending that may not even be grounded in reality.

This narrative plays directly into the political strategy of undermining Powell’s leadership—an effort to destabilize confidence in the Fed’s ability to manage monetary policy during critical economic times. By framing the renovation as emblematic of broader systemic greed, political actors aim to create a narrative where independence is seen as privilege rather than necessity. It’s an effort to shift blame for economic challenges, such as inflation or sluggish growth, onto an institution that, despite its imperfections, operates under a framework designed to shield it from partisan influence.

The recent appointments of White House-aligned officials to the Fed oversight board only intensify suspicions that this is a calculated move to co-opt a traditionally autonomous body. Such actions threaten to impair the Fed’s credibility, turning it into a pawn in partisan battles rather than a guardian of monetary stability.

The Consequences of Eroding Trust and the Risks of Politicization

The dangers of allowing political figures to interfere in the Fed’s operations extend far beyond mere budget disputes. Framing the institution as wasteful or corrupt erodes public confidence, which is foundational for effective monetary policy. When people begin to doubt the integrity of the Fed, markets can become volatile, and financial stability risks increase. The allegations surrounding the renovation project may seem trivial to some, but the underlying motives and implications are profound: a deliberate undermining of the central bank’s credibility.

Furthermore, these political attacks tend to oversimplify complex financial realities. The costs associated with maintaining a historic building—often essential for functioning in the nation’s capital—are portrayed as emblematic of systemic greed, when in fact, they are usually a fraction of the national budget and serve a vital administrative function. Yet, by amplifying these costs, critics evoke a sense of moral outrage that distracts from more substantive threats—rising inequality, fiscal deficits, or the influence of financial interests that truly shape economic policy.

The weaponization of fiscal disputes into political tools also risks creating a climate of hostility towards technocratic institutions that are designed to operate shielded from partisan pressures. If the independence of the Fed continues to be challenged, the consequences could include a more politically motivated monetary policy that exacerbates economic instability, especially during downturns or financial crises.

The Bigger Picture: A Fight Over the Future of Economic Governance

Ultimately, the controversy over the Fed’s renovations is a microcosm of the larger ideological battle over the role of government and central banking. Center-wing liberals should view these tactics with skepticism: they threaten the delicate balance between accountability and independence that is crucial for a healthy economy. While oversight is necessary, it must never devolve into petty political witch hunts that undermine the institutional credibility of the Fed.

The ongoing attacks are reflective of a broader tendency to reduce complex fiscal and monetary issues into simplistic narratives of greed and mismanagement. This approach not only hampers meaningful reform but also risks destabilizing an institution that, despite its flaws, plays a vital role in maintaining economic stability. A resilient central bank requires integrity, independence, and transparency—not the politicization and demonization we are witnessing today. Addressing rightful concerns about government spending and oversight is legitimate, but it must be rooted in facts, not in sensationalism designed to serve narrow political interests.