As Nvidia continues to assert its dominance within the rapidly evolving landscape of artificial intelligence (AI) technology, its latest earnings report for the fiscal fourth quarter has shed light on the remarkable trajectory of growth the company has achieved. Released shortly after the market closed on Wednesday, the report not only exceeded analysts’ expectations but also provided a strong revenue forecast for the upcoming quarter. This article will explore Nvidia’s financial performance, discuss the implications of its up-and-coming products, and analyze the challenges that lie ahead for the tech giant as it navigates an increasingly competitive market.

Nvidia reported impressive numbers in its latest earnings call, presenting a revenue of $39.33 billion—significantly higher than the anticipated $38.05 billion. With an adjusted earnings per share (EPS) of 89 cents, which surpassed the 84 cents forecasted by analysts, these figures indicate robust operational performance. Compared to the previous year, this quarter saw a striking net income rise to $22.09 billion, reinforcing the company’s profitable ventures amid a significant AI boom.

Despite the apparent success, Nvidia’s growth appears to be slowing. The upcoming fiscal quarter’s revenue guidance of approximately $43 billion represents a year-on-year increase of around 65%. This slowdown becomes particularly notable when contrasted with the staggering 262% growth recorded in the same fiscal quarter the previous year. This trend raises questions about the sustainability of Nvidia’s growth as the company matures and its market presence solidifies.

Central to Nvidia’s continued success is the anticipation surrounding its next-generation AI chip, Blackwell. The company’s Chief Financial Officer, Colette Kress, highlighted the “significant ramp” in Blackwell sales expected during the upcoming quarter. With $11 billion in Blackwell revenue already achieved, the commitment of large cloud service providers to this new chip signifies a growing demand within the data center segment—a sector that now accounts for 91% of Nvidia’s total sales.

Blackwell represents a pivotal shift in Nvidia’s strategy; while previous generations of chips were primarily utilized for training AI, these new processors are expected to facilitate the delivery of AI-generated software through a process known as inference. This marks a significant expansion in the application of Nvidia’s technology, highlighting the company’s ability to adapt to evolving market needs.

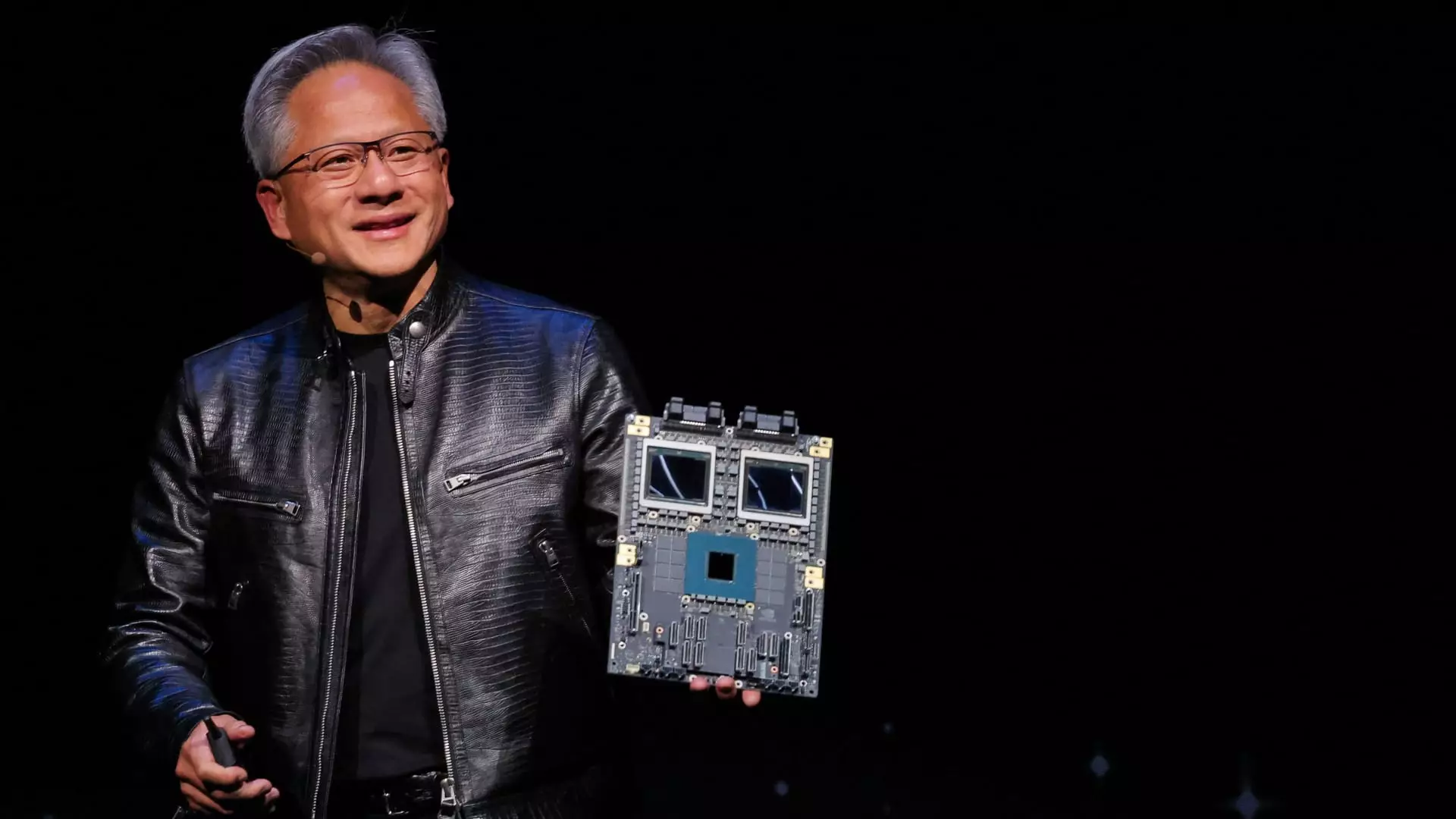

Nvidia’s CEO, Jensen Huang, emphasized the astonishing demand for Blackwell, stating that the product ramp is unprecedented in the company’s history. However, there are rising concerns regarding technological competition from custom chip developers in companies like Amazon and Google. Huang reassured investors that the transition from chip design to actual deployment is a formidable challenge, hinting at Nvidia’s resilience in the face of increasing competition.

Despite strong earnings and innovative advancements, Nvidia faces several challenges on its road ahead. While the company’s data center revenue surged 93% from the previous year to $35.6 billion, the overall dependency on a single segment poses risks. Nvidia is aware that as the market evolves, the demands for computing capacity in AI applications could exponentially increase. Kress noted that emerging AI paradigms might require 100 times more compute power for certain tasks, which indicates a critical need for future innovations and enhancements to Nvidia’s existing offerings.

Furthermore, Nvidia must address the declining performance of its gaming business, which reported sales of $2.5 billion—short of the anticipated $3.04 billion. These declines underscore a potentially saturated market for consumer-grade GPUs, putting pressure on Nvidia as it simultaneously expands its enterprise solutions.

Another area of concern is Nvidia’s networking segment, which, despite expectations of growth, posted a 9% decline year-over-year. The challenge lies in balancing investment in high-demand markets like AI while managing segments that do not meet growth targets.

Nvidia’s results this quarter portray an impressive narrative of growth, reinforced by robust AI-driven performance. However, as the company marches forward in its ambitions, it must remain cognizant of the competitive landscape, technological advancements, and market demands that can sway its trajectory. The unveiling of Blackwell marks a significant leap forward, yet the company must navigate the complexities of innovation, market saturation, and diversification to secure its future leadership in the AI sector. As they look to the horizon, Nvidia’s ability to adapt and innovate will dictate their continued success in a dynamic and ever-changing technological landscape.