The Biden administration recently declared a significant initiative aimed at alleviating the financial burdens faced by student loan borrowers. This initiative, which some are calling the concluding phase of its student loan forgiveness efforts, involves the cancellation of over $600 million in debt for thousands of individuals. Targeted relief will benefit approximately 4,550 borrowers who are eligible through the Income-Based Repayment (IBR) plan, along with an additional 4,100 former students from DeVry University, a for-profit institution. The Department of Education determined that DeVry had misrepresented its job placement rates, leading to this targeted debt relief.

The response from DeVry University regarding this decision was notably absent, highlighting a recurring issue surrounding transparency and accountability within for-profit educational institutions. As the administration wraps up its tenure, this final announcement serves as a poignant reminder of the colossal student debt crisis affecting millions in the United States.

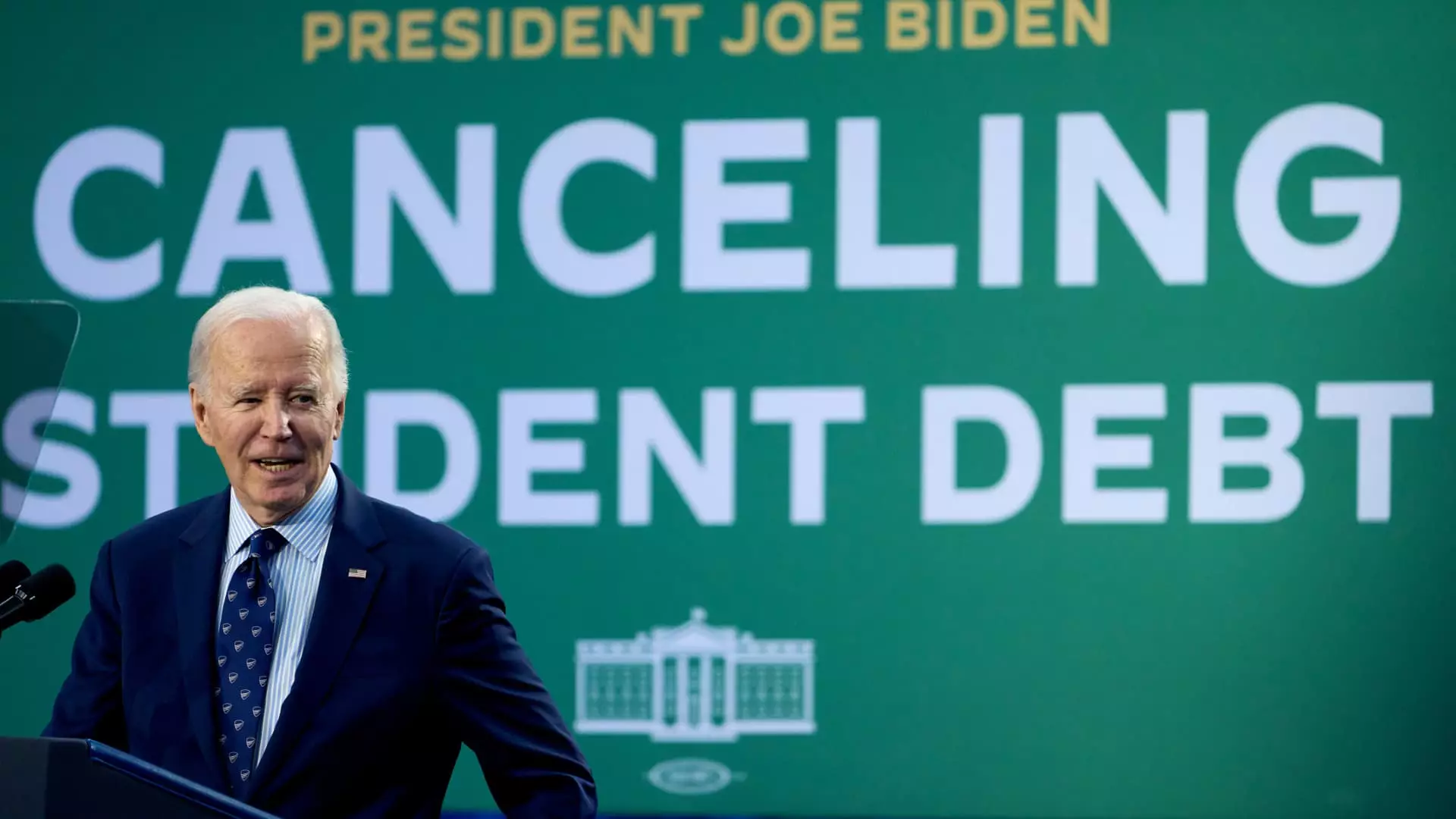

This student loan forgiveness program is a notable achievement in President Biden’s domestic policy agenda. By the time he leaves office, the Biden administration will have discharged approximately $188.8 billion in student debt, benefitting around 5.3 million borrowers. This feat positions Biden as a president who has outperformed his predecessors in terms of loan forgiveness, as stated by higher education analyst Mark Kantrowitz. However, the legacy of this initiative is complicated by broader challenges faced by student borrowers.

In 2023, the Supreme Court thwarted Biden’s ambitious plan to provide widespread loan forgiveness. Nevertheless, the administration was able to improve existing relief processes, showcasing a commitment to reforming a system many consider broken. U.S. Secretary of Education Miguel Cardona articulated this sentiment, emphasizing the administration’s mission to enhance programs that had long failed to adequately support borrowers.

Alongside the debt forgiveness announcement, the Department of Education also revealed the completion of its payment count adjustments for borrowers enrolled in income-driven repayment (IDR) plans. Historically, these repayment structures promised eventual loan forgiveness after a set period—generally 20 to 25 years. However, many borrowers have voiced their frustrations, alleging that loan servicers failed to maintain accurate records of their payment timelines, creating further confusion.

Through these systemic adjustments, the Biden administration aims to provide borrowers with transparent access to their payment histories via the Studentaid.gov platform. This move is pertinent not just for current borrowers but also for restoring faith in a financial aid system that many view as opaque and labyrinthine.

As the Biden administration closes this chapter on student loan reforms, the broader implications of these actions remain to be seen. The varying success of these initiatives underscores a crucial crossroads for U.S. educational financing. While significant debt relief has been achieved, the reality is that millions continue to grapple with the repercussions of a flawed student loan system. Going forward, it will be essential to evaluate both the effectiveness of implemented changes and the prospects for further reforms to support future generations of borrowers effectively. This evolving landscape will ultimately shape the narrative surrounding student debt in America for years to come.