On Thursday, AppLovin’s stock experienced a remarkable rise of 45%, reaching an impressive record of over $245 per share during midday trading. This spike reflects a robust 515% increase in the company’s stock value since the beginning of the year, making it the standout performer among tech corporations valued at over $5 billion, as noted by FactSet data. Such performance has propelled AppLovin’s market capitalization to exceed $80 billion, marking a transformational period for the firm that has continually pushed the boundaries of online gaming and digital advertising.

In its most recent quarterly report, AppLovin showcased a stellar revenue growth of 39%, amounting to $1.2 billion, which eclipsed analysts’ average estimate of $1.13 billion. Moreover, the company’s earnings per share (EPS) of $1.25 significantly surpassed the expected 92 cents. As the fourth quarter approaches, AppLovin anticipates revenue between $1.24 billion and $1.26 billion, suggesting approximately 31% growth. This forecast also comfortably exceeds the $1.18 billion expected by industry analysts.

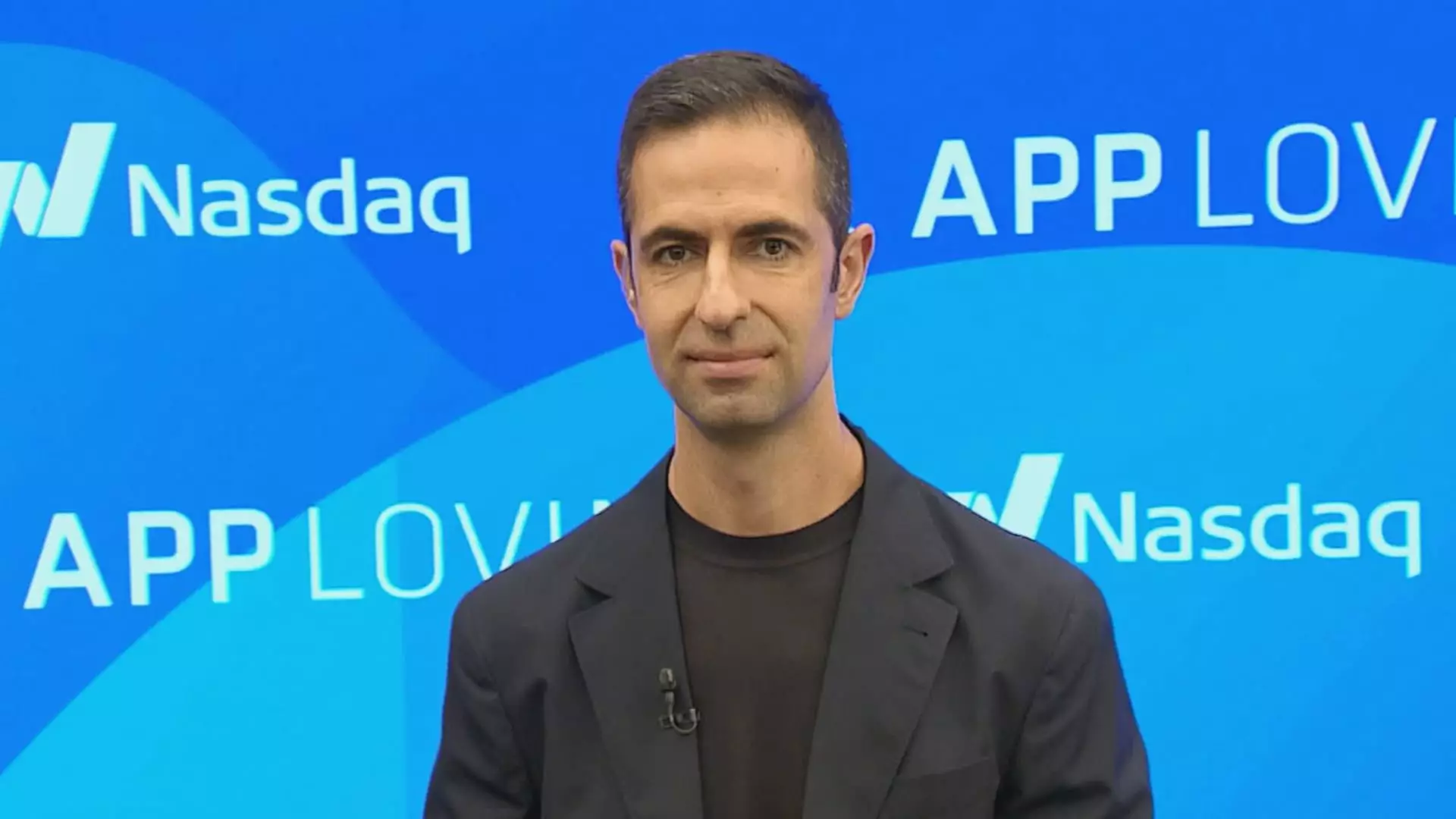

Established a little over a decade ago, AppLovin went public in 2021 amidst a pandemic-driven surge in online gaming popularity. Despite the gaming segment now displaying more moderate growth, the company’s online advertisement business is thriving, thanks largely to innovations in artificial intelligence that enhance ad targeting capabilities.

AppLovin attributes much of its explosive growth to its proprietary AI advertising platform known as AXON, especially after launching the enhanced 2.0 version last year. This advanced technology not only boosts targeted advertising on AppLovin’s gaming apps but is also available for licensing by other developers. The revenue derived from this software platform rose by an impressive 66%, reaching $835 million this quarter, driven by advancements in AXON’s functionality.

In a letter to shareholders, the company emphasized the significance of improving its ad models, stating that such upgrades enable advertising partners to spend more effectively at larger scales. As a result, sustaining high revenue growth has become a hallmark of AppLovin’s business model.

Although remarkable revenue gains have drawn attention, Wall Street is particularly fascinated by AppLovin’s substantial profitability. The company reported a staggering 300% surge in net income for the quarter, jumping to $434.4 million, equivalent to $1.25 per share, compared to just $108.6 million, or 30 cents per share, from a year earlier. Furthermore, the adjusted profit margin of the software platform stood at an extraordinary 78%, indicating operational efficiency and financial robustness.

This compelling financial performance has led analysts, including those from Wedbush, to recommend buying AppLovin’s stock and raising their price target from $170 to an impressive $270.

In line with the company’s rapid evolution, CEO Adam Foroughi discussed developments surrounding an innovative e-commerce initiative aimed at enabling businesses to deliver targeted ads within gaming environments. Foroughi hailed the product as the best AppLovin has ever released, highlighting its rapid growth potential despite still being in the pilot phase.

AppLovin’s exceptional stock performance, robust earnings report, and major advancements in advertising technology underscore the company’s dynamic growth strategy. As it continues to evolve, investors and market analysts will be closely watching its next moves amid a highly competitive digital landscape.