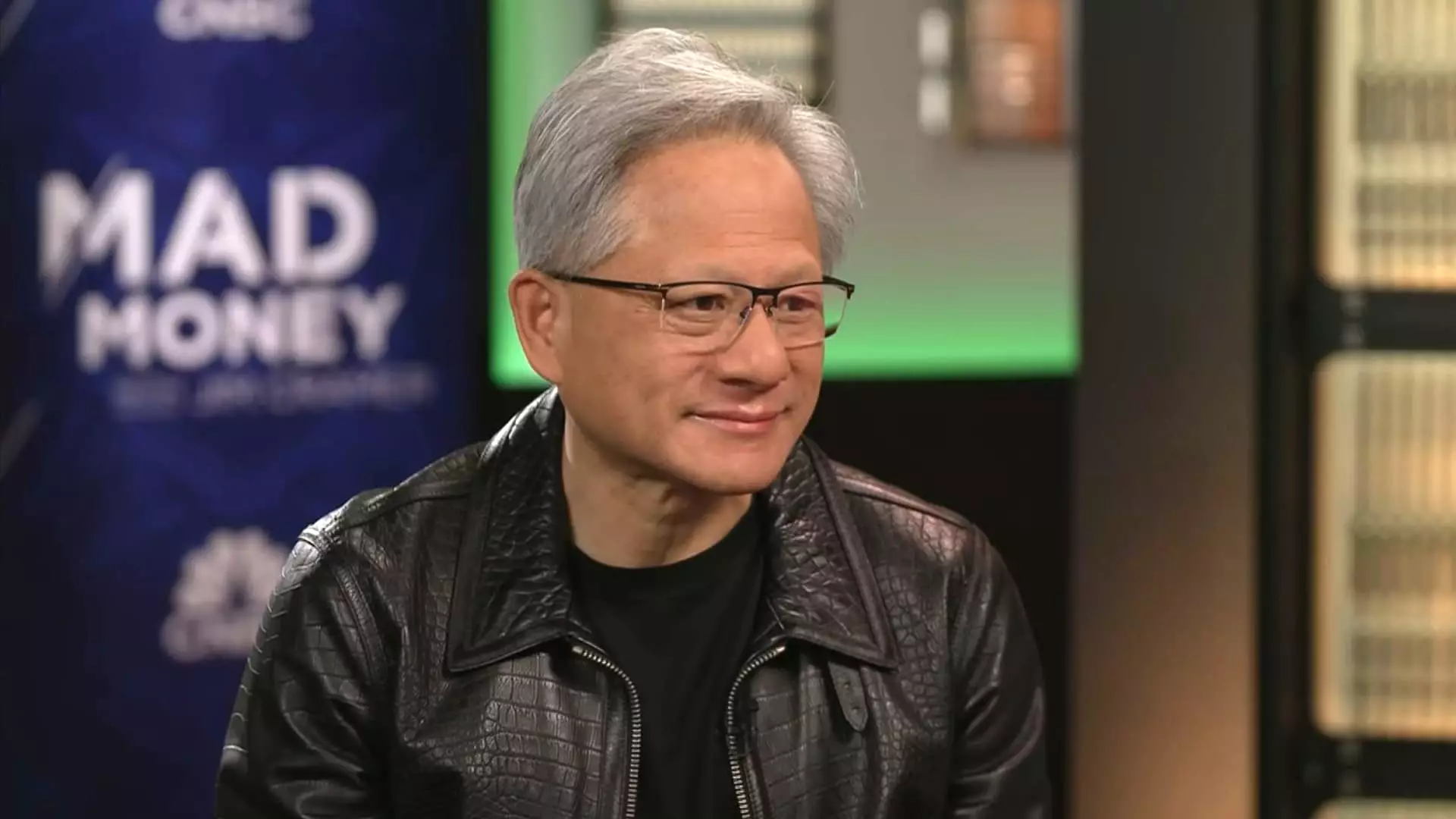

Nvidia’s CEO, Jensen Huang, recently faced the challenges of a turbulent trade landscape with a kind of optimism that can come off as almost naïve. In a recent interview, he confidently asserted that President Trump’s tariffs would have minimal short-term consequences for the company. This assertion begs the question: are we too quick to dismiss the implications of a trade war? Huang’s enthusiastic commitment to building in America is commendable, but it also raises critical doubts about whether the groundwork for sustainable growth can withstand external pressures. In the aftermath of the tariffs imposed on key trading partners, the effects are likely to be more profound than simply an “insignificant” blip in the radar.

The AI Revolution: Boon or Bane?

Huang’s declaration that “AI is the foundation, the operating system of every industry” paints a strikingly optimistic picture of the future. However, this stance may overlook the urgent realities facing the tech industry. While the potential for artificial intelligence to enhance operational capabilities across sectors is substantial, it would be irresponsible to ignore the challenges posed by rapidly evolving competition, particularly from nations like China, which are investing aggressively in AI technologies. The threat from Chinese advancements and domestic companies like DeepSeek can’t be glossed over. Huang’s pushback against claims that companies could achieve comparable AI performance at lower costs might just be a defensive maneuver rather than a substantiated counterargument.

Financial Health: The Unseen Cracks

The question that looms heavy above Nvidia’s optimistic narrative is its stock performance. Shares have plummeted over 20% since their peak in January, a stark reminder that investor sentiment can shift dramatically based on market perceptions and geopolitical tensions. The sell-off was triggered by fears that lower-cost competitors could erode Nvidia’s stronghold in AI technologies—an unforeseen vulnerability for a company that has thrived amid unprecedented demand for GPUs and other computing resources. Huang’s focus on potential partnerships with key players like TSMC and Foxconn reflects an awareness of the necessity to adapt, but does this diversification strategy have the potential to shield Nvidia from larger economic fluctuations, or is it merely a stopgap?

Regulatory Hurdles: A Double-Edged Sword

Another significant issue facing Nvidia is the complex landscape shaped by U.S. export restrictions on crucial technologies and their implications for its operations in China. Huang previously estimated that Nvidia’s revenue share from China had halved due to these conditions, which are aggravating the competitive pressures emanating from Chinese tech giants like Huawei. The reality that restrictive policies are driving a wedge between America and its vital trading partners should not be underestimated, nor should the profound impact they will have on future partnerships and revenue models.

In a tech world marked by competition and innovation, one’s agility in navigating political landscapes is essential. Huang’s steadfast optimism about building in America is admirable, but it must be tempered with realistic assessments of the rapidly shifting forces at play. As AI continues to permeate all industries, the path ahead will undoubtedly feature both remarkable opportunities and daunting challenges.