Wall Street has witnessed a maelstrom of volatility this past week, a theatre of chaos not easily forgotten. Stocks soared on Friday, as glimmers of hope emerged from the fog of the ongoing U.S.-China trade conflict. The White House expressed optimism that China would be inclined to negotiate, even as Beijing retaliated by elevating its tariffs on American products to a staggering 125%. This escalating tension highlights an alarming trend: markets grounded in uncertainty often oscillate wildly, leaving investors on edge and questionably informed about the stability of their investments. While cautious optimism might be warranted, it’s a dangerous game played with real stakes.

The previously mentioned 145% U.S. import duty levied by President Trump only underscores this perilous landscape. The juxtaposition of these two nations—one desperate to safeguard its economic interests, the other unyielding in its pursuit—creates an environment rife with unpredictability. Economic policy seems increasingly a weapon, not a tool, leading to dizzying fluctuations in stock prices, which can transform the financial comfort of a portfolio into a nightmarish landscape in mere hours.

Market Whiplash: A Rollercoaster of Emotion

The investment climate this week has resembled a nerve-wracking amusement park ride. The S&P 500 experienced one of its most tumultuous weeks since WWII, with pronounced surges followed by equally violent retreats. How should investors navigate such a landscape? On one hand, there is cause for excitement—an indication that the market can rebound from dire straits. On the other, this wild oscillation can easily strip away hard-earned gains and leave portfolios gasping for air.

Wednesday’s rally was intoxicating; at one point, investors toasted to the S&P 500 making its third-largest single-session gain since 1945. Yet, the subsequent sell-off on Thursday served to extinguish that fire as swiftly as it had begun. The lesson here lies in understanding the emotional rollercoaster of the markets; excitement can quickly transform into despair. An astute investor must juggle this emotional turbulence with a calculated approach—embracing the highs while remaining guarded against the inevitable lows.

The Big Players: Financial Institutions Under Scrutiny

Commentary from financial giants such as Wells Fargo and BlackRock grabbed headlines this week, but not all attention was welcome. Wells Fargo’s quarterly report fell short of expectations, sending its stock plummeting by 5% before it managed a slight recovery. Meanwhile, BlackRock surprisingly posted solid results, sending its shares climbing nearly 3%. Yet, the market continues to grapple with the implications of these earnings. Will financial institutions emerge onto more stable ground, or will they continue to reflect the broader uncertainties in the economy?

These fluctuations serve as a reminder: even the strongest financial institutions are not immune to the rattling storms of the geopolitical landscape. Investors are advised to remain judicious—the ground beneath them is shaky, and the implications of these earnings could reverberate through the industry, influencing investor sentiment and decisions far beyond this immediate week.

Tech Titans: Resilient or Reckless?

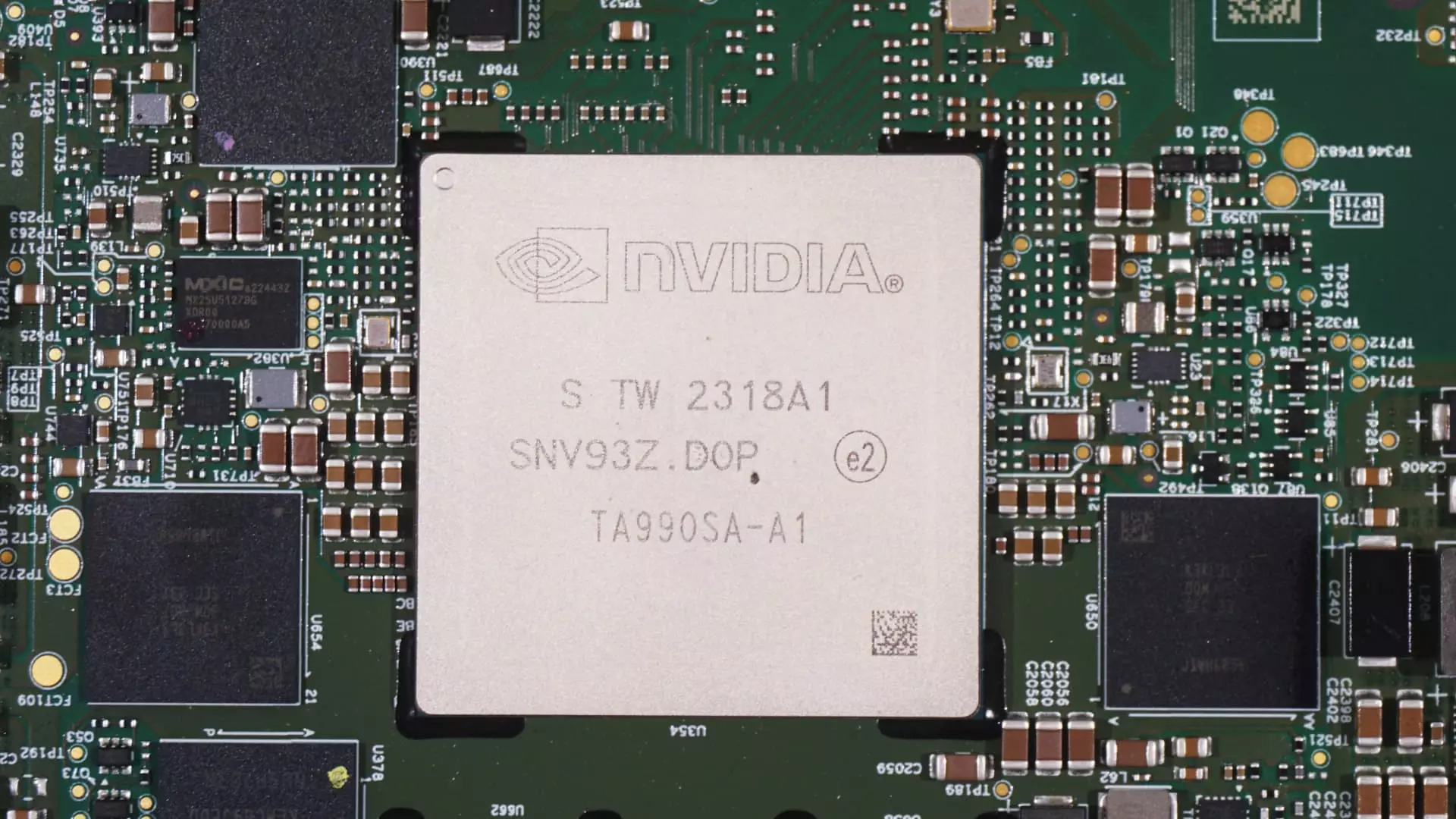

In the midst of this turmoil, chipmakers emerged as the unexpected stars of the week. Companies like Broadcom and Nvidia flourished amid the whirlwind, their stocks radically rejuvenated as they capitalized on fleeting moments of market recovery. Broadcom saw its stocks surge over 22% week-to-date, while Nvidia wasn’t far behind with a commendable 17% gain. But one must ask—are these gains sustainable or merely the byproducts of a fluctuating market rebound?

The encouraging developments surrounding these companies provide a façade of stability against the backdrop of a tumultuous market. Notably, Broadcom’s announcement of a $10 billion stock buyback program signals its commitment to supporting its share price, while Nvidia benefits from positive sentiment surrounding its AI innovations. Despite these victories, both companies remain haunted by their more than 25% declines from their peak prices earlier this year. Investors must remain astutely aware of the transient nature of these successes, questioning whether they are engaging in genuine recovery or simply curating the aftermath of volatility driven by the whims of economic policy.

The Weekly Outlook: What Lies Ahead?

As we look beyond the rapidly shifting sands of this week, the landscape holds a wealth of uncertainty and potential. Earnings reports from key players like Goldman Sachs and Abbott Labs are forthcoming, and dissecting these results will provide critical insights into broader market trends. Furthermore, upcoming economic data, including retail sales reports and pricing indexes, will enable investors to gauge consumer sentiment amid external pressures.

The path ahead is fraught with challenges and potential pitfalls, and while optimism may be irresistible, a more cautious stance is prudent. Understanding the confluence of economic forces, geopolitical tensions, and market dynamics will be crucial. As the market navigates these towering complexities, only those equipped with a discerning eye and a steady mind will maneuver successfully through Wall Street’s labyrinthine corridors.